Tuolumne County Unclaimed Property Lookup

Tuolumne County unclaimed money is primarily held by the California State Controller. The county directs residents to the state system for searching and claiming unclaimed property. Banks, employers, insurance companies, and other businesses in Tuolumne County report dormant accounts and uncashed checks to the state after required waiting periods. This includes forgotten bank accounts, old paychecks, insurance proceeds, utility deposits, and more. The state holds billions of dollars in unclaimed property and reunites it with owners at no cost. You can search the database for free and file claims without paying any fees. The process is straightforward and designed to make it easy for rightful owners to recover their property.

Tuolumne County Quick Facts

California State Controller Database

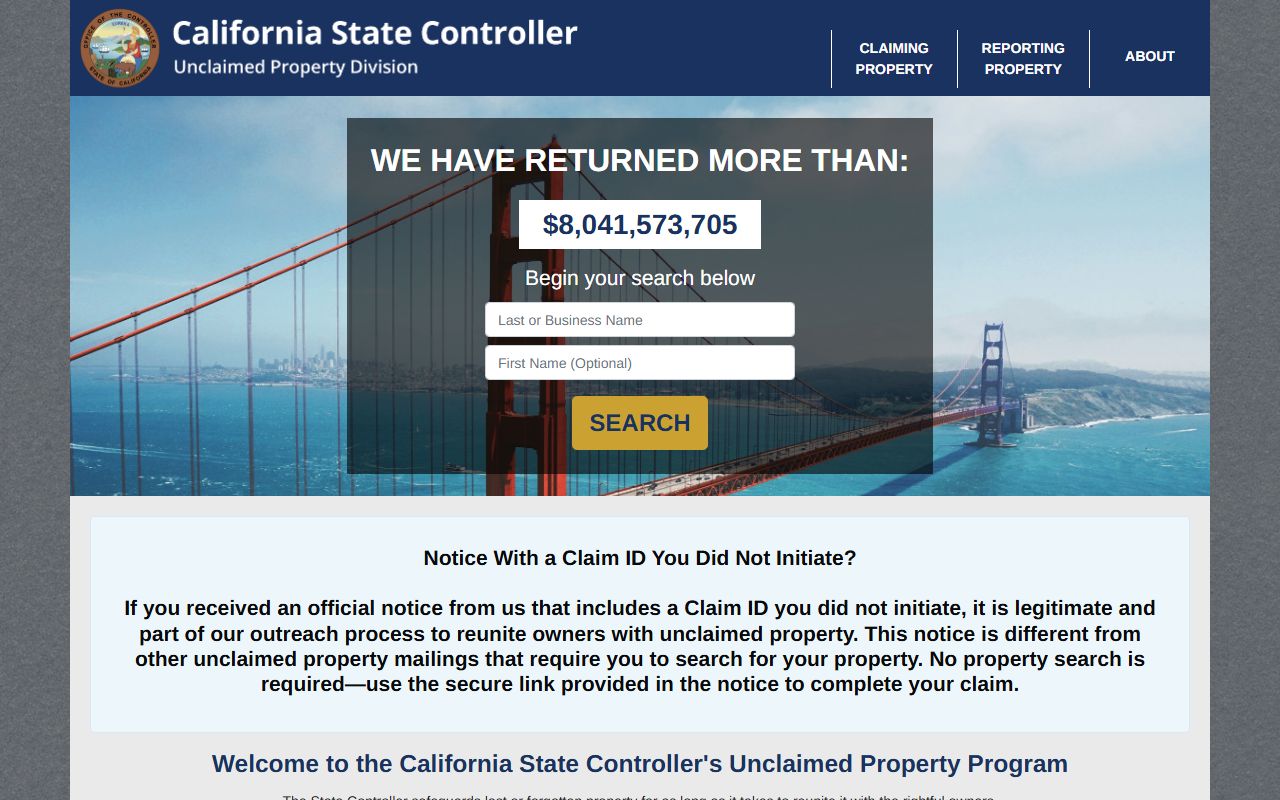

The California State Controller holds unclaimed property for Tuolumne County residents. Over $11 billion in total unclaimed property sits with the state waiting for owners. Tuolumne County accounts for a portion of this total. Rural mountain counties like Tuolumne often have unclaimed property from residents who moved away and lost track of old accounts.

