San Francisco Unclaimed Funds

San Francisco offers two main ways to search for unclaimed money. The City and County of San Francisco treasurer posts unclaimed funds from old city checks and estate funds. The California State Controller maintains a statewide database with billions in lost property from banks, wages, and insurance. Both programs let you search and claim at no cost. San Francisco is a city and county combined, so one local office handles both city and county funds. Thousands of residents have money waiting in the state system. No deadline exists to file a claim once your name appears in either database.

San Francisco Quick Facts

City and County Unclaimed Funds

San Francisco is unique as a consolidated city and county. The treasurer office handles unclaimed funds for both jurisdictions. These funds come from uncashed city checks, old vendor payments, and estate monies. When the city issues a check but you never cash it, the money sits in a city account. After six months the check becomes stale-dated. The treasurer keeps these funds until you file a claim.

The treasurer also holds funds from absent and missing heirs. When someone dies in San Francisco without known relatives, their estate may end up with the city. After proper probate procedures and public notice, unclaimed estate funds transfer to the treasurer. Heirs can still claim years later by proving their relationship to the deceased.

Check the San Francisco treasurer page at sftreasurer.org/unclaimed-funds for more information. Call 628-652-6514 to ask about funds in your name. The treasurer can search their records and tell you if they hold money for you. Claims are free. The city charges no processing fee when you claim your own funds.

Note: The city transfers some unclaimed funds to the state after a set time, so check both databases.

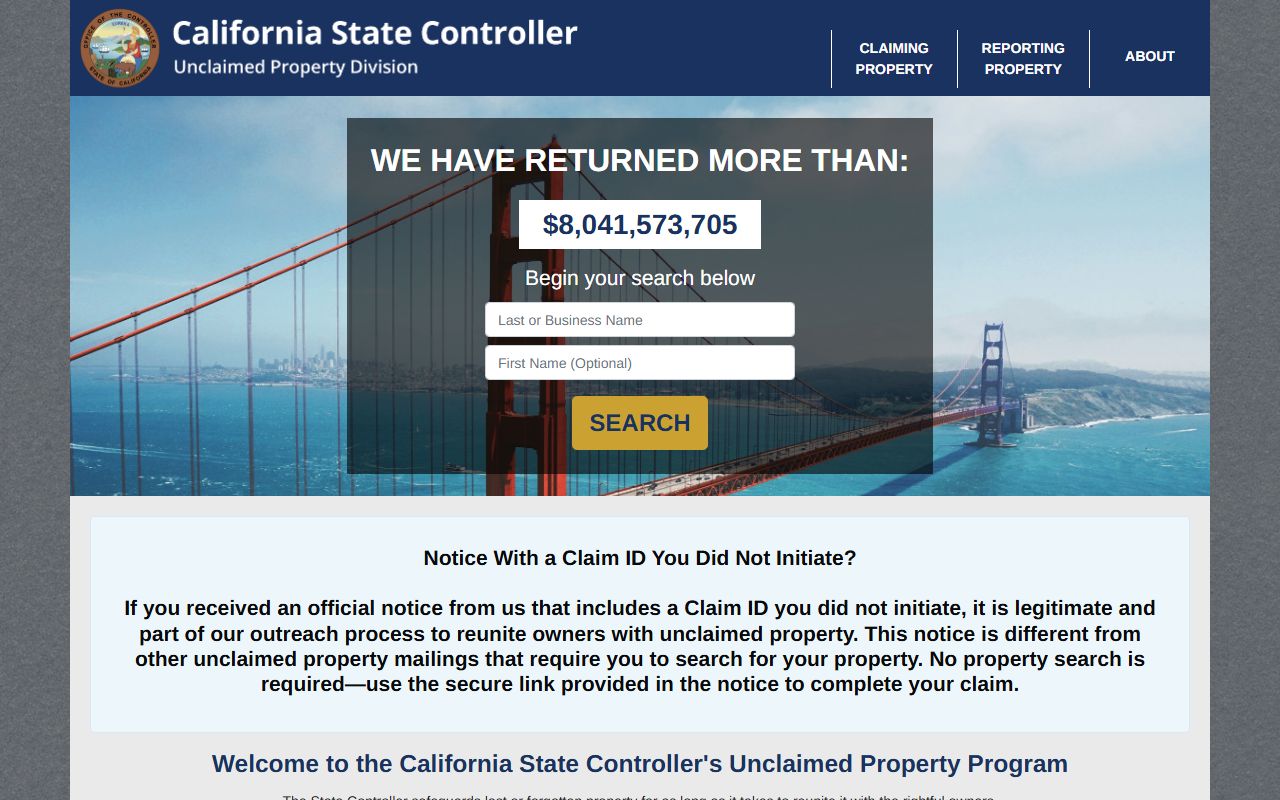

California State Controller Unclaimed Property

The California State Controller holds the largest pool of unclaimed money for San Francisco residents. This includes old bank accounts, uncashed wages, stock dividends, insurance proceeds, and safe deposit box contents. Banks and businesses send funds to the state after three years of no owner contact. The state keeps your money safe indefinitely with no claim deadline.

