Find San Joaquin County Unclaimed Funds

San Joaquin County unclaimed money is managed by the county treasurer-tax collector who declares monies in the amount of $33,156 held in the Unclaimed Tax Refunds Fund. The county maintains records of property tax refunds and other funds that have gone unclaimed. With about 790,000 residents centered around Stockton and Lodi, San Joaquin County processes significant amounts of unclaimed property. Contact the treasurer-tax collector at 209-468-2133 to search for locally held funds or check the California State Controller database for private business property like bank accounts and paychecks.

San Joaquin County Quick Facts

San Joaquin County Tax Refunds

The San Joaquin County Treasurer-Tax Collector declares monies held in the Unclaimed Tax Refunds Fund. This money comes from property tax refunds that were issued but never claimed by property owners.

Property tax refunds occur when assessments are reduced after appeals, when taxes are overpaid through escrow accounts, or when duplicate payments happen. The county auditor-controller issues refund checks to property owners. If those checks go uncashed for six months, they may be transferred to the unclaimed tax refunds account.

Under Government Code sections 50050 to 50057, counties must hold unclaimed funds for three years before they can escheat to the general fund. San Joaquin County publishes notices of unclaimed refunds to help owners claim their money.

Contact the treasurer-tax collector at 209-468-2133 to search for unclaimed tax refunds. Provide your name and the parcel number or address of property you owned in San Joaquin County. Staff can check records to see if any refunds are being held.

Filing Claims with San Joaquin County

If the treasurer-tax collector finds a refund in your name, they will explain the claim process. Requirements vary based on when you owned the property and your current situation.

For property you currently own, bring recent property tax bills showing your name as the owner. If you sold the property, bring the settlement statement from the sale showing how taxes were prorated. This establishes your right to refunds from your ownership period.

For inherited property, bring death certificates, probate documents, or affidavits of heirship showing your relationship to the deceased owner. Small estates under certain values can be claimed with simplified documentation under Probate Code Section 13100.

Bring government-issued photo ID matching your current legal name. If you changed your name since owning the property, bring documentation such as marriage certificates or court orders showing the name change.

Note: San Joaquin County does not charge fees to file claims for property tax refunds held by the county.

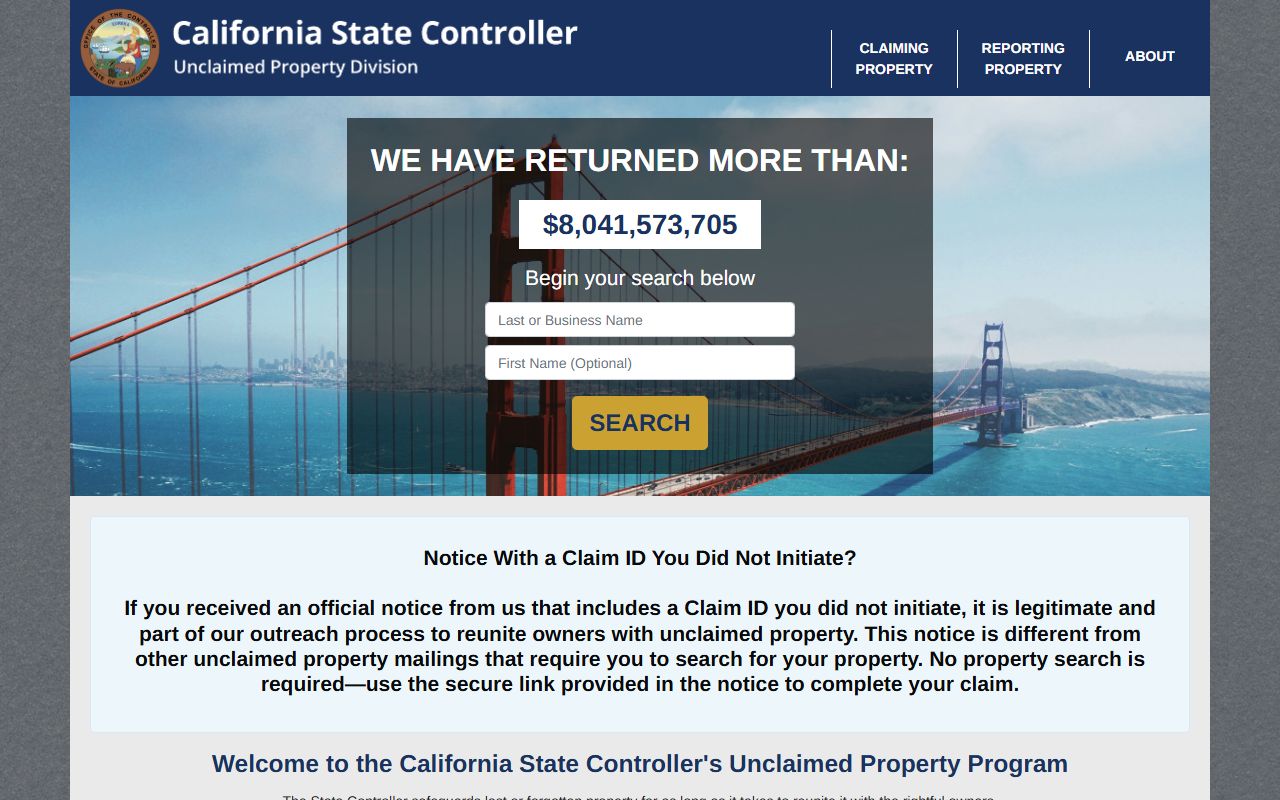

California State Controller Database

Most unclaimed money in San Joaquin County is held by the state, not the county. The California State Controller maintains over $11 billion in unclaimed property statewide. This includes bank accounts, paychecks, insurance policies, stock dividends, and safe deposit box contents.

Banks and businesses report property to the state after three years of no owner contact. The state holds funds indefinitely with no deadline to claim.

Search the state database by name at no cost. Many San Joaquin County residents have multiple properties listed from different sources. You might find old bank accounts from credit unions that merged or closed, uncashed paychecks from previous employers, or insurance proceeds.

Filing state claims is free. Most property can be claimed online at the state controller claim portal. Simple claims process in 30 to 60 days. Complex claims involving estates or businesses can take up to 180 days.

San Joaquin County Cities

Stockton is the county seat and largest city with over 320,000 residents. The city may maintain its own unclaimed property program for city-issued checks and refunds. Contact Stockton's finance department separately from the county treasurer.

Lodi has about 67,000 residents. Tracy has roughly 94,000 people. Manteca has around 87,000 residents. These cities may hold small amounts of unclaimed funds from utility refunds or business licenses. Check with city finance departments for locally held property.

Other Unclaimed Money Sources

Public employees in San Joaquin County should check CalPERS for unclaimed pension benefits. CalPERS serves county workers and city employees. Call 888-225-7377 or search online.

Teachers should check CalSTRS for unclaimed property from school employment. Call 800-228-5453 with questions.

The California Franchise Tax Board holds unclaimed state income tax refunds. Refund checks are valid for six months. After that, request a replacement.

Unclaimed Property Laws

Code of Civil Procedure Section 1500 establishes California's unclaimed property law. This statute defines abandoned property and sets dormancy periods.

Bank accounts are deemed abandoned after three years of no activity. Paychecks need one year. Money orders take seven years. Section 1530 requires businesses to file annual reports with the state controller by November first.

Government Code sections 50050 through 50057 govern San Joaquin County's program. These laws require the county to hold funds for three years before escheating them to the general fund.