Ventura Unclaimed Property Lookup

Ventura residents should search for unclaimed money at three levels. The California State Controller holds the most funds statewide from banks, employers, and insurance companies. Ventura County runs its own program for property tax refunds and unclaimed estates. The City of Ventura may have utility deposits or city payments that went uncashed. All three sources let you search and claim for free. No time limit applies. People regularly find funds from years or decades past. Check under your name, spouse's name, and deceased family members. Even if you moved away from Ventura, old accounts tied to addresses there may still appear in these databases waiting for you to claim them.

Ventura Quick Facts

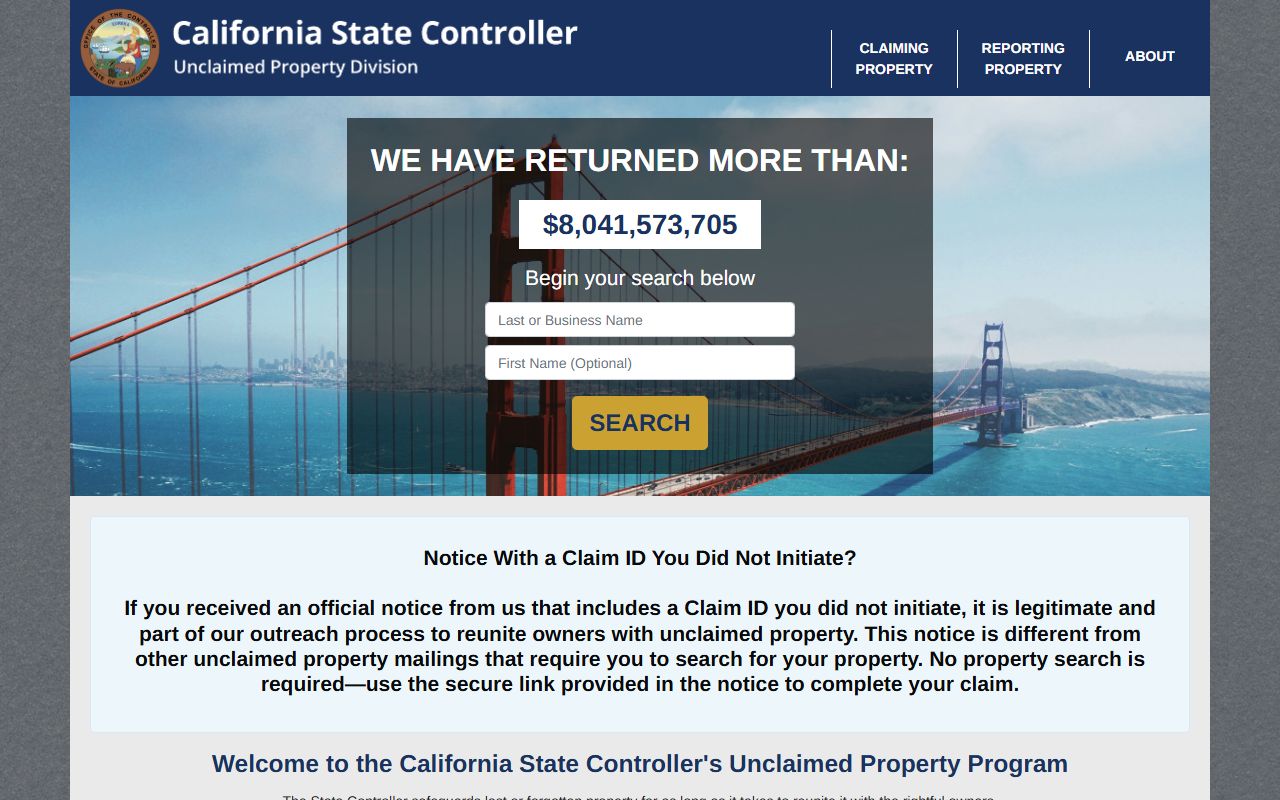

State Controller Unclaimed Property

California holds over $11 billion in unclaimed money. The State Controller manages this massive program. Banks report accounts after three years of inactivity. Employers send unpaid wages after one year. Stock brokers transfer dividends that were never claimed. Insurance companies report life insurance proceeds when they cannot find beneficiaries. All of this money sits in Sacramento waiting for owners.

Search the database at ucpi.sco.ca.gov/en/Property/SearchIndex right now for free. Type your name in the search box. Results appear instantly showing who sent the property, what type it is, and roughly how much. Click any match to see if you can file online. Most small claims under $1,000 qualify for electronic filing with just ID and a signature.

The online claim process is simple. Upload a photo of your California driver's license or state ID. Enter your current mailing address. Sign the electronic form. Submit it. The state reviews and processes most claims within 30 to 60 days. If approved, you get a check. No fee is charged for this service to Ventura residents.

Larger claims need notarization. Any amount of $1,000 or more must be signed by a notary public. Print the Claim Affirmation Form from the controller website. Fill it out. Visit a notary with your ID. The notary verifies and stamps it. Mail the notarized form with ID copies to Sacramento. These claims take longer but usually finish in 60 to 120 days.

