San Bernardino County Unclaimed Funds

San Bernardino County unclaimed money can be searched through an online database for property tax refunds. The county auditor-treasurer-tax collector maintains a searchable system for unclaimed property tax refunds. As California's largest county by land area with over 2.1 million residents, San Bernardino County processes substantial amounts of unclaimed property each year. The county program focuses on tax-related refunds while most other unclaimed property goes to the California State Controller. Residents should search both county and state databases to locate all funds that may belong to them.

San Bernardino County Quick Facts

Property Tax Refund Database

San Bernardino County maintains a searchable database for unclaimed property tax refunds at the auditor-treasurer-tax collector website. This system shows property tax refunds that were issued but never claimed by property owners.

Property tax refunds occur for several reasons. Assessment reductions after successful appeals generate refunds. Overpayments from escrow accounts or duplicate payments also create refund situations. When property ownership changes, refunds may be issued to a previous owner who no longer receives mail at that address.

The county database lets you search by parcel number, owner name, or address. If you find a match, the system displays the refund amount and instructions for filing a claim. Most claims require proof you owned the property or paid the taxes during the period in question.

Under Government Code sections 50050 to 50057, counties must hold unclaimed funds for at least three years. San Bernardino County maintains records beyond this minimum to help residents claim older refunds.

Filing Claims in San Bernardino County

Search the county tax refund database first. If you find property in your name, contact the auditor-treasurer-tax collector office for claim instructions. Each refund type may require different documentation.

For refunds from property you owned, bring proof of ownership such as old property tax bills, grant deeds, or escrow closing statements. If you paid the taxes through an escrow account, your mortgage statement or escrow analysis may serve as proof.

If you sold the property and believe you are entitled to a refund from the ownership period, bring the settlement statement from the sale. This shows how property taxes were prorated between buyer and seller. The statement establishes your claim to refunds from your ownership period.

For business property, bring business registration documents showing the business owned the property during the tax period in question. Corporate officers may need to provide resolutions authorizing them to claim funds on behalf of the business.

Note: San Bernardino County does not charge fees to file claims for property tax refunds held by the county.

