Find California Unclaimed Property

California holds over $11 billion in unclaimed money and property. The State Controller's Office keeps these lost funds safe for owners. You can search for free at any time. No fee to claim what is yours. Most unclaimed property comes from old bank accounts, wages, stock, insurance, and safe deposit boxes. Counties and cities also hold unclaimed funds from tax refunds and estates. Anyone can search online or file a claim to get their money back.

California Unclaimed Money Quick Facts

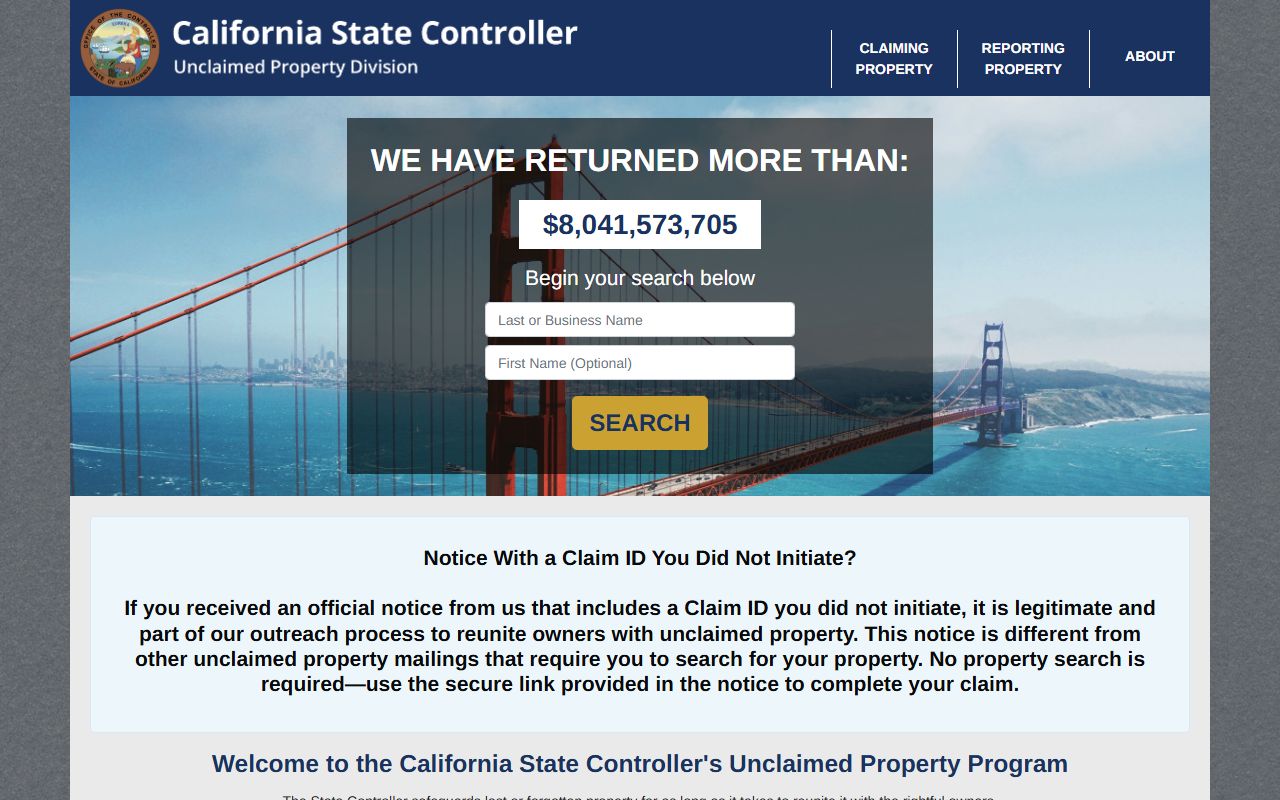

California State Controller Unclaimed Property

The California State Controller's Office is the main place to find lost money. They hold funds from banks, stocks, old paychecks, and more. Most property goes to the state after three years of no contact. The office keeps it safe until you claim it. There is no time limit. You can claim funds from 50 years ago or last year.

Controller Malia M. Cohen runs this program for California. Her office gets reports from banks and firms each year. They try to find owners before the money comes to the state. If they cannot reach you, the funds transfer to Sacramento. The state then lists your name in a free public database. Over 49 million properties wait to be claimed in California.

You can search the state database at ucpi.sco.ca.gov/en/Property/SearchIndex right now. Type your name or a business name. The search is free. No login needed. Results show if the state holds money in your name. You can file a claim online for most items. Some claims need paper forms sent by mail.

