Search Merced County Unclaimed Funds

Merced County unclaimed money comes from both the California State Controller and the county treasurer. The state holds most unclaimed property from banks, employers, and insurance companies. Merced County also runs its own unclaimed funds program for money held by the county. The Merced County Treasurer maintains a trust fund for unclaimed monies per Government Code sections 50050 to 50057. You can search the state database online for free and contact the county treasurer for local funds. Both systems work independently, so you should check both to find all unclaimed money that may belong to you in Merced County.

Merced County Quick Facts

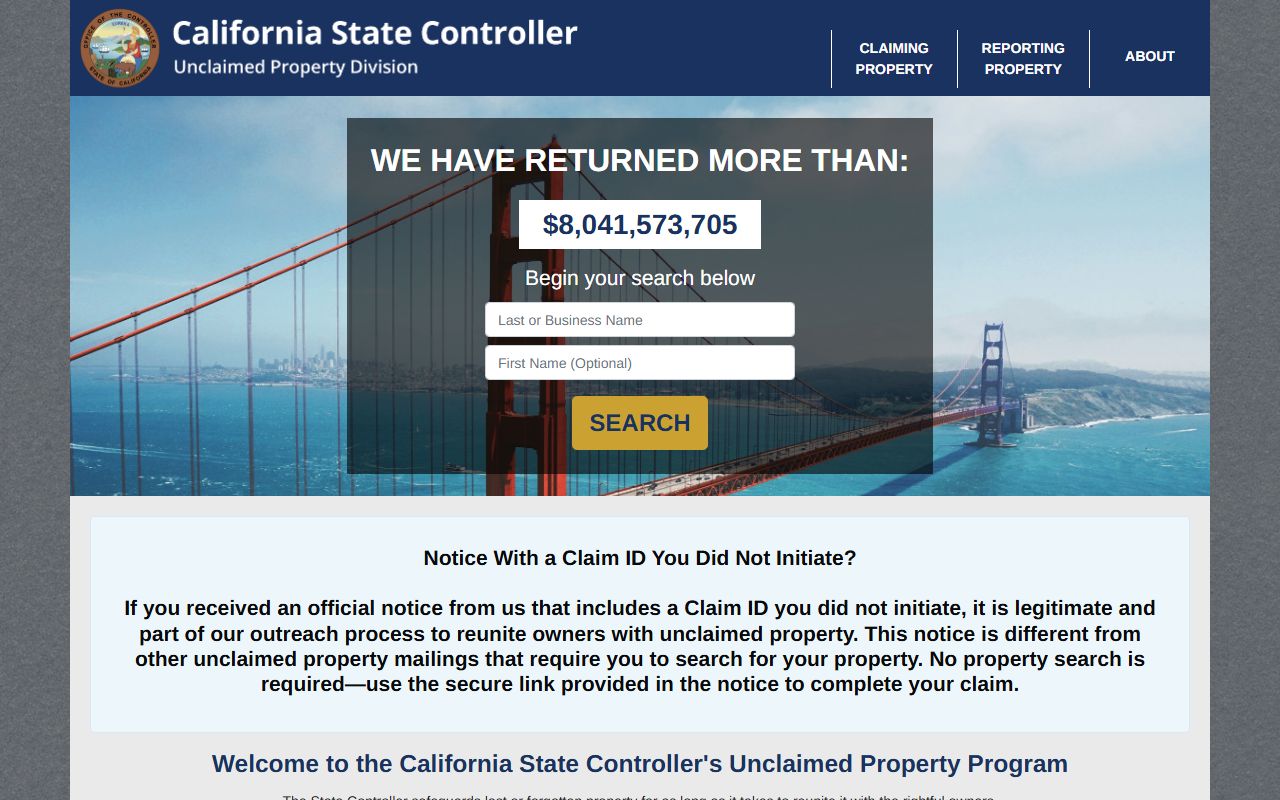

California State Controller Unclaimed Property

The California State Controller holds most unclaimed money for Merced County residents. The state manages over $11 billion in lost property. Banks report accounts that have been inactive for three years. Employers turn over uncashed paychecks after one year. Insurance companies report unclaimed proceeds. Stock brokers send dividends that were never claimed. All of this property goes to the state controller.

Search the database at the controller's property search portal. Enter your name or business name to see what the state holds. The search is free and takes just a few minutes. You can also search for deceased relatives if you are an heir. Results show the property type, approximate value, and the business that reported it.

When you find property in your name, you can file a claim online in many cases. The state controller's claim page walks you through the process step by step. Simple claims take 30 to 60 days to process. More complex claims involving heirs, businesses, or securities can take up to 180 days. The state processes all claims for free. You do not need to hire a company to help you. Asset locators may contact you and offer to file on your behalf for a fee of up to 10 percent of the property value. You can avoid this fee by filing directly with the state.

