Orange County Unclaimed Property

Orange County unclaimed money sits in five different programs run by the county treasurer. You can search for funds from deceased estates, tax auction excess proceeds, landlord sales surplus, commercial landlord sales, and general county unclaimed funds. The Orange County Treasurer maintains online databases for all five categories. Most other California counties send unclaimed money to the state after three years, but Orange County keeps an active local program. This gives residents more options to search and claim lost property. The county holds millions of dollars waiting for rightful owners across these programs.

Orange County Quick Facts

Five Types of Orange County Unclaimed Funds

Orange County runs five separate unclaimed property programs. Each program handles a different type of funds. The county treasurer maintains all five databases at the main unclaimed funds portal.

Deceased estates make up the first category. When someone dies without known heirs, their property may end up with the county. The treasurer holds these funds until rightful heirs come forward with proof of claim. Estate funds can sit for years or even decades before someone claims them.

Tax auction excess proceeds form the second type. When Orange County sells property for unpaid taxes, any money left after paying the tax debt goes into a trust fund. Former owners and lien holders can file claims for this surplus. The county publishes notices after each tax sale with a list of available excess proceeds.

Landlord sales surplus is the third category. When a landlord auctions off abandoned property from a rental unit, state law requires holding surplus funds. If the sale brings more money than the tenant owed in rent and storage fees, the extra amount goes to the county treasurer. Former tenants can claim these funds by proving they owned the sold items.

Commercial landlord sales work the same way but involve business properties. This fourth type includes funds from commercial evictions and storage unit auctions. Business owners who lost equipment or inventory can file claims through the county treasurer.

The fifth type covers general county unclaimed funds. This includes uncashed checks from county departments, overpayments on property taxes, refunds that were never picked up, and deposits from contractors or vendors. Any check issued by Orange County that goes uncashed for six months may end up in the unclaimed funds database.

How to Search Orange County Records

Visit the Orange County Treasurer unclaimed funds page to start your search. The website has separate search tools for each of the five program types. You can search by name, address, or parcel number depending on the category.

Each search tool works a bit different. The deceased estates database lists names of people who died with unclaimed property. The tax auction database shows property addresses and former owners. The landlord sales databases list the name of the person who lost property in an eviction or storage auction.

If you find a match, the system will tell you how much money is available and what documents you need to file a claim. Most claims require proof of identity and proof that you have a right to the funds. For deceased estates, you may need probate documents or an affidavit of heirship.

Note: Orange County processes most claims within 60 to 90 days after receiving complete documentation.

