Unclaimed Property in Pasadena

Pasadena residents can search for unclaimed money at three levels. The city finance department holds uncashed checks from city operations. Los Angeles County maintains excess proceeds from tax sales and other county funds. The California State Controller holds billions in lost property from banks, insurance companies, and employers. All three searches are free and take only a few minutes. Many people find old bank accounts they forgot about. Some discover final paychecks from jobs they held years ago. Others find insurance money or utility deposits. The state holds property forever with no deadline to claim it. You can file a claim decades after the property was reported.

Pasadena Quick Facts

City of Pasadena Unclaimed Funds

The City of Pasadena holds unclaimed money from its own operations. This includes uncashed checks issued by city departments for refunds, vendor payments, and deposits. If you did business with the city and never got paid, or if you lost a check, you may have funds waiting. The city finance department can search for unclaimed checks in your name.

California cities must follow state escheatment laws. Government Code Section 50050 says that money held for three years without contact may become city property after public notice. But you can still file a claim after escheatment if you prove the money belongs to you. The city does not charge a fee to return your own funds.

Visit the City of Pasadena finance department page for information on unclaimed funds. You can call the department at 626-744-7175 to ask if they have uncashed checks in your name. They will need your full name and possibly your Social Security number to search their records.

To claim city-held funds, you need proof of identity. A driver's license or state ID is usually enough. If the check is for a business, you may need business documents. The city will verify the check belongs to you and issue a replacement. The process usually takes a few weeks depending on how long it takes to verify ownership.

City funds come from many sources. Water or utility refunds are common when you close an account with a deposit on file. Business license refunds happen if you overpaid or if the city denied your application. Building permit refunds occur if you cancelled a project after paying fees. Some people have vendor payments from contract work they did for the city.

Los Angeles County Unclaimed Money

Pasadena is in Los Angeles County. The county has a large unclaimed property program. The treasurer-tax collector holds excess proceeds from tax sales. When the county sells property for unpaid taxes, any money left after paying the taxes and fees goes into an excess proceeds fund. The former owner or other parties with an interest in the property can claim these funds.

The county reminds residents that they can file claims for free. State law allows asset locators to charge fees, but you can file directly with the county at no cost. Visit the Los Angeles County excess proceeds page to search for funds. The page lists all sales with excess proceeds. You can search by property address or by name.

To claim excess proceeds, you must prove you have an interest in the property. Former owners need to show they owned the property at the time of sale. Provide a deed, title report, or property tax bill. Lienholders need to show their lien was recorded before the tax sale. Heirs need a death certificate and proof they are legal heirs.

Excess proceeds must be claimed within one year from the date of the tax sale. After one year, they may escheat to the county general fund. Even after escheatment, you can try to file a claim, but it gets harder to prove ownership as time passes. File as soon as you discover you have excess proceeds waiting.

The county may also hold other types of unclaimed funds. Contact the treasurer-tax collector at (213) 974-2111 to ask about any money in your name. The county publishes annual notices of unclaimed funds. If you miss a notice, you can still file a claim later.

