Search Ventura County Unclaimed Money

Ventura County unclaimed money programs include both local property tax refunds and state-held property. The Ventura County Auditor-Controller's Office maintains records of unclaimed property tax refunds that result from reduced assessments, overpayments, and duplicate payments. These refunds stay with the county until claimed. Beyond county programs, most unclaimed property from Ventura County residents ends up with the California State Controller. Banks, employers, insurance companies, and other businesses report unclaimed property to the state after legal dormancy periods pass. You can search both the county system and the state database to find money that belongs to you. No fees apply to searching or filing claims.

Ventura County Quick Facts

Ventura County Property Tax Refunds

The Ventura County Auditor-Controller's Office manages unclaimed property tax refunds. These refunds occur when property owners overpay their taxes or when assessments are reduced after payment has been made. The county holds these funds in trust until the rightful owner comes forward to claim them.

Property tax refunds can sit unclaimed for years. Owners move and forget to update their address with the county. The refund check gets mailed to the old address and never reaches them. Some people sell property and do not realize they may be owed a refund from a prior tax year. Others receive the notice but set it aside and forget about it. Ventura County publishes information about unclaimed refunds to help owners locate their money.

You can contact the Ventura County Auditor-Controller at (805) 654-3139 for information about property tax refunds. The office can search their records to see if they are holding funds in your name. They will provide claim forms and explain what documentation you need to submit. There is no charge to file a claim with the county.

Ventura County follows Government Code sections 50050 to 50057 when handling unclaimed property. These laws require local agencies to hold unclaimed money for three years. After that time, the county must publish a notice giving potential claimants a chance to come forward. If no claim is filed, the money may escheat to the county general fund. But owners can still file claims even after escheatment.

California State Controller Database

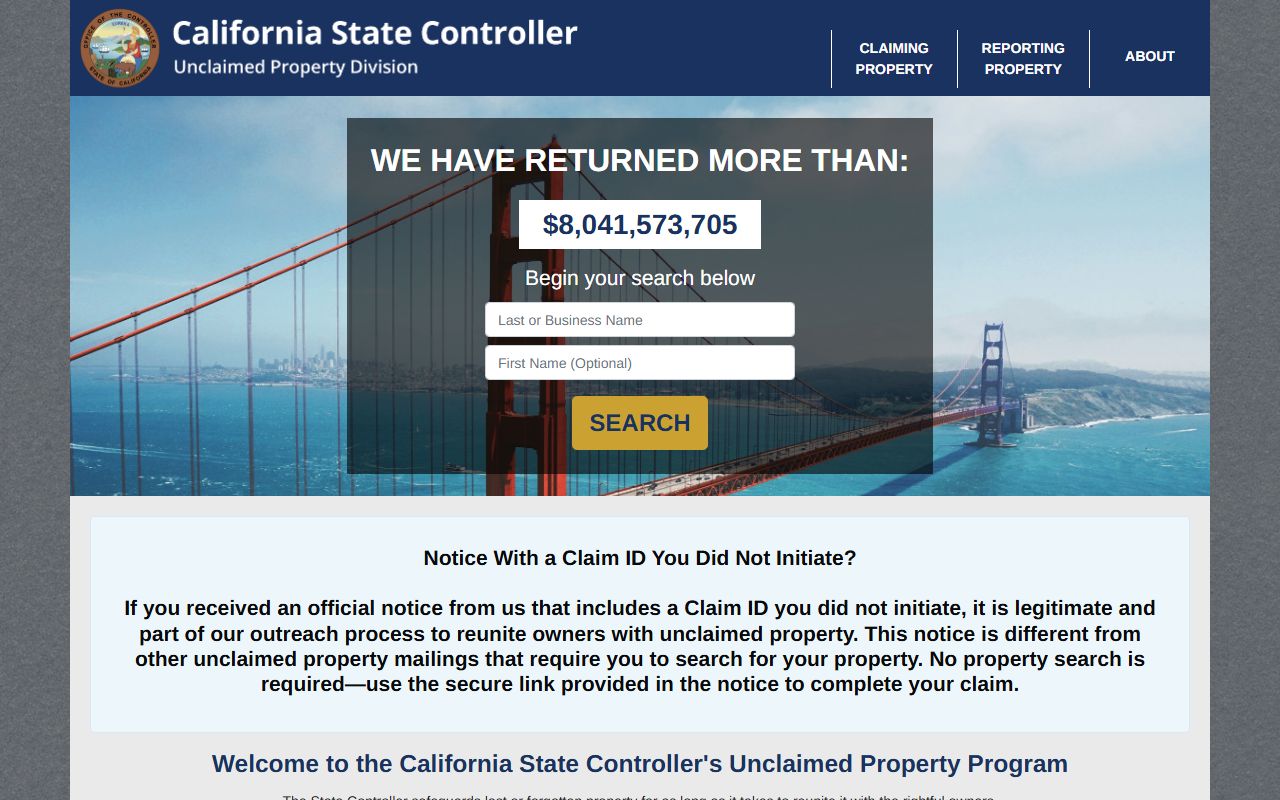

Most unclaimed money from Ventura County is held by the California State Controller. The state holds over $11 billion in unclaimed property. Ventura County, with a population over 850,000, accounts for millions of dollars of this total. Banks, insurance companies, employers, and other businesses turn over unclaimed property to the state after dormancy periods expire.

Search the state database at the controller's property search portal. The search is free and available 24 hours a day. Type your name to see all property reported in your name. The results show the property type, the reporting business, and the approximate value.

Try different name variations. Use your full legal name and any nicknames. Search maiden names if you married. Include middle initials and try dropping them. Search business names if you owned a company in Ventura County. Many people find property by trying multiple search terms. A forgotten bank account here, an old paycheck there. Small amounts add up.

When you find property that belongs to you, click on it to start a claim. The website tells you if you can file online or need to submit a paper claim. Online claims are faster. The system generates a claim form pre-filled with property information. You add your current contact details and submit the form electronically.

Claims under $1,000 typically require just basic proof of identity. The state verifies who you are and processes the claim. Claims over $1,000 must be notarized. You sign the claim form in front of a notary public who verifies your identity and witnesses your signature. All securities claims require notarization regardless of value. Safe deposit box claims need additional documentation because contents may include valuables beyond cash.

Filing Your Claim

Start by determining where your property is held. Property tax refunds are with Ventura County. Most other unclaimed property is with the state controller. Search both to find all money owed to you.

For Ventura County refunds, call (805) 654-3139 and ask if they have unclaimed property tax refunds in your name. The auditor-controller's office will check their records. If they find refunds owed to you, they will send claim forms with instructions. Fill out the forms completely and return them with proof of identity. The county will review your claim and issue payment if approved.

For state-held property, visit the California State Controller's unclaimed property website. Search your name and any previous names you have used. When you find your property, follow the claim instructions. Many claims can be completed online. The website will tell you if online filing is available for your specific property.

Documents you may need for claims include:

- Government-issued photo ID like driver's license or passport

- Social Security number or tax identification number

- Proof of current address such as utility bill or bank statement

- Death certificate if claiming for a deceased person

- Probate documents or affidavit for estate claims

- Business formation papers for business property

- Marriage certificate or divorce decree if name changed

Mail paper claims to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. Include all required documents with your claim. The controller sends an acknowledgment when they receive it. A decision letter follows when they approve or deny the claim. Approved claims result in a check mailed to your address. Processing time ranges from 30 days for simple claims to 180 days for complex situations.

Note: The state removes property from the public database while processing your claim to prevent duplicate filings.

Types of Unclaimed Property

Bank accounts are the most common unclaimed property. A checking or savings account sits unused for three years. The bank cannot reach you. They report the account to the state. Ventura County has thousands of forgotten bank accounts with the state controller. People move between cities like Oxnard, Thousand Oaks, and Simi Valley and lose track of small accounts.

Paychecks go unclaimed regularly. An employer issues a final paycheck. The employee moved without leaving a forwarding address. The check cannot be delivered. After one year, the employer sends the uncashed wages to the state. This happens frequently with seasonal workers, temporary employees, and people who switch jobs often.

Insurance proceeds often go unclaimed. Life insurance pays out when someone dies but the beneficiary never knew the policy existed. Auto insurance issues refunds after policy cancellations. Health insurance overpays claims. All of these become unclaimed property if not collected within the dormancy period. Ventura County, with its large and mobile population, generates substantial unclaimed insurance proceeds each year.

Utility deposits are another common type. You close an electric, gas, or water account. The utility owes you a deposit refund. They mail a check to your last address on file. You already moved. The check cannot be delivered. One year later, the utility reports the unclaimed deposit to the state. These deposits typically range from $50 to several hundred dollars.

Additional types of unclaimed property include:

- Stock dividends and mutual fund distributions

- Rebates and refunds from retailers

- Escrow refunds from real estate transactions

- Security deposits from rental properties

- Royalties from oil and gas rights (common in Ventura County)

- Safe deposit box contents including jewelry and coins

- Court deposits and legal settlements

- Matured savings bonds

Ventura County property tax refunds are a specific local type. They result from assessment reductions, overpayments, or duplicate payments. If you paid your property tax and the assessor later reduced your assessed value, you get a refund. If you accidentally paid twice, you get the duplicate payment back. These refunds stay with the county until you claim them.

Understanding Dormancy Periods

California law sets specific dormancy periods for different types of property. These periods determine when a business must report property to the state. Code of Civil Procedure section 1513 establishes the rules.

Bank accounts become unclaimed after three years of no owner activity. No activity means no deposits, withdrawals, or contact with the bank. Even logging into online banking counts as activity and restarts the three-year clock. Banks must try to contact you before reporting the account. If they cannot reach you, the funds go to the state.

Wages and paychecks have a one-year dormancy period. An employer holding an uncashed paycheck for one year must report it to the state. This short period protects workers who need their pay. Waiting three years would be unfair when someone might desperately need the money for living expenses.

Money orders must be held for seven years before becoming unclaimed. Traveler's checks have a fifteen-year dormancy period. These longer periods recognize that people sometimes buy these instruments and forget about them for years. The extended holding time gives owners more opportunity to remember and use them.

Insurance proceeds follow special rules. Life insurance becomes reportable immediately after the insurance company knows the insured person died. Insurers must search the Death Master File and other resources to find beneficiaries. Other insurance types like health and auto follow the standard three-year dormancy period.

Other key dormancy periods include:

- Utility deposits: one year after account closure

- Stocks and dividends: three years from payment date

- Safe deposit boxes: three years after rent becomes overdue

- Court deposits: three years after final judgment or dismissal

- Mineral proceeds: three years from date payable

Once property reaches the state controller, dormancy periods no longer matter. The state holds the property indefinitely. There is no time limit for filing a claim. You can claim property reported decades ago if you prove ownership. The state does not charge storage fees or reduce value over time.

California Unclaimed Property Law

The Unclaimed Property Law appears in the California Code of Civil Procedure. Section 1500 establishes the short title. Sections 1501 through 1577 contain all provisions governing unclaimed property.

Section 1501 defines important terms. A holder is anyone holding property belonging to another person. An owner is the person entitled to the property. An apparent owner is the person named on the holder's records. These definitions determine who must report property and who can claim it.

Section 1530 requires holders to file annual reports with the state controller. Life insurance companies report between December 1 and December 15. All other businesses report between June 1 and June 15. The report must list each piece of unclaimed property, identify the apparent owner, and show the last known address. Holders must deliver the property to the controller with the report.

The controller maintains a public database of all reported property. Section 1540 governs the claim process. Anyone can search the database and file claims. The controller has 180 days to decide each claim. The controller can request additional proof before approving a claim. Approved claims result in payment. No interest is paid on unclaimed property.

Section 1576 sets penalties for non-compliance. Willfully failing to report unclaimed property is a misdemeanor. Late delivery of property triggers a 12 percent annual interest penalty from the date the property should have been delivered. These penalties push businesses to comply with reporting requirements.

Local agencies like Ventura County follow Government Code sections 50050 to 50057. These sections govern unclaimed money held by counties, cities, and special districts. The rules mirror the state law but apply to public entities instead of private businesses.

Contact Information

For Ventura County property tax refunds, contact the Auditor-Controller's Office at (805) 654-3139. The office is located in Ventura. Staff can search county records for refunds in your name and provide claim forms. There is no charge to file a claim with the county.

For all other unclaimed property, contact the California State Controller's Unclaimed Property Division. Call toll-free at (800) 992-4647 from anywhere in the United States. International callers can dial (916) 323-2827. The call center operates during business hours Pacific time. Staff can help you search for property and answer questions about the claim process.

Visit the state controller's public counter at 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670. This office serves walk-in customers who need help searching or filing claims. Bring photo identification and any documents related to your property. Call ahead to confirm hours before making the trip from Ventura County.

Mail all paper claim forms and supporting documents to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. This is the official mailing address for state controller claims. The controller sends an acknowledgment when they receive your claim. A decision letter follows when they approve or deny it.

Submit general questions through the online form on the state controller's website. Most questions receive responses within a few business days. Email works for general inquiries but should not be used to send claims or sensitive information.

Major Cities in Ventura County

Several cities in Ventura County have populations over 100,000 and may maintain their own local unclaimed money programs in addition to the county and state systems. Residents of these cities should search local, county, and state databases to find all unclaimed property.

Oxnard is the largest city in Ventura County with over 200,000 residents. The city may hold unclaimed funds from city operations. Thousand Oaks has over 125,000 residents and robust city services that can generate unclaimed property. Simi Valley has over 125,000 residents and may hold unclaimed city funds.

Check with your city government to see if they maintain a local unclaimed property program. Many cities publish annual notices of unclaimed funds as required by state law. Even if your city does not have an online database, they can check their records if you call and ask.

Note: Always search the state controller database in addition to any local databases because most unclaimed property ends up with the state.