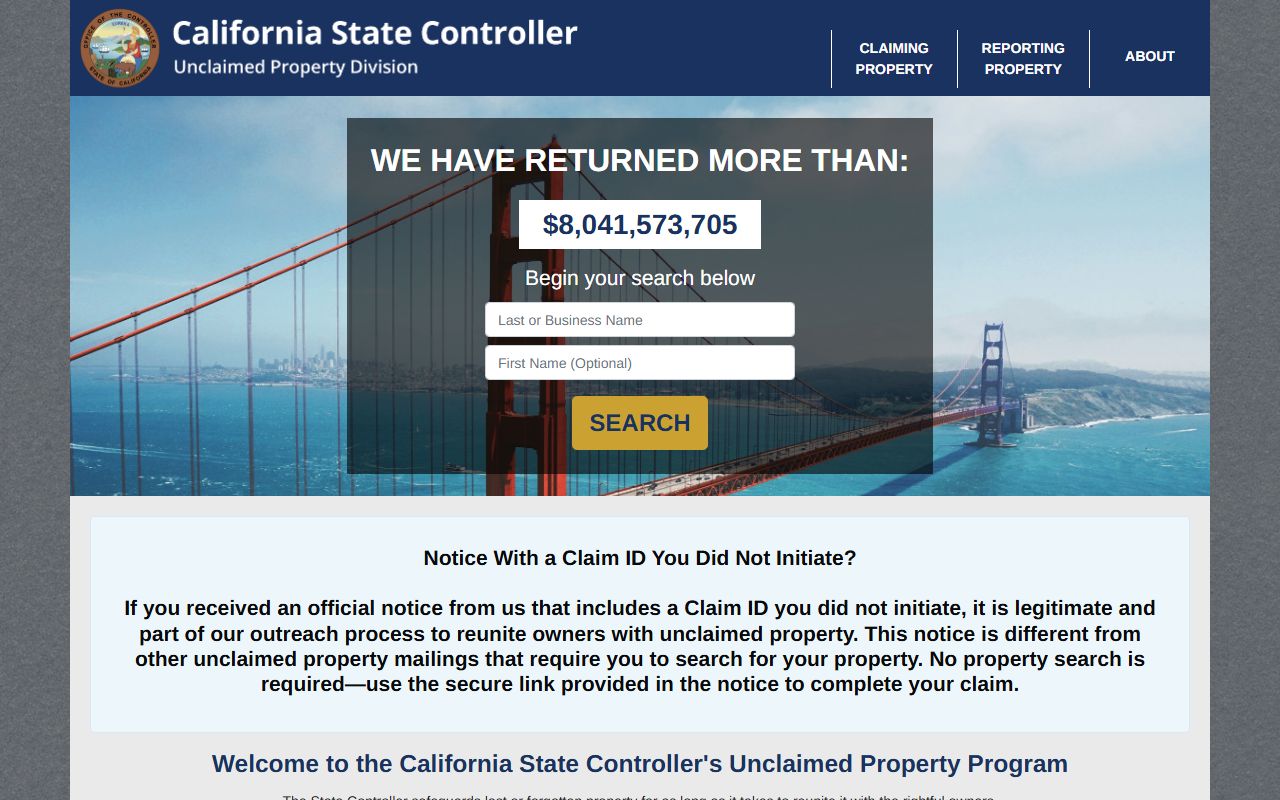

California State Controller Database

Most unclaimed money in San Bernardino County is held by the state, not the county. The California State Controller maintains over $11 billion in unclaimed property statewide. This includes bank accounts, paychecks, insurance policies, stock dividends, and safe deposit box contents.

Banks and businesses report unclaimed property to the state after three years of no owner contact. The state holds these funds indefinitely. There is no deadline to claim your money.

Search the state database by name at no cost. Many San Bernardino County residents have multiple properties listed from different sources. You might find old bank accounts, uncashed paychecks, or insurance proceeds you never knew about.

Filing state claims is free. Most property can be claimed online through the state controller claim portal. The system generates customized claim forms with instructions for your specific property type. Simple claims are processed in 30 to 60 days.

Cities in San Bernardino County

San Bernardino County includes many large cities. San Bernardino is the county seat with about 222,000 residents. The city runs its own unclaimed property program for city-issued checks and refunds.

Fontana has over 210,000 people. Ontario has roughly 185,000 residents. Rancho Cucamonga has about 178,000 people. Victorville has around 136,000 residents. Hesperia has approximately 100,000 people.

Some cities maintain separate unclaimed property programs. If you lived in a San Bernardino County city, check the city finance department in addition to county and state databases. Cities handle utility refunds and city-issued checks. The county handles property tax refunds. The state handles private business property like bank accounts.

Pension and Retirement Benefits

Public employees in San Bernardino County may have unclaimed pension benefits. CalPERS serves county workers, city employees, and many public agencies. If you left public employment without claiming retirement contributions, search the CalPERS database or call 888-225-7377.

Teachers should check CalSTRS for unclaimed property from school employment. CalSTRS handles retirement benefits for public education workers. Call 800-228-5453 with questions.

The California Franchise Tax Board holds unclaimed state income tax refunds. Refund checks are valid for six months. After that, request a replacement. Refunds one to three years old need a letter. Older refunds require form 3900A or 3900B and take up to eighteen months to process.

Unemployment and disability benefits can go unclaimed. The California Employment Development Department has form DE 903SD for claiming uncashed checks. No fee is required. Call 800-300-5616 for unemployment or 800-480-3287 for disability insurance.

California Unclaimed Property Law

Code of Civil Procedure Section 1500 establishes California's unclaimed property law. This statute defines abandoned property and sets dormancy periods for different asset types.

Bank accounts are deemed abandoned after three years of no activity. Paychecks need one year. Money orders take seven years. Traveler's checks require fifteen years before businesses must report them to the state.

Section 1530 requires businesses to file annual reports with the state controller. Most businesses file by November first each year. The report must list all unclaimed property with owner names and addresses.

Government Code sections 50050 through 50057 govern county unclaimed funds. These laws require San Bernardino County to hold money for three years before it can escheat to the general fund. The county must publish notices giving owners a chance to claim.

Section 1540 gives the state controller 180 days to decide on claims. Complex claims may take longer if additional documents are needed. The state does not pay interest on unclaimed property.

Search Tips for Large Counties

San Bernardino County covers over 20,000 square miles from the deserts to the mountains. Property owners may have lived in multiple cities within the county over the years. Search all your previous addresses when looking for unclaimed property.

Try different name variations. Use maiden names, previous married names, and nicknames. Property records use the name on file when accounts were opened, which may differ from your current legal name.

Look for deceased relatives. Many heirs don't know family members left unclaimed property. Search for parents and grandparents who lived in San Bernardino County. You may be entitled to property tax refunds from their estates.

Check both county and state databases. The county system focuses on property tax refunds. The state system holds bank accounts, paychecks, and insurance proceeds. Search both to find all money that may belong to you.

If you worked in San Bernardino County but lived elsewhere, search here for employment-related unclaimed property. Paychecks and retirement contributions may be listed in the county where you worked.

Be wary of heir finders. These people charge fees up to ten percent. You can claim property yourself at no cost by searching databases directly.

Note: Never pay upfront fees to claim unclaimed property from government agencies.