The state also runs a claim portal at claimit.ca.gov that shows your next steps after a search. Many simple cash claims get approved in 30 to 60 days. More complex claims can take up to 180 days. Securities and stocks may take longer if extra proof is needed to verify ownership in California.

What Kind of Unclaimed Money California Holds

California law covers many types of lost property. Bank accounts are the most common. When you close an account but leave a small balance, that money becomes unclaimed after three years. Forgotten savings accounts and checking accounts add up fast. Safe deposit box contents also go to the state if you stop paying rent on the box.

Uncashed paychecks and wages become unclaimed after one year in California. Employers must report unpaid wages to the state. Stock dividends, matured bonds, and mutual fund distributions are other big sources. Insurance companies send unclaimed policy proceeds to the state. This includes life insurance payouts when beneficiaries cannot be found. Estates of people who died without known heirs also end up with the state.

Utility deposits are on the list too. When you move and forget to get your deposit back, the utility company holds it for three years. Then it goes to California. Rebate checks, customer refunds, and gift certificates can become unclaimed as well. Even mineral royalties and oil lease payments end up with the Controller if owners do not cash checks.

The state returns unclaimed money as a check. They do not hold real estate or cars. Only cash and items that can be sold for cash. Most people find between $50 and $500, but some claims are worth much more. The largest claim in California history was over $40 million paid to heirs of an estate.

How California Gets Unclaimed Property

California Code of Civil Procedure Section 1513 sets the dormancy rules. Banks must send inactive accounts to the state after three years. Wages go after one year. Money orders take seven years. Traveler's checks need 15 years to become unclaimed. Each type of property has its own time limit in the law.

Holders must try to contact you first. They send letters to your last known address. If mail comes back or you do not respond, they wait out the dormancy period. Then they file a report with the State Controller. The report lists your name, last address, and the amount owed. Holders must send the actual funds along with the report each year.

Two main report dates exist in California. Life insurance companies report before May 1 each year and send funds between December 1 and 15. All other businesses report before November 1 and remit funds between June 1 and 15. This means new property gets added to the state database twice per year. Your name might appear in a future update if a holder just reported it.

How to Claim Unclaimed Money in California

Start by searching the database. Go to the property search page at sco.ca.gov/search_upd.html and enter your name. Try different name formats. Use your full legal name, maiden name, and any nicknames. Search for family members who may have passed away. You can claim on behalf of an estate if you are the heir.

When you find a match, click on it to see details. The site will tell you if you can file online or need to mail a paper claim. Most simple claims under $1,000 can be done online with just basic ID proof. You upload a copy of your driver's license or state ID. Sign the form electronically. Submit and wait for review.

Larger claims need notarized signatures. Any claim of $1,000 or more must be notarized in California. Securities and safe deposit box claims always need a notary. You fill out the Claim Affirmation Form from the website, get it notarized, and mail it with proof of identity. The state may ask for extra documents depending on the type of property.

Heirs claiming for someone who died must send more paperwork. This includes a death certificate and proof you are the legal heir. Small estates under $166,250 can use a Declaration Under Probate Code 13101 instead of full probate. Larger estates need Letters of Administration or Letters Testamentary from probate court. The state form called Table of Heirship helps show family relationships when multiple heirs exist in California.

Mail paper claims to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. Allow 30 to 60 days for simple claims and up to 180 days for complex ones. The state removes your property from the public website once they get your claim. This prevents duplicate claims while yours is being reviewed. If approved, you get a check in the mail.

Note: The State Controller charges no fee to file or process a claim in California.

County Unclaimed Money Programs

Many counties run their own programs separate from the state. California Government Code 50050-50057 allows local agencies to escheat unclaimed funds. Counties hold money from tax refunds, estates, and old warrants. A warrant is a county-issued check. If you do not cash it within six months, it becomes stale-dated. After three years the county can take ownership unless you claim it first.

Each county has different rules and amounts held. Los Angeles County keeps a large fund from excess proceeds of tax sales. When property sells at auction for more than the owed taxes, the extra money goes to the former owner. If no one claims it, the county holds it for years. Orange County has five different unclaimed fund types including deceased estates and landlord sales surplus.

Some counties have online search tools. Kern County runs a database at kcttc.co.kern.ca.us where you can look up unclaimed money by name. Fresno County offers a lookup tool for outstanding checks six months or older. Santa Clara County has an online search for property tax refunds at eservices.sccgov.org/Propertytaxrefunds/. Check with your local county treasurer or auditor to see what they hold.