California law sets different dormancy periods for different types of property. Bank accounts become unclaimed after three years of no activity. Wages must be reported after one year. Money orders take seven years, and traveler's checks take fifteen years. These rules are set in Code of Civil Procedure section 1513. Once property reaches the state, there is no time limit for claiming it. Merced County residents can file claims decades later if they can prove ownership.

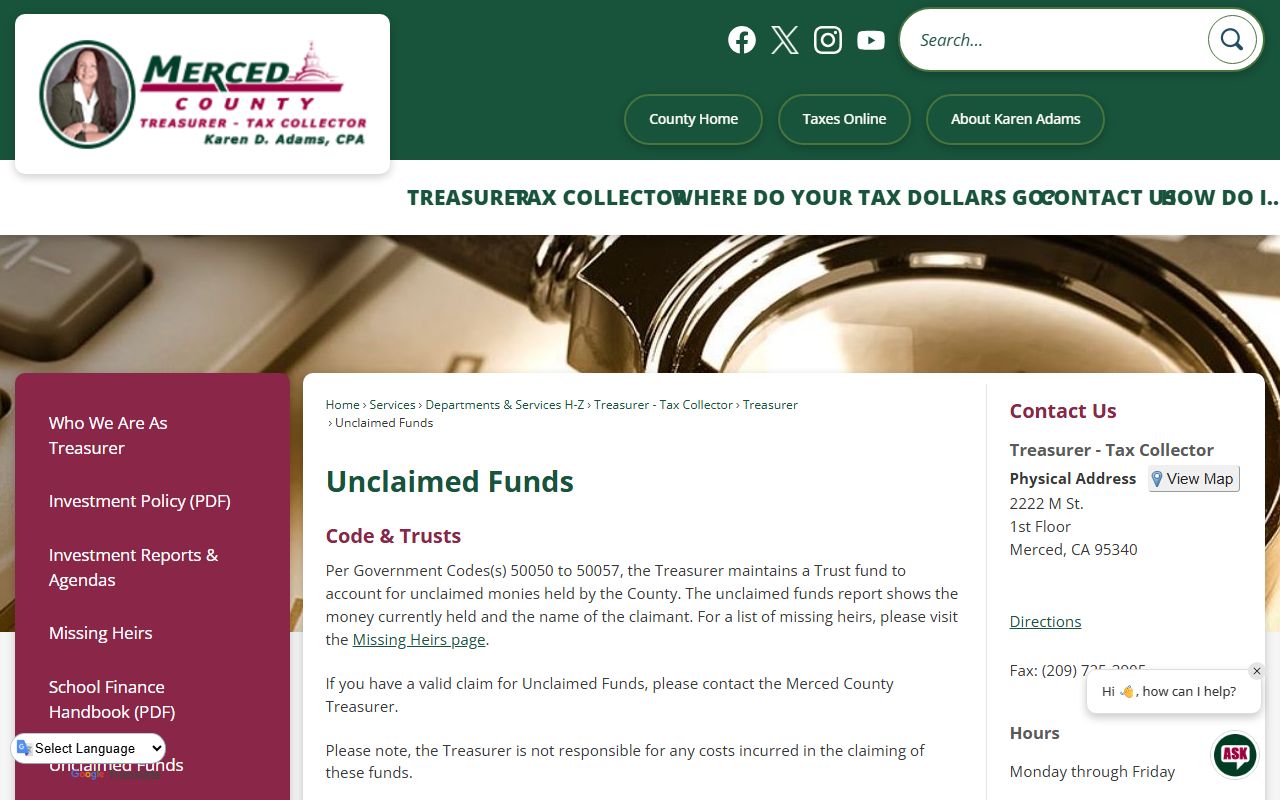

Merced County Unclaimed Funds Program

Merced County runs its own unclaimed funds program separate from the state controller. The county treasurer maintains a trust fund to account for unclaimed monies held by the county. This includes uncashed checks from county departments, deposits that were never refunded, and other funds owed to individuals or businesses.

The Merced County Treasurer manages the program under Government Code sections 50050 to 50057. These laws require the county to hold unclaimed funds for three years before they can escheat to the general fund. The county publishes a notice of unclaimed funds as required by law. If no one claims the money within three years of publication, it becomes county property.

Contact the Merced County Treasurer at (209) 385-7307 to inquire about county-held unclaimed funds. The treasurer's office can tell you if the county has any money in your name. You can file a claim directly with the county if they hold funds for you. The county process is separate from the state controller's system, so you need to check both places to find all unclaimed money.

Merced County may also hold excess proceeds from property tax sales. When the county sells a property to collect back taxes, any money left over after paying the debt goes into a trust. Former owners and lien holders can claim these funds. Tax sales happen periodically in Merced County, and excess proceeds can add up, especially in areas where property values have risen.

Note: Merced County provides information about its unclaimed funds program on the county website and through the treasurer's office.

How to File a Claim

Start by searching the California State Controller's unclaimed property website. This is where most Merced County unclaimed funds are held. When you find property in your name, click on it to start a claim. The site will tell you if you can file online or need to mail a paper claim. Many claims can be completed electronically, which is faster and easier.