You can search the database at the state controller's property search portal. The search is free and takes just minutes. Enter your name to see if the state is holding property for you. Try different variations of your name. Use your full legal name, nicknames, and any previous names you have used.

The search results show the type of property, the business that reported it, and an approximate value. Click on any result that looks like it belongs to you. The system displays more details and starts the claim process. Many claims can be filed online right away. The website generates a claim form with the property information. You fill in your current contact details and submit the form.

Simple claims under $1,000 often require just basic identification. The state verifies your identity and processes the claim. Larger claims over $1,000 must be notarized. You sign the claim form in front of a notary public who witnesses your signature and verifies your photo ID. This extra step prevents fraud on high-value claims.

Securities claims always require notarization no matter the value. Stocks, bonds, and mutual funds have special handling requirements. Safe deposit box contents also need extra documentation because the contents may include jewelry, coins, or other valuables beyond simple cash.

How Property Becomes Unclaimed

Property becomes unclaimed when the owner cannot be located after a period of inactivity. Each type of property has a specific dormancy period set by law. When that period passes with no owner contact, the holder must report the property to the state.

Bank accounts are the most common example. You open a checking or savings account. Life gets busy and you stop using it. Three years pass with no deposits, withdrawals, or logins. The bank tries to contact you by mail. Their letters come back as undeliverable. The bank then reports the account to the state controller. The state holds the money until you claim it.

Paychecks go unclaimed frequently in tourism and hospitality areas like Tuolumne County. Someone works a seasonal job and moves on. The employer issues a final paycheck. The check gets mailed to an old address. After one year, the employer must send the uncashed wages to the state. Anyone who worked temporary or seasonal jobs should search for unclaimed wages.

Utility deposits create unclaimed property when people move. You close your electric or gas account. The utility owes you a deposit refund. They mail a check to the address on file. You already moved to a new place. The check cannot be delivered. One year later, the utility turns the deposit over to the state.

Code of Civil Procedure section 1513 sets the dormancy periods:

- Bank accounts: three years of no activity

- Wages and paychecks: one year from payment date

- Money orders: seven years from issuance

- Traveler's checks: fifteen years from issuance

- Utility deposits: one year after account closure

- Insurance proceeds: varies by type

- Stock dividends: three years from payment date

Once the state receives property, it holds it indefinitely. There is no deadline for filing a claim. You can claim property reported decades ago if you can prove ownership. The state does not charge storage fees or reduce the value over time.

Common Types of Unclaimed Property

Forgotten bank accounts lead the list. Small checking accounts with minimal balances often get overlooked. You close most of your accounts when you move but forget about one. Or you open a savings account for a specific purpose and then forget it exists. Years later, that account sits with the state controller waiting for you to claim it.

Insurance proceeds frequently go unclaimed. Life insurance pays out when someone dies but the beneficiary may not know the policy exists. A parent or grandparent bought a small policy years ago. They never told anyone about it. After they die, the insurance company tries to find the beneficiary but cannot. The proceeds go to the state. Anyone whose parent or relative lived in Tuolumne County should search for unclaimed life insurance.

Tourism and recreation businesses in Tuolumne County create unclaimed wages and vendor payments. Seasonal workers receive final checks that never get cashed. Tour guides, campground staff, and ski resort employees move frequently. Paychecks sent to old addresses become unclaimed after one year. Vendors who supplied goods or services may have uncashed payment checks sitting with the state.

Property from estates often becomes unclaimed. Someone dies without a will or with distant heirs. The estate includes bank accounts, stocks, or other assets. Heirs may not know the assets exist. The financial institutions cannot locate the heirs. After the required dormancy period, the assets go to the state. Heirs can still claim them later by providing proof of their relationship to the deceased owner.