Ventura County Unclaimed Funds

Ventura serves as the county seat. Ventura County runs a comprehensive unclaimed property program through the Auditor-Controller's Office. The county holds property tax refunds that were never claimed. When assessments get reduced or payments are duplicated, the county owes you a refund. If the refund check goes uncashed, the county keeps it in a trust fund. You can claim it anytime with no deadline.

Visit venturacounty.gov auditor unclaimed property tax refunds for details on the county program. The site explains how to search and file claims. Contact the Auditor-Controller at (805) 654-3139 to ask if they hold funds in your name. The county charges no fee to claim what belongs to you.

Estates of deceased persons also end up with the county. When someone dies without a will or known heirs, their assets go through probate. If no family comes forward, the estate escheats to Ventura County. Years later, relatives may discover they have a claim. The county will verify relationships and pay valid claims even if escheatment happened long ago.

California Government Code 50050-50057 allows counties to take ownership of dormant funds after three years. But state law also protects your perpetual right to claim. There is no statute of limitations on getting your money back from Ventura County.

City of Ventura Unclaimed Money

The City of Ventura may hold unclaimed funds from city services. Utility deposits are common. When you close a water, sewer, or trash account and move, the city should refund any deposit. If the check gets mailed to an old address and comes back, the city holds it for you. Business license refunds and vendor payments can also go unclaimed if checks are never cashed.

Contact the Ventura Finance Department to inquire about unclaimed funds. The city can search records by name or business name. If they find a match, they will tell you what documents to provide. Most cities need proof of identity and a signed claim form. No service fee applies when you claim directly from the city instead of using a third party.

Cities often send unclaimed money to the state after keeping it locally for a few years. So if Ventura transferred your funds to Sacramento, you will find them in the State Controller database. Always search the state system first since it consolidates property from many sources across California.

How Money Becomes Unclaimed

Code of Civil Procedure Section 1513 defines when property escheats to California. Bank accounts go dormant after three years with no activity. No deposits, no withdrawals, no communication. The bank sends letters to your last address. If mail comes back or you do not respond, they wait out three years. Then they report the account to the state with your name and last known address.

Wages have a shorter timeline. Employers must send unpaid wages to the state after just one year. This covers final paychecks, commissions, expense reimbursements, and any other wage payments that were never cashed. Even a small check from an old job may be waiting for you in Sacramento right now.

- Bank accounts after three years of no contact or activity

- Payroll checks and wages after one year with no contact

- Stock dividends and bond interest after three years

- Insurance proceeds from policies when beneficiaries are not found

- Utility deposits not refunded within three years of account closure

- Money orders after seven years from the issue date

- Traveler's checks after 15 years before they escheat

Holders file reports annually. Most businesses report in November and remit funds to the state in June. Life insurance firms report in May and send money in December. New property gets added to the database twice per year. Your name might appear in a future update if a Ventura holder just reported it to the controller.

How to File Claims in Ventura

Start at sco.ca.gov/search_upd.html to search the state database. Enter your full legal name. Try variations. Search your maiden name if you changed it. Look up family members who may have died. You can claim on behalf of estates if you are an heir or executor with proof.

When you find a match, click it for details. The site tells you if online filing is available. Most claims under $1,000 can be done electronically. Upload your ID. Fill in your current address. Sign digitally. Submit. The state processes simple claims in 30 to 60 days typically.

Claims of $1,000 or more need a notary signature. Print the Claim Affirmation Form. Complete it. Take it to a notary with your ID. The notary checks your identity and stamps the form. Mail it with ID copies to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. Include additional documents if the website requests them based on property type.

Claiming for deceased owners takes extra steps. You need the death certificate. Spouses and children send proof of relationship. Small estates under $166,250 can use a Declaration Under Probate Code 13101. Larger estates need Letters from probate court. The controller provides forms to help with estate claims in California.

Note: The State Controller charges no fee to search, file, or process claims for unclaimed property.

Additional Unclaimed Money Sources

Some funds do not go to the State Controller. Pension systems handle retirement money separately. CalPERS manages public employee benefits at calpers.ca.gov unclaimed property if you worked for government. CalSTRS handles teacher pensions at calstrs.com/unclaimed-property for education workers in Ventura.

Tax refunds stay with the Franchise Tax Board. Call 800-852-5711 if you never cashed a California income tax refund. They reissue checks over six months old. Recent refunds are quick. Older ones need Form 3900A or 3900B and take longer to process.

EDD holds unclaimed unemployment and disability benefits. File Form DE 903SD to claim old UI or SDI payments. No fee is required since 2016. Call 1-800-300-5616 for unemployment or 1-800-480-3287 for disability questions related to Ventura claims.

Nearby Cities Unclaimed Money

Other cities in Ventura County also have programs. Check these if you lived or worked there:

- Oxnard - Largest city in Ventura County

- Simi Valley - Neighboring city to the east

- Thousand Oaks - City in eastern Ventura County

- Camarillo - City in central Ventura County

Visit the Ventura County page for county-wide programs covering all cities in the county.