California State Controller Program

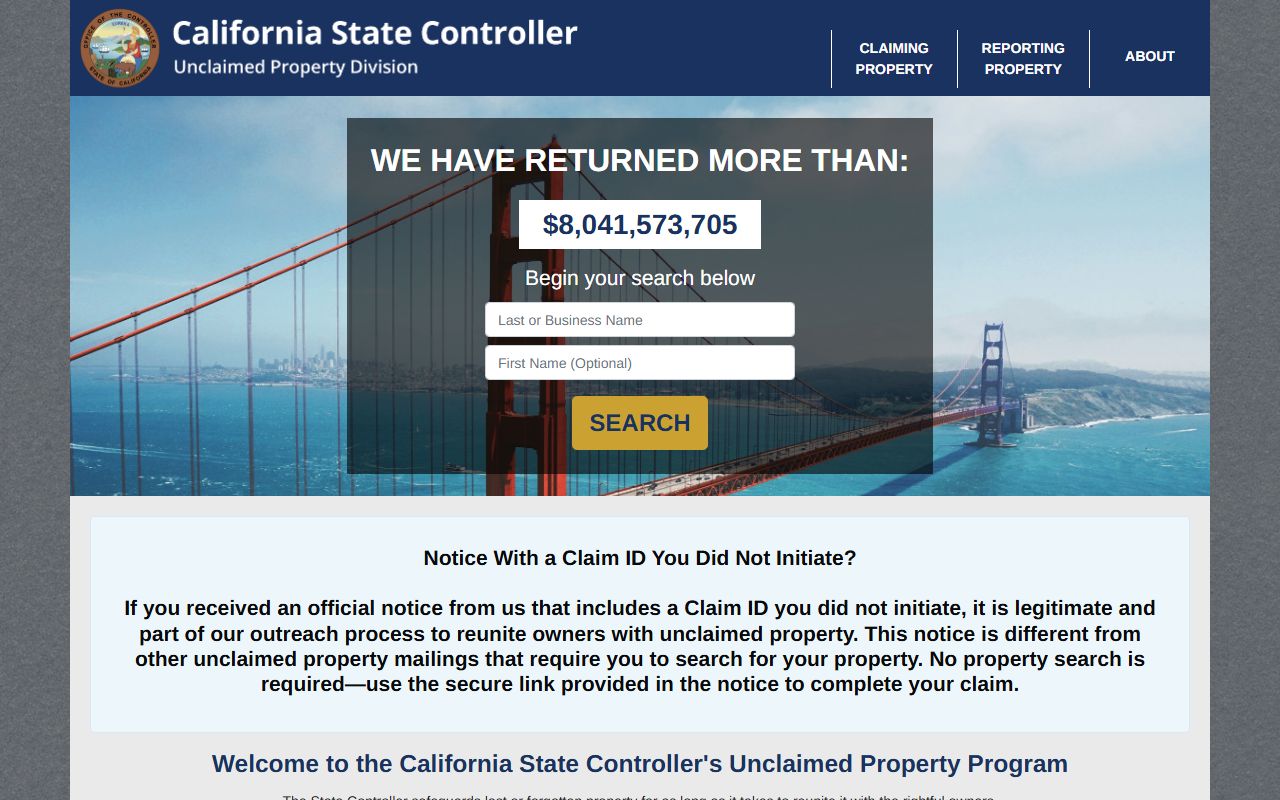

The California State Controller holds the most unclaimed property. The state has over $11 billion in lost funds from all over California. Banks must report dormant accounts after three years of no activity. Employers report uncashed paychecks after one year. Insurance companies report old policies and unclaimed death benefits. All this property goes to the state until the rightful owner claims it.

Search for your property at the state controller's property search database. Enter your name or business name. The search is free and takes only a minute. You might find old bank accounts, paychecks, stock dividends, or insurance money. The database shows the property type, the business that reported it, and an estimated value.

If you find property in your name, you can file a claim online or by mail. Simple claims can be filed electronically. Complex claims may require paper forms and additional documentation. The state does not charge a fee to claim your property. You can do it yourself without hiring anyone.

There is no deadline to claim property from the state. The state holds it forever until you file a claim. If you lived in Pasadena years ago and moved away, you may still have property under your name. The property stays with the state no matter how much time has passed. This is different from county excess proceeds, which have a one-year deadline.

Dormancy periods vary by property type. Bank deposits become dormant after three years of no activity. Wages and paychecks are dormant after one year. Money orders wait seven years and traveler's checks wait fifteen years. These rules come from Code of Civil Procedure Section 1513. When the dormancy period ends, the holder must report the property to the state.

Note: The state controller processes simple cash claims in 30 to 60 days and complex claims in up to 180 days.

Filing Your Claim

The claim process depends on who holds your property. For state property, start at the state controller's claim filing page. Search for your property first. When you find it, click to start a claim. The website will tell you if you can file online or if you need to mail forms. Online claims are faster and you get email updates.

You must prove you are the rightful owner. For claims under $1,000, you may only need your name, address, and Social Security number. Claims of $1,000 or more require a notarized signature. If you are claiming for a deceased person, you need a death certificate and proof you are an heir. Business claims require corporate documents such as articles of incorporation.

Forms you may need:

- Claim Affirmation Form (generated from your search results)

- Declaration Under Probate Code 13101 (for small estates under $166,250)

- Table of Heirship (for heirs claiming deceased owner's property)

- Safe Deposit Box Property Release Form (for safe deposit box contents)

Mail paper claims to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. You can also drop off claims in person at 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670. The controller reviews claims and sends a check if approved. Your property is removed from the public search database while the claim is being processed.