Search at ucpi.sco.ca.gov/en/Property/SearchIndex by typing your name. The system shows all matches statewide. Many San Francisco residents appear because the city has a large population and high concentration of financial institutions. Try different name formats like your maiden name or nicknames. Search for deceased relatives too. You can claim on behalf of an estate if you are the legal heir.

When you find property in your name, click to see details. The state shows the holder who reported it and the approximate amount. Simple claims under $1,000 can often be filed online with just an ID upload. Larger claims need a notarized signature. Download the Claim Affirmation Form, get it notarized, and mail it to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. Most claims process in 30 to 60 days. Complex cases take up to 180 days.

Searching for San Francisco Unclaimed Money

Start with the city treasurer website. Check if they list your name on their unclaimed funds page. Then search the state database, which covers a wider range of property types. Use your full legal name when searching. Include middle names and any suffixes. Some systems match names exactly, so try different formats to catch all possibilities.

Try old addresses when searching the state system. If you moved from another part of California to San Francisco, your property might be tagged with your former city. Searching by name alone picks up records from all addresses. Write down property ID numbers and holder names for matches you find. This information helps when you file claims later.

Search for family members who lived in San Francisco. Parents, grandparents, or other relatives may have unclaimed money. If they died, you can claim as an heir with proper documentation. The state has forms to prove heirship. Small estates can use simplified procedures without full probate court.

How to File Claims

For city funds, contact the San Francisco treasurer at 628-652-6514. Ask about the specific property you want to claim. The treasurer explains their claim process and tells you what documents to send. Usually you need a claim form and ID copy. Fill out the form completely. Sign where indicated. Send it to the address provided. The treasurer verifies your identity and mails a check if approved.

State claims start online at the State Controller website. Find property in your name and click the claim button. Upload your ID and submit the claim electronically if it qualifies. For larger amounts or certain property types, print the form and get it notarized. Mail the signed form with ID copies to Sacramento. The state sends updates by mail or email depending on what you choose during the claim process.

Keep copies of all documents you submit. If mail gets lost, you can resend without starting over. Track your state claim online using the claim status tool. For city claims, call after a few weeks if you have not heard back. Most claims finish within 30 to 90 days depending on complexity and office workload.

Additional Unclaimed Money Sources

The Franchise Tax Board holds unclaimed state tax refunds. If your California tax refund check expired after six months, you can request a new one. Refunds under three years old need a letter to the FTB with your name, tax year, and Social Security number. Older refunds require form 3900A or 3900B. Processing takes 8 weeks to 18 months depending on age. Call 800-852-5711 for help.

The Employment Development Department keeps unclaimed unemployment and disability benefit checks. If you lost a check or it expired, file form DE 903SD for a replacement. Download it at edd.ca.gov. No fee applies. Call 800-300-5616 for unemployment or 800-480-3287 for disability. EDD can search by your Social Security number to find unclaimed benefits.

CalPERS holds retirement funds for former public employees. If you worked for a California government agency and left without claiming your account, search at www3.calpers.ca.gov/a/contact-us/unclaimed-property-search. Teachers check CalSTRS at calstrs.com/unclaimed-property. Both systems keep funds indefinitely with no claim deadline.

Finding Lost Life Insurance Policies

Many San Francisco families lose track of life insurance when a relative dies. The National Association of Insurance Commissioners runs a free search at eapps.naic.org/life-policy-locator. Enter the deceased person's name and info. The system searches multiple insurance companies at once. If a policy exists, they tell you how to claim it.

Some insurance proceeds end up with the State Controller if the company cannot find beneficiaries. Search the state database using the deceased person's name. If the insurance company reported the funds to California, they appear in results. Claim as the beneficiary by providing a death certificate and proof of your relationship to the insured.

For insurance help, call the California Department of Insurance at 800-927-4357. They answer questions about policies and claims. They can verify if a company is licensed and provide contact info. Old policies remain valid even if the company changed names or merged over the years.

Protecting Yourself from Scams

You may get a letter from an heir finder or asset locator. These companies search public databases and contact people with unclaimed money. They offer help in exchange for a fee, usually 10 percent. California law allows them, but you do not need their services. You can search and claim for free on your own. If you choose to hire one, read the contract and know you have five days to cancel after signing.

Never pay upfront to claim unclaimed property. Government agencies do not charge fees before you receive your funds. If someone asks for payment to search or file a claim, it is a scam. The city and state both process claims at no cost. Be wary of emails or calls asking for bank account numbers or Social Security numbers. Only give sensitive info to verified government offices.

Check website URLs before entering personal data. Official California sites end in .ca.gov. The State Controller site is sco.ca.gov. San Francisco city sites use sftreasurer.org for the treasurer. If a site looks similar but has a different ending, it may be fake. Report scams to the California Attorney General at 800-952-5225 or online at oag.ca.gov.

Contact Information

For city and county funds, visit sftreasurer.org/unclaimed-funds or call the San Francisco treasurer at 628-652-6514. The treasurer office is at City Hall, 1 Dr. Carlton B. Goodlett Place, Room 140, San Francisco, CA 94102. You can visit in person during business hours to ask about claims.

For state unclaimed property, call 800-992-4647 from the U.S. Outside the country, dial 916-323-2827. Mail claims to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. Visit in person at 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670 to file or drop off documents.