Counties do not charge a fee to claim your money. You contact the treasurer or auditor office directly. Some ask you to fill out a claim form. Others just need proof of identity and your signature. Each county has its own process, so call or visit their website for instructions in California.

City Unclaimed Funds in California

Large cities also keep unclaimed money lists. San Diego holds over $916,000 for more than 800 people and businesses. Their finance department maintains a searchable list at sandiego.gov/finance/unclaimed. You can claim directly by emailing unclaimedmonies@sandiego.gov or calling 619-236-6310. No service fee applies when you file with the city.

San Francisco posts stale-dated checks online. Their system at openbook-report.sfgov.org lets you search by name. Sacramento runs an unclaimed property program through the city finance department at cityofsacramento.gov/finance/unclaimed-property. Oakland, Long Beach, and Fresno all have similar programs for uncashed city checks.

Smaller cities may transfer their unclaimed funds to the state after a set time. Others publish annual notices in local papers. If you think a city owes you money, contact their finance or treasurer office. They can search their records by your name and tell you how to claim in California.

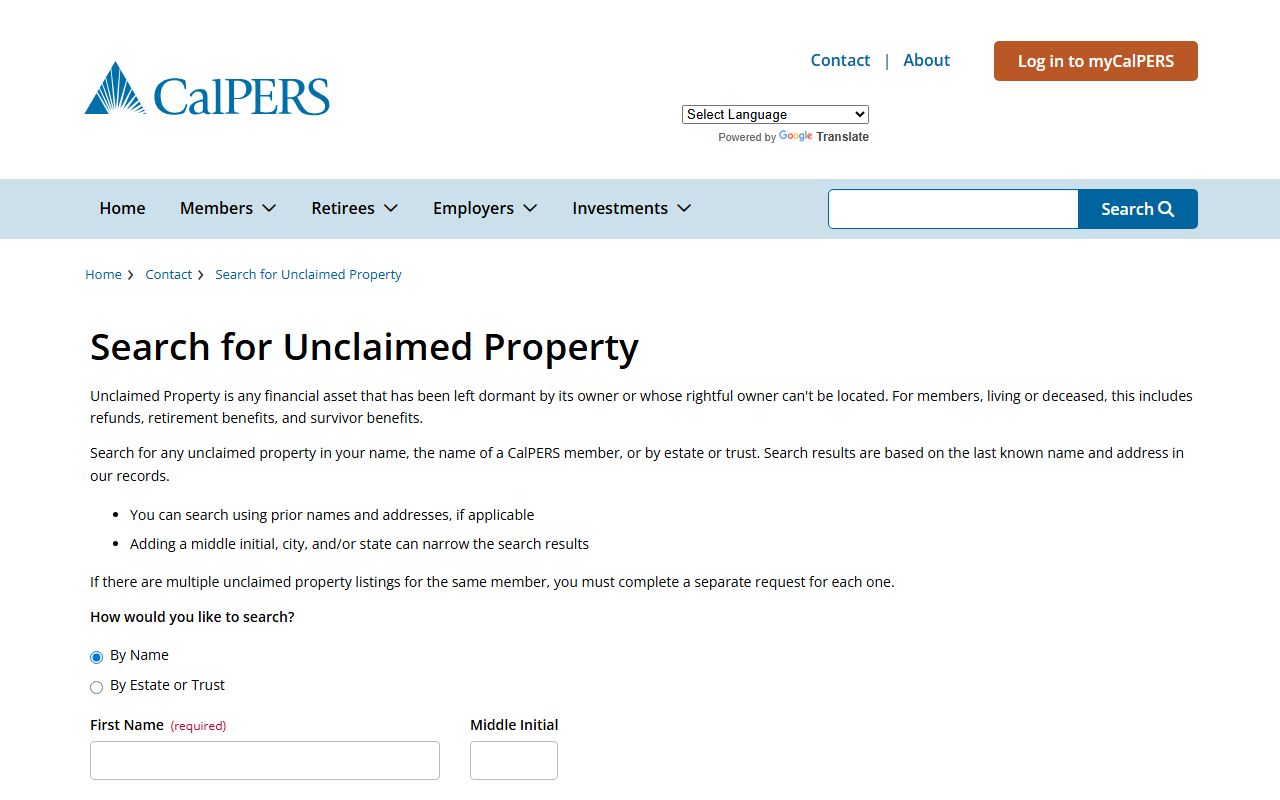

Retirement System Unclaimed Property

CalPERS and CalSTRS hold unclaimed benefits for former public employees. CalPERS serves state and local government workers. If you left a job and never claimed your retirement account refund, CalPERS may still have it. Search at www3.calpers.ca.gov/a/contact-us/unclaimed-property-search to check. Call 888-225-7377 for help with a claim.