For City of Pasadena funds, contact the finance department at 626-744-7175. For Los Angeles County excess proceeds, follow the instructions on the county website or call (213) 974-2111. Each agency has its own claim process and requirements. But none of them charge a fee to return your own money.

Types of Unclaimed Property

Bank accounts are the most common type of unclaimed property. Checking accounts, savings accounts, and certificates of deposit all become dormant after three years of no activity. People move and forget to update their address. The bank tries to reach them but cannot. After the dormancy period, the bank reports the account to the state.

Paychecks go unclaimed more often than you might think. An employer sends a final paycheck to your last known address. If you moved without leaving a forwarding address, the check comes back. After one year, the employer must report it to the state. Many Pasadena residents have unclaimed wages from jobs they held years ago in the Los Angeles area.

Insurance proceeds often go unclaimed. Life insurance pays out when someone dies, but the beneficiaries may not know a policy exists. Health insurance refunds, auto insurance claim checks, and property insurance overpayments also end up as unclaimed property. California requires insurers to check the Death Master File, but many policies still slip through.

Other common types include:

- Stock dividends and mutual fund distributions

- Utility deposits from closed accounts

- Escrow accounts and earnest money deposits

- Court deposits and legal settlements

- Oil, gas, and mineral royalties

- Safe deposit box contents

- Matured savings bonds

City and county funds are usually uncashed checks. Pasadena may hold refund checks for permits, licenses, or utilities. Los Angeles County may hold property tax refunds or excess proceeds from tax sales. If you had financial dealings with the city or county and never received payment, check both agencies for unclaimed funds.

Contact Information

For state unclaimed property, call the California State Controller's toll-free hotline at 1-800-992-4647 from anywhere in the United States. Outside the country, call (916) 323-2827. Mail claims to P.O. Box 942850, Sacramento, CA 94250-5873. The public counter is at 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670 for in-person visits.

| State Controller | California State Controller - Unclaimed Property Division |

|---|---|

| Phone | (800) 992-4647 |

| Outside U.S. | (916) 323-2827 |

| Website | sco.ca.gov/search_upd.html |

For City of Pasadena unclaimed funds, call the finance department at 626-744-7175 or visit the city finance page. For Los Angeles County excess proceeds and other unclaimed funds, call the treasurer-tax collector at (213) 974-2111 or visit the county website.

Other Unclaimed Money Sources

CalPERS holds unclaimed retirement benefits for state and local government employees. If you worked for the City of Pasadena, Los Angeles County, or any public agency in California, you may have CalPERS benefits waiting. Search at the CalPERS unclaimed property page or call 1-888-225-7377.

CalSTRS holds unclaimed benefits for teachers. If you taught in Pasadena Unified School District or any California school, check with CalSTRS. Call 1-800-228-5453 or visit calstrs.com/unclaimed-property to search.

The California Franchise Tax Board holds unclaimed tax refunds. State tax refund checks are good for six months from the issue date. If you did not cash yours within that time, you need to request a new check. For refunds one to three years old, send a letter to the board with your name, tax year, and subject line "Old refund check." For refunds over three years old, file a Replacement Warrant Claim form. Call 1-800-852-5711 for help.

The Employment Development Department holds unclaimed unemployment and disability insurance benefits. If you have an uncashed check from EDD, file form DE 903SD to claim it. There is no filing fee for claims submitted after July 1, 2016. Call 1-800-300-5616 for unemployment insurance questions or 1-800-480-3287 for disability insurance.

The Department of Industrial Relations holds unpaid wages in the Unpaid Wage Fund. This fund was created in 1975 for wages that employers could not pay due to bankruptcy or other reasons. If you are owed wages your employer could not pay, check with the DIR. Call the toll-free line at 1-833-526-4636 for information.

For lost life insurance policies, use the National Association of Insurance Commissioners Life Insurance Policy Locator. Visit the NAIC policy locator service to search for policies nationwide. This helps if a family member died and you think there may be a life insurance policy but do not know which company issued it.

Los Angeles County Unclaimed Money

Pasadena is in Los Angeles County. The county holds excess proceeds from tax sales and other unclaimed funds under state law. For more on county programs, claim procedures, and contact information, visit the Los Angeles County unclaimed money page.