You need to prove you are the rightful owner. For claims under $1,000, you may only need to provide basic information like your name, address, and Social Security number. Claims of $1,000 or more require notarization. If you are claiming on behalf of a deceased person, you need a death certificate and proof you are the legal heir. Business claims require articles of incorporation or other corporate documents.

Forms you may need include:

- Claim Affirmation Form (generated from your search results)

- Declaration Under Probate Code 13101 (for estates under $166,250)

- Table of Heirship (for heirs claiming on behalf of deceased owners)

- Safe Deposit Box Property Release Form (if claiming box contents)

Mail paper claims to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. You can also visit the public counter at 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670. The controller will review your claim and send a check if approved. Property is removed from the public database while a claim is being processed.

For Merced County-held funds, you need to file directly with the county treasurer. Contact the treasurer at (209) 385-7307 to get the correct forms and instructions. The county has its own claim process that differs from the state controller. Make sure you know which agency holds your money before you file a claim.

Types of Unclaimed Property

Bank accounts are the most common type of unclaimed property. Checking accounts, savings accounts, and certificates of deposit become unclaimed after three years of no activity. Merced County has many financial institutions serving residents and businesses. All of them report unclaimed accounts to the state controller when they cannot reach the owner.

Uncashed paychecks add up over time. Employers must turn over wages after one year if they cannot locate the employee. This happens when someone moves without updating their address or when a final paycheck gets lost in the mail. Merced County's economy includes agriculture, education, healthcare, and manufacturing. All of these sectors generate unclaimed paychecks each year.

Insurance proceeds often go unclaimed. Life insurance policies pay out when the insured person dies, but beneficiaries may not know the policy exists. Property and auto insurance refunds can also become unclaimed. Health insurance overpayments are another source. Merced County residents should search for insurance-related property if a family member passed away or if they had an old policy.

Other common types of unclaimed property:

- Stock dividends and mutual fund distributions

- Utility deposits from PG&E and other providers

- Escrow accounts from real estate transactions

- Court deposits and legal settlements

- Royalties from mineral rights or creative works

- Safe deposit box contents

- Matured savings bonds

Tax refunds can also go unclaimed. The California Franchise Tax Board holds old refund checks. Refund checks are good for six months. After that, you must request a replacement. Call (800) 852-5711 to claim an old tax refund. This is separate from the state controller's unclaimed property program.

California Unclaimed Property Laws

The Unclaimed Property Law is found in Code of Civil Procedure sections 1500 through 1582. These laws apply in Merced County and throughout California. The law defines what property must be reported and sets the rules for claiming it.

Holders of unclaimed property must file an annual report with the state controller. Most businesses file by November 1 each year. Life insurance companies have until May 1. Before turning property over to the state, holders must try to notify the owner. Under section 1530, written notice must be sent at least six months before filing the report. This gives owners a chance to claim their property before it goes to the state.

The state controller decides whether to approve or deny claims. According to section 1540, the controller has 180 days to decide on a complete claim. No interest is paid on claims. This means your money does not grow while the state holds it. Inflation can reduce the purchasing power of old funds over time.

Penalties apply to holders who do not comply with the law. Willful violations can result in misdemeanor charges under sections 1576 and 1577. Late delivery of property triggers a 12 percent annual interest penalty. These rules ensure that businesses in Merced County follow the law and protect property owners.

Other Unclaimed Property Resources

Several California agencies hold unclaimed money separate from the controller's program. CalPERS manages retirement benefits for public employees. If you worked for a California government agency, you may have unclaimed pension funds. Call (888) 225-7377 to search for benefits. Merced County government workers should check CalPERS for unclaimed retirement accounts.

CalSTRS holds property for teachers and school employees. If you worked in a Merced County school and did not claim your retirement account, CalSTRS may have your money. Contact them at (800) 228-5453 to file a claim.

The California Department of Insurance provides access to the Life Insurance Policy Locator. This tool helps you find policies when you do not know which company held the policy. Call the consumer hotline at (800) 927-4357.

The Employment Development Department handles unclaimed unemployment and disability benefits. If you had an uncashed check from EDD, file a claim using form DE 903SD. There is no fee. Call (800) 300-5616 for unemployment insurance or (800) 480-3287 for disability insurance.

For unpaid wages, the Department of Industrial Relations runs an Unpaid Wage Fund. This fund holds money collected from employers who did not pay workers. Call (833) 526-4636 to see if you have wages waiting.

Contact Information for Claims

For California State Controller unclaimed property, call (800) 992-4647 during regular business hours. If calling from outside the United States, dial (916) 323-2827. You can also contact the controller through an online form.

Mail claims to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. For in-person visits or overnight mail, use 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670.

For Merced County local unclaimed funds, contact the Treasurer at (209) 385-7307. Visit the county unclaimed funds page for more information on local programs.

Nearby Counties

These counties border Merced County. If you lived or worked in multiple counties, search for unclaimed money in each location.