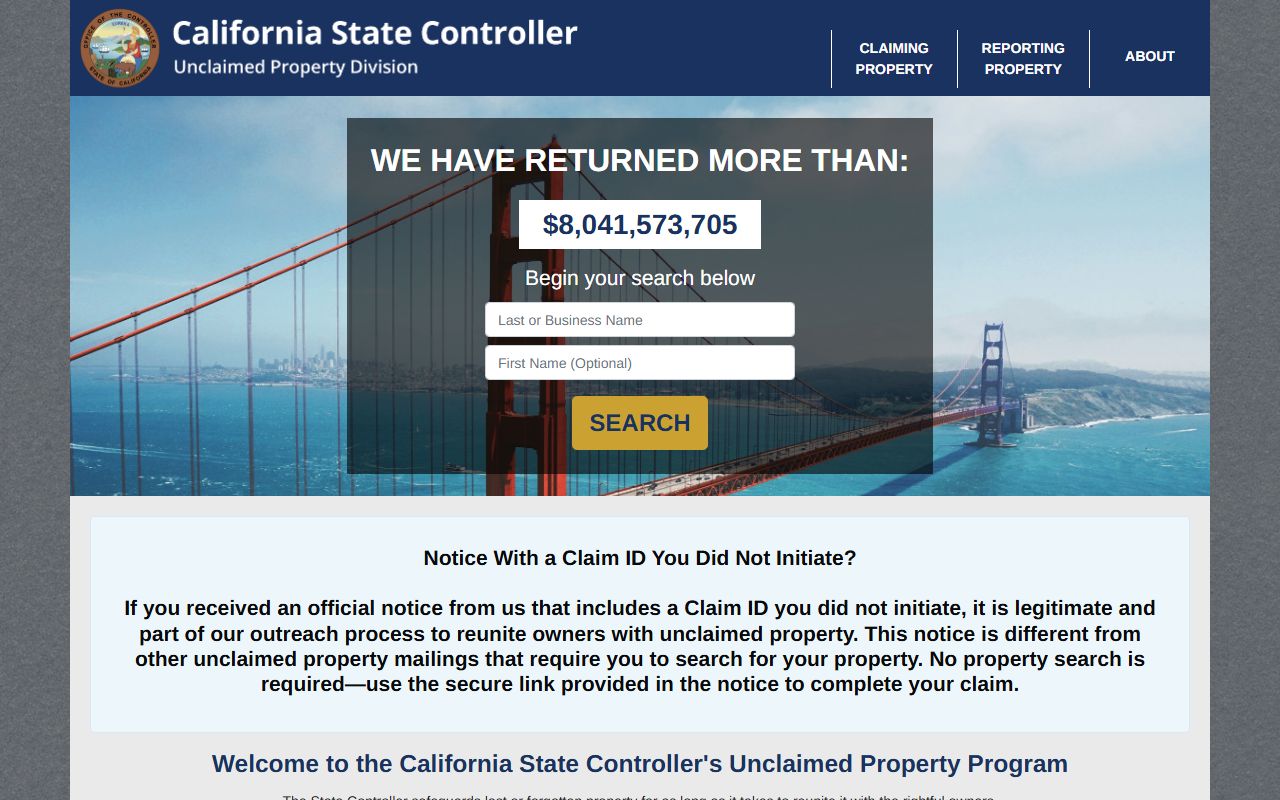

California State Controller Database

In addition to county programs, Orange County residents should check the state database. The California State Controller holds over $11 billion in unclaimed property. This includes bank accounts, paychecks, insurance policies, stock dividends, and safe deposit box contents.

Banks and businesses send unclaimed money to the state after three years of no owner contact. The state holds these funds forever with no deadline to claim. You can search by name at no cost. Filing a claim with the state controller is free and can be done online for most property types.

Orange County has millions of residents and a long history of business activity. Many people move in and out of the county, leaving behind bank accounts or forgetting about old paychecks. The state database likely has thousands of Orange County properties waiting for owners.

Search both the county and state databases to find all unclaimed money that may belong to you. Each system holds different types of property. The county focuses on local government funds, tax sales, and estates. The state handles private business property like bank accounts and insurance.

Pension and Retirement Benefits

Orange County residents who worked in public service may have unclaimed retirement benefits. CalPERS holds unclaimed pension refunds and retirement benefits. Teachers should check CalSTRS for lost property from education employment.

These funds accumulate when someone leaves public employment without claiming their contributions. Or a retiree dies and beneficiaries never file for survivor benefits. The pension systems try to locate owners but often lose contact when people move.

CalPERS has a searchable database on their website. You can also call 888-225-7377 to ask about unclaimed property. CalSTRS uses a similar system with a phone line at 800-228-5453. Both agencies process claims free of charge once you prove identity and employment history.

Legal Rules for Unclaimed Money

California follows strict laws about unclaimed property. Code of Civil Procedure Section 1500 establishes the state unclaimed property law. This code defines what counts as abandoned property and who must report it.

Most property becomes abandoned after three years of no owner activity. Bank accounts need three years of no deposits or withdrawals. Paychecks are considered abandoned after one year. Money orders take seven years. Traveler's checks need fifteen years before they escheat to the state.

Government Code sections 50050 to 50057 govern local agency unclaimed money like the Orange County programs. These sections let counties hold funds for three years before escheating them to the county general fund. But the county must publish notice and give owners a chance to claim.

Orange County chooses to maintain ongoing databases rather than escheat all funds after three years. This benefits residents by keeping claims local and searchable. Many other counties transfer everything to the state controller after the required holding period.

Filing a Claim in Orange County

Each type of unclaimed money has its own claim process. For deceased estates, you need to prove you are an heir or have a legal right to the property. This usually means providing a death certificate, birth certificate, marriage license, or court documents showing heirship.

Tax auction excess proceeds require proof you owned the property or held a lien on it. Bring documentation like old property tax bills, mortgage records, or mechanic's lien paperwork. The county treasurer will verify your interest before releasing funds.

Landlord sales surplus claims need proof you owned the items that were sold. This can be tricky if your belongings were auctioned off years ago. Receipts, photos, storage unit contracts, or rental agreements help establish ownership. You also need to show the amount you claim is reasonable based on what was sold.

General unclaimed funds like uncashed checks are easier to claim. Just prove your identity matches the name on the check. Bring a driver's license or other government ID to the treasurer's office. If the check was issued to a business you own, bring business registration documents.

All claims must be filed with the Orange County Treasurer either in person, by mail, or through the online system if available. Call 855-886-5400 with questions about the claim process or required documents.

Note: Orange County does not charge fees to file claims for unclaimed property held by the county treasurer.

Major Cities in Orange County

Orange County includes several large cities, each with over 100,000 residents. Some of these cities run their own unclaimed money programs in addition to the county system.

Anaheim is the largest city with over 350,000 people. Santa Ana is the county seat with about 310,000 residents. Irvine has around 310,000 people and runs its own unclaimed property program for city-issued checks. Huntington Beach has roughly 200,000 residents and maintains a local unclaimed funds database. Garden Grove has about 171,000 people with its own city program.

If you lived or worked in one of these cities, check both the city and county databases. Cities handle unclaimed checks from city departments, utility refunds, and business license deposits. The county handles tax sales, estates, and landlord auction surplus.