Garden Grove Unclaimed Funds

Garden Grove residents can search for unclaimed money through the city, Orange County, and California State Controller. The City of Garden Grove Finance Department maintains a list of unclaimed property from uncashed checks and other city payments. Orange County operates five different unclaimed funds programs including deceased estates, tax auction proceeds, landlord sales, and general county funds. The state holds over $11 billion statewide from forgotten bank accounts, paychecks, insurance proceeds, and stock dividends. All three sources provide free searches with no time limits to file claims. Start with the state database as it contains the most records. Then check Orange County's extensive programs and the city's list to see if local funds are waiting for you in Garden Grove.

Garden Grove Quick Facts

City of Garden Grove Unclaimed Property

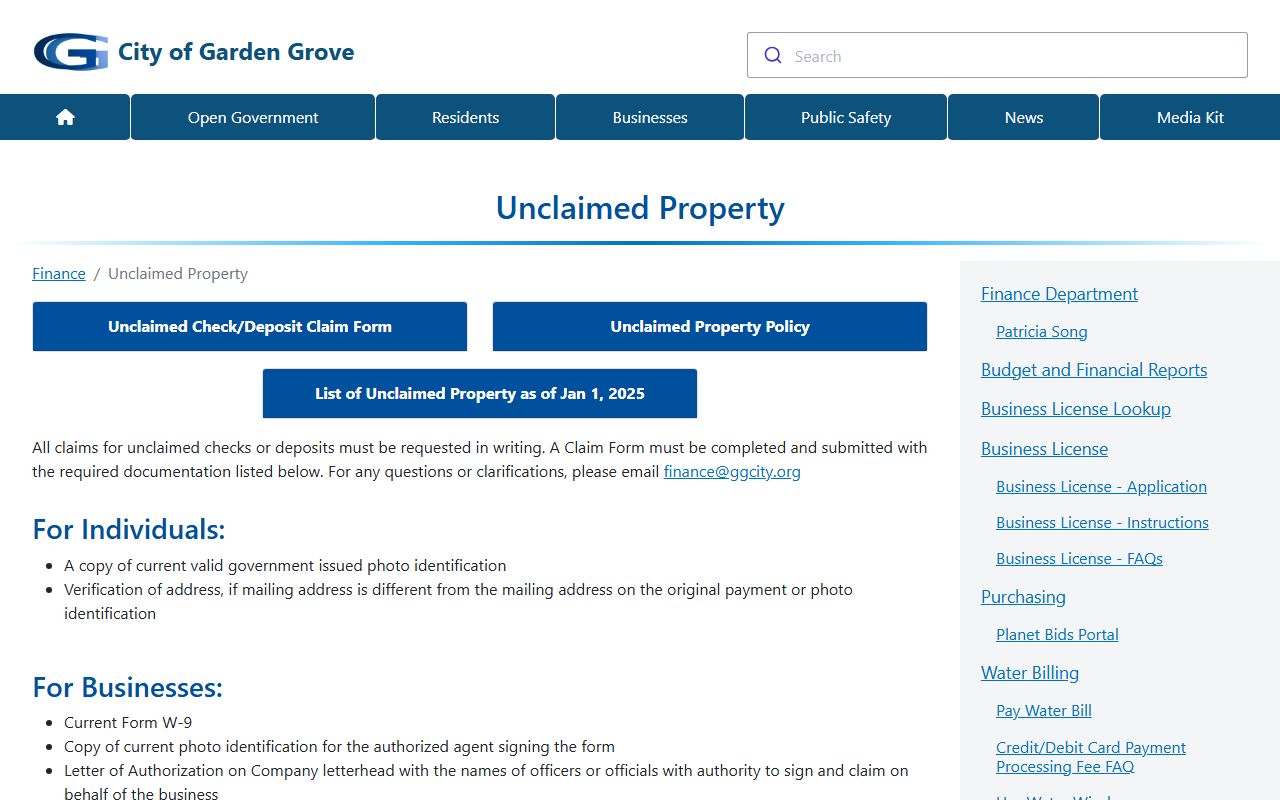

The City of Garden Grove Finance Department maintains a list of unclaimed property. These are checks the city issued but that were never cashed. Common sources include vendor payments, permit refunds, utility deposits, and employee checks. If you moved from Garden Grove and forgot to update your address, you may have missed a check from the city.