Other types found in Tuolumne County include:

- Security deposits from rentals

- Rebates from retail purchases

- Escrow refunds from real estate transactions

- Mineral rights and royalty payments

- Safe deposit box contents

- Court deposits and settlements

- Refunds from cancelled services

Note: Even small amounts add up and are worth claiming since they cost nothing to search for or claim.

How to File a Claim

Start at the California State Controller's unclaimed property website. This is the official government site. Avoid third-party websites that charge fees or make promises they cannot keep. The state controller processes all claims for free.

Search thoroughly. Use every name you have ever used. Search your current name and any previous names from marriage, divorce, or legal name changes. Try your spouse's name. Search any business names if you owned a company. Search addresses where you lived in Tuolumne County. Many people find property they did not remember by searching multiple ways.

When you find property, click on it to view details. The website tells you how to claim it. Online claims are fastest. You create an account, verify your email, and submit the claim form electronically. The system may ask you to upload proof of identity. Simple claims under $1,000 can often be completed entirely online in minutes.

Paper claims work for people who prefer mail. Print the claim form generated by your search. Fill it out completely. Sign where indicated. Get it notarized if required. Gather supporting documents. Mail everything together to the address on the form.

Documents you may need include:

- Photo ID such as driver's license or passport

- Social Security number or tax ID

- Proof of address like utility bill or lease agreement

- Death certificate for deceased owners

- Probate documents or affidavit for estate claims

- Business documents for business property

- Marriage or divorce papers if name changed

The state controller has 180 days to decide your claim. Simple cash claims typically process in 30 to 60 days. Complex claims involving multiple heirs, businesses, or securities can take the full 180 days or longer. The state removes property from the public database while processing your claim. This prevents duplicate claims from other people.

You receive a letter when the state makes a decision. Approved claims result in a check mailed to your address. Denied claims include an explanation of why the claim was rejected and what additional information might help. You can submit more documents and refile if your claim is denied.

California Unclaimed Property Law

California's Unclaimed Property Law is codified in the Code of Civil Procedure. Section 1500 gives the law its short title. The law runs from section 1500 through section 1577 and covers all aspects of unclaimed property.

Section 1501 defines key terms used throughout the law. A holder is any person or business holding property belonging to another. An owner is the person entitled to the property. An apparent owner is the person whose name appears on the holder's records. These definitions determine who must report property and who can claim it.

Section 1530 requires holders to file annual reports. Life insurance companies report between December 1 and December 15 each year. All other businesses and entities report between June 1 and June 15. The report must list every piece of unclaimed property with the owner's name and last known address. Holders must deliver the actual property to the state controller along with the report.

The controller maintains a public database of reported property. Anyone can search it. Section 1540 governs claims. You file a claim for property in your name. The controller has 180 days to decide. The controller can ask for additional proof of ownership. Approved claims result in payment. No interest is paid on unclaimed property held by the state.

Section 1576 sets penalties for violations. Willfully failing to report unclaimed property is a misdemeanor. Late delivery of property to the state triggers a 12 percent annual interest penalty. These penalties encourage businesses to comply with reporting deadlines and turn over property on time.

Local government agencies follow Government Code sections 50050 to 50057. These sections govern unclaimed money held by counties, cities, and special districts. Tuolumne County follows these laws when handling any county-held unclaimed funds.

Contact Information

For Tuolumne County government questions, contact the county treasurer at (209) 533-5544. The county seat is located in Sonora. The treasurer can answer questions about county finances and direct you to the appropriate resources for unclaimed property searches.

For all unclaimed property searches and claims, contact the California State Controller's Unclaimed Property Division. The toll-free number is (800) 992-4647. This line operates nationwide. From outside the United States, call (916) 323-2827. The call center can help you search for property and answer questions about claiming it.

You can visit the state controller's public counter at 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670. Staff can help you search the database in person and file claims. Bring photo identification and any documents related to your property. The office has limited hours so call ahead before making the trip from Tuolumne County.

Mