Search Torrance Unclaimed Property

Torrance unclaimed money searches should cover three main sources. The California State Controller holds billions in lost funds from old bank accounts and uncashed checks. Los Angeles County keeps unclaimed property from tax sales and estates. The City of Torrance may hold utility deposits and city warrant refunds. All three sources are free to search and free to claim. No deadline exists for filing. You can find money from decades ago. Most claims process in 30 to 180 days depending on complexity. Search under your current name and any past names you used while living in the South Bay area.

Torrance Quick Facts

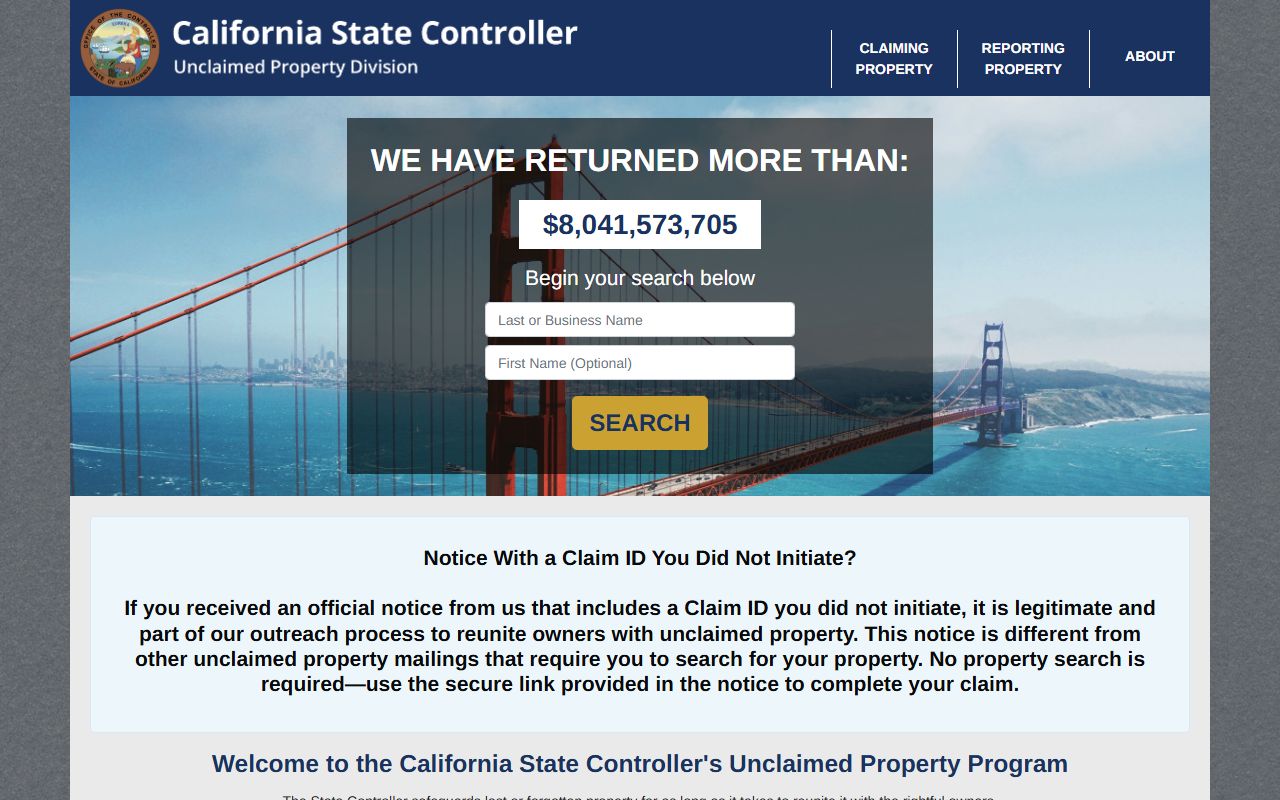

California State Controller Database

The main place to look is the state database. Over 49 million properties sit unclaimed in California. The State Controller keeps funds safe until owners claim them. Banks turn over accounts after three years of no contact. Employers send unpaid wages after one year. Stock brokers report dividends that were never cashed. Insurance firms transfer life insurance proceeds when they cannot locate beneficiaries.

Search for free at ucpi.sco.ca.gov/en/Property/SearchIndex any time. Type in your name. The system shows matches instantly. Each result lists who sent the money and roughly how much. Click a match to start the claim process. The site will guide you through next steps. Simple claims can be filed online in minutes. Just upload your ID and sign the form.

Larger amounts need more proof. Claims of $1,000 or more must be notarized. You print the claim form, fill it out, and take it to a notary. The notary stamps it after checking your ID. Then you mail the notarized form to the Unclaimed Property Division in Sacramento. Include copies of your ID. Heirs claiming for someone who died also need a death certificate and proof of relationship to the deceased.

The state upgraded its system in 2025. California now uses the Kelmar Abandoned Property System to process claims faster. This industry standard platform helps verify ownership and speed up payments. Most cash claims finish in 30 to 60 days. Securities and complex claims can take 120 to 180 days in Torrance.

Los Angeles County Unclaimed Funds

Torrance is part of Los Angeles County. The county runs its own unclaimed property programs under state law. LA County holds excess proceeds from tax sales. When property gets sold at auction for unpaid taxes, any money left over after paying the tax debt belongs to the former owner. If no one claims it, the county treasurer keeps it in trust. These funds can be claimed years later with no time limit.

Check the county program at ttc.lacounty.gov/notice-of-excess-proceeds/ to see published lists. The county posts notices of excess proceeds online. You can search by property address or owner name. If you find a match, contact the LA County Treasurer-Tax Collector at (213) 974-2111 to start a claim. The county does not charge fees for filing. You can claim directly without hiring anyone.

Estates of deceased persons with no known heirs also end up with the county. When someone dies without a will or family, their assets go through probate. If no heirs come forward, the money escheats to the county after a waiting period. Distant relatives can still claim these funds if they prove their relationship. LA County holds millions in unclaimed estate funds at any given time.

Government Code 50050-50057 governs local unclaimed money in California. These sections let counties take ownership of dormant funds after three years. But the law also protects your right to claim anytime in the future. Even if the county escheated your money 20 years ago, you can still file a claim today in Los Angeles County.

City of Torrance Unclaimed Property

The City of Torrance may hold unclaimed funds from city operations. This includes utility deposits from water and trash service. When you move out of Torrance and close your account, you should get a refund of any deposit. If the city mails a refund check and it comes back undelivered, they hold that money for you. Old vendor payments and business license refunds can also become unclaimed.

Contact the Torrance Finance Department to ask about unclaimed funds. The city offices are located at 3031 Torrance Blvd. Call their main number or visit in person. They can search their records to see if they hold money in your name. Most cities require proof of identity and a signed claim form. The process is free. No fee is charged to get your own money back from the city.

Cities often send unclaimed funds to the state after a few years. So if Torrance does not have your money, it may already be with the State Controller. Always search the state database first since it covers more sources. Then check with the county and city to be complete. Between these three levels, you will find most unclaimed property tied to Torrance addresses.

What Becomes Unclaimed in Torrance

Many types of assets turn into unclaimed property. Bank accounts are the most common. You open a checking or savings account, use it for a while, then forget about it. After three years of no deposits, withdrawals, or contact, the bank must report it to California. Safe deposit box contents also go to the state if you stop paying rent on the box. The bank tries to contact you first but eventually sends everything to Sacramento.

Paychecks and wages become unclaimed faster. Code of Civil Procedure Section 1513 says employers must turn over unpaid wages after one year. This includes final paychecks you never picked up, commission checks sent to old addresses, and expense reimbursements that were never cashed. Even a $50 paycheck from years ago may be waiting at the state.

- Dormant bank accounts and credit union shares after three years

- Uncashed payroll checks and wage payments after one year

- Stock dividends and mutual fund distributions after three years

- Life insurance proceeds when beneficiaries cannot be located

- Utility deposits not refunded within three years after service ends

- Safe deposit box contents when rent goes unpaid for three years

- Customer refunds and rebate checks that were never cashed

Businesses must report unclaimed property each year. Most companies report in November and send funds to the state in June. Life insurance firms report in May and remit in December. This cycle means new property appears in the database twice per year. If a Torrance business just reported your name, it will show up in the next update at the State Controller.

Filing Your Claim for Unclaimed Money

Start at sco.ca.gov/search_upd.html to search the state database. Enter your full name as it appears on your ID. Try variations. Use your maiden name if you got married. Search your spouse and children too. Look up parents or grandparents who may have passed away. You can claim on behalf of deceased family if you are an heir.

Results show the holder, property type, and a rough amount. Click on any match to see if you can file online. Small claims under $1,000 usually qualify for electronic filing. You upload a photo of your California driver's license or state ID card. Fill in your current mailing address. Sign the form digitally. The state reviews it and processes payment if everything checks out. Easy claims finish in 30 to 60 days from start to check.

Claims of $1,000 or more need a notary. Print the Claim Affirmation Form. Complete all fields. Take it to a notary public with valid ID. The notary will verify your identity and stamp the form. Mail the notarized claim with a copy of your ID to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. The state will contact you if they need more documents. Respond quickly to avoid delays in processing.

Claiming for someone who died requires extra steps. You need the death certificate. If you are a spouse or child, include proof of relationship like a marriage certificate or birth certificate. Small estates under $166,250 can use a simple Declaration Under Probate Code 13101. Larger estates need formal probate documents. The state provides a Table of Heirship form to show family trees when multiple heirs exist in California.

Note: The State Controller charges no fee to search, file, or process unclaimed property claims.

Other Unclaimed Money Programs

Not all unclaimed money goes to the State Controller. Pension benefits have separate systems. CalPERS manages unclaimed retirement funds for public employees. If you worked for a city, county, or state agency in California, search calpers.ca.gov unclaimed property for pension money. CalSTRS handles teacher pensions at calstrs.com/unclaimed-property if you worked in education.

Tax refunds stay with the Franchise Tax Board. If you never cashed a California income tax refund check, call 800-852-5711. They can reissue checks that are over six months old. Refunds less than three years old are quick to replace. Older refunds need Form 3900A or 3900B and can take up to 18 months to process through the state system.

Unemployment and disability benefits are held by EDD. The Employment Development Department keeps unclaimed checks from UI and SDI programs. File Form DE 903SD to claim old benefit payments. There is no filing fee as of 2016. Call 1-800-300-5616 for unemployment questions or 1-800-480-3287 for disability benefit claims in Torrance.

Unclaimed Money in Nearby South Bay Cities

Other large cities in the Los Angeles area also have unclaimed property. Check these nearby cities if you lived or worked in them:

- Long Beach - Adjacent city with its own program

- Los Angeles - County seat with extensive resources

- Carson - Neighboring city in LA County

- Redondo Beach - Coastal neighbor to the west

- Inglewood - City to the north

You can also visit the Los Angeles County page for county-wide programs that cover all cities in the county including Torrance.