Visit ggcity.org/finance/unclaimed-property to view the current list of unclaimed funds. The city updates it regularly as new checks become unclaimed. Contact the Finance Department at 714-741-5060 or email finance@ggcity.org to ask if they hold money in your name. You will need to prove your identity and provide details about the payment.

The claim process is simple. Fill out a form and show ID. The city checks its records to verify the payment was issued to you. Then they issue a new check to your current address. No fee applies for city claims. Most get processed within a few weeks once you submit the required documents.

Under Government Code Section 50050, cities must send unclaimed funds to the state after three years. Once transferred, you claim through the State Controller instead of the city. Check both the city list and state database if you think you had a Garden Grove payment more than three years ago.

California State Controller Unclaimed Property

Most unclaimed money shows up with the state. Banks, employers, insurance companies, and utilities send forgotten funds to Sacramento each year. Garden Grove residents should search the state database even if they do not find anything with the city or county. The State Controller holds funds from all over California and other states if you lived there before moving to Garden Grove.

Search for free at ucpi.sco.ca.gov/en/Property/SearchIndex by entering your name. You can also search old Garden Grove addresses or business names if you owned a company. The database shows the property type and approximate value. Many claims are between $50 and $500, but some reach thousands of dollars.

Common items include old checking or savings accounts. When you close an account and leave a small balance, it sits for three years. Then the bank reports it to the state under California Code of Civil Procedure Section 1513. Paychecks become unclaimed after one year if sent to an old address. Stock dividends, insurance proceeds, and utility deposits also end up with the state when companies cannot locate owners.

To file a claim, go to claimit.ca.gov after finding a match. Simple claims take 30 to 60 days to process. Complex claims with heirs or multiple owners can take up to 180 days. The state never charges a fee. Call (800) 992-4647 if you need help while in Garden Grove.

California has no time limit to claim unclaimed property once it reaches the State Controller. Your money waits until you file a claim. This differs from other states where funds can be seized after a set period.

Orange County Unclaimed Funds Programs

Garden Grove is in Orange County, which has one of the most extensive unclaimed money programs in California. The county Treasurer runs five separate types of unclaimed funds. These include deceased estates, tax auction excess proceeds, landlord sales surplus, commercial landlord sales, and general county unclaimed funds. Each type has its own claim process and contact method.

Visit octreasurer.gov/unclaimedfunds to access all five programs. The website explains each type and provides forms for filing claims. Call the Orange County Treasurer at 855-886-5400 with questions about any of the programs. This toll-free number connects you to staff who can help determine if the county holds money in your name.

Tax auction excess proceeds are common in Garden Grove. When the county sells property for unpaid taxes and the sale brings more than the tax debt, the extra money becomes excess proceeds. The former property owner or other parties with an interest can claim it. Deceased estates arise when someone dies without known heirs. The county holds the money until a relative files a claim proving their relationship to the deceased.

Under Government Code Section 50050, counties can take ownership of unclaimed money after three years and proper notice. Once escheated, you file a claim to prove the money belongs to you. Orange County does not charge fees to file or process unclaimed money claims. Bring documents that connect you to the property or payment when you file.

Types of Unclaimed Property in Garden Grove

Bank accounts lead the list. Old savings or checking accounts become dormant after no activity for three years. The bank sends the balance to the state. Many Garden Grove residents switch banks and forget to close old accounts with small balances. Those add up over time.

Wages and paychecks are common. Final paychecks from jobs you left, commission checks, or bonuses can become unclaimed if sent to an old address. Under California Code of Civil Procedure Section 1530, employers must report uncashed wages after one year. This is shorter than the three-year rule for bank accounts.