CalSTRS handles teacher retirement accounts. Teachers who left the profession and did not request a refund can search at calstrs.com/unclaimed-property. Their phone line is 800-228-5453. Both systems try to locate former members, but addresses change over the years. Check if you worked for any California public agency or school in the past and left funds behind.

Other California Agencies with Unclaimed Funds

The Franchise Tax Board holds unclaimed tax refunds. If your refund check expired after six months, you must ask for a new one. Refunds less than three years old need a simple letter. Write to the FTB with your name, tax year, and the words "Old refund check" in the subject line. Processing takes about eight weeks. Refunds over three years old need form 3900A or 3900B and can take up to 18 months. Call 800-852-5711 for help.

The Employment Development Department keeps unclaimed unemployment and disability benefits. If you never cashed a benefit check, file form DE 903SD to get the money reissued. The form is at edd.ca.gov. No filing fee is charged for old checks. Call 800-300-5616 for unemployment or 800-480-3287 for disability questions in California.

The Department of Industrial Relations runs the Unpaid Wage Fund. Employers who go out of business or refuse to pay owed wages sometimes end up sending money here. Workers can claim unpaid wages from this fund. Call 833-526-4636 toll-free for information. You need proof of employment and the amount owed to file a claim in California.

The Department of Insurance helps find lost life insurance policies. Use the National Association of Insurance Commissioners Life Insurance Policy Locator at eapps.naic.org/life-policy-locator if you think a relative had a policy but you cannot find it. The service searches multiple companies at once. Call the California insurance hotline at 800-927-4357 for help with claims.

Unclaimed Property Investigators and Scams

You may get a letter from an heir finder or asset locator. These are private investigators who search for unclaimed money. They contact people who show up in the database. California law allows them to charge a fee of up to 10 percent of the property value. They must give you a written contract before you agree. You have five days to cancel the contract after signing it.

You do not need an investigator to claim your money. The State Controller processes claims for free. The same goes for counties and cities. Only use an investigator if you want help and agree to pay their fee. Never pay money up front to claim unclaimed property. Real agencies do not ask for payment before you get your funds in California.

Watch out for scams. Some letters look official but are not from the state. Check the return address and website. The real State Controller website is sco.ca.gov. If someone asks you to pay a fee to search or claim, it is likely a scam. Report fraud to the Attorney General's office at 800-952-5225 or online at oag.ca.gov.

California Unclaimed Property Laws

Code of Civil Procedure Section 1500 establishes the Unclaimed Property Law in California. This law defines terms and sets rules for how property becomes unclaimed. Section 1501 defines key terms like "holder," "owner," and "apparent owner." A holder is any business or institution that owes you money. An owner is the person who has a legal right to the property.

Section 1530 requires holders to report unclaimed property each year. They must send a list of owners and amounts to the State Controller. The report must include the owner's last known address. Holders must also try to notify owners before reporting the property to the state in California.

Section 1540 covers the claims process. The Controller must decide on a claim within 180 days of receiving it. The state does not pay interest on unclaimed property when you claim it. You get back the original amount that was reported, not more. If the property was stock, you get the current value of the shares or cash if they were sold.

Sections 1576 and 1577 set penalties for holders who fail to report. Willful violations are a misdemeanor. Holders who deliver property late must pay 12 percent interest per year on the amount owed. This encourages businesses to follow the law and report on time in California.

Contact California Unclaimed Property Division

The main phone line is 800-992-4647. This number works from anywhere in the United States. If you call from outside the U.S., dial 916-323-2827. The call center answers questions about searching and claiming. Hours are Monday through Friday during business hours.

Mail paper claims to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. For overnight mail or to visit in person, use the public counter at 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670. This office is open for walk-ins and accepts hand-delivered documents. Bring your claim form and ID if you want to file in person.

The legal office is at 300 Capitol Mall, Suite 1850, Sacramento, CA 95814. This address is for formal legal matters related to unclaimed property. Email the Controller's office through the contact form at sco.ca.gov/scocontactus/otherinquiries.aspx. Choose the unclaimed property topic when filling out the form for fastest response.

Browse California Unclaimed Money by County

Each county treasurer or auditor may hold unclaimed funds separate from the state. Check county resources for tax refunds, estates, and excess proceeds from property sales.

View All 58 California Counties →

Unclaimed Funds in Major California Cities

Large cities maintain their own lists of unclaimed money. Search city finance departments for old checks and refunds that may be waiting for you.