Utility deposits happen when you close an account with the water company, trash service, or electric company. If you do not request your deposit back, the utility holds it for three years, then sends it to Sacramento. Security deposits from apartments also end up unclaimed if landlords cannot find you after you move out of Garden Grove.

Insurance proceeds include life insurance death benefits when beneficiaries do not know a policy exists. Matured policies and annuities also get reported to the state. Stock dividends, mutual fund distributions, and safe deposit box contents round out the list. Some Garden Grove residents inherit money from relatives but never knew about it. Those funds wait at the State Controller until an heir files a claim.

Note: Property tax refunds often end up with Orange County when they cannot locate former property owners.

How to Claim Unclaimed Money

The claim process depends on who holds the money. For city funds, contact Garden Grove Finance at 714-741-5060 or email finance@ggcity.org. They will send you a claim form. Fill it out and return it with a copy of your ID. That is all it takes for most city claims. The city verifies its records and issues a new check if everything matches.

For state claims, start at ucpi.sco.ca.gov/en/Property/SearchIndex to search. Click on any property that matches your name to see details. Then go to claimit.ca.gov to file online. Many claims can be submitted electronically. You upload a photo ID and proof of address. Some claims need extra documents like death certificates for heir claims or business records for company claims.

If the state claim is $1,000 or more, you need a notary to witness your signature. Claims for securities and safe deposit box contents always require notarization. The state sends detailed instructions after you start the claim. Follow them to avoid delays. Most Garden Grove residents get paid within two months for simple cash claims.

For county claims, contact Orange County Treasurer at 855-886-5400. They will tell you which of the five programs applies and what forms you need. Each program has different requirements. The county verifies your claim and issues a check if approved. County claims are free and do not need a lawyer.

Under California Code of Civil Procedure Section 1540, the State Controller must decide on claims within 180 days. If denied, you can appeal or provide more proof. The state does not pay interest on unclaimed money, so you get the original amount reported.

Other Unclaimed Money Resources

Some types of money do not go through the State Controller. Retirement benefits are separate. If you worked for a California public employer and left money in a retirement account, check CalPERS for unclaimed property. Call 888-225-7377 with questions. Teachers should check CalSTRS at 800-228-5453 if they worked in Garden Grove schools.

Tax refunds from the California Franchise Tax Board can become unclaimed if you moved and did not get your refund check. Call FTB at (800) 852-5711 to ask about old state tax refunds. Federal tax refunds go through the IRS. Call 1-800-829-1040 or visit irs.gov for federal refund help.

Life insurance policies sometimes go unclaimed when beneficiaries do not know a policy exists. The California Department of Insurance offers a policy locator service. You can also use the national service at eapps.naic.org/life-policy-locator to search for policies of deceased relatives. This is free and covers insurance companies nationwide.

Unemployment and disability benefits from EDD may be unclaimed if you never cashed a payment. Use form DE 903SD to claim old EDD checks. Download it from the EDD website or call 1-800-300-5616 for UI or 1-800-480-3287 for DI. No fee applies to claim old EDD benefits.

Watch Out for Scams

Scammers target people searching for unclaimed money. They send emails or letters claiming you have large sums waiting. Then they ask for fees or personal information. The State Controller never charges to claim unclaimed property. Any message asking for money upfront is a scam.

Asset locators are legal in California but can only charge up to 10 percent of the property value. They must have a written contract before collecting fees. You do not need to hire anyone. Search for free at ucpi.sco.ca.gov/en/Property/SearchIndex without paying.

Some firms offer to search on your behalf for a flat fee. This is unnecessary. The search takes minutes and costs nothing. If someone contacts you about money you did not know about, verify it by calling the State Controller at (800) 992-4647 before responding.

Never give out your Social Security number, bank account, or credit card to someone claiming to help with unclaimed property. Agencies send you a check once approved. They do not ask for payment details. Report suspected fraud to the California Attorney General at (800) 952-5225.

Orange County Unclaimed Money

Garden Grove is in Orange County. The county operates five distinct unclaimed funds programs covering estates, tax auctions, landlord sales, and general county funds. For full details on all programs, claim procedures, and contact information, visit the Orange County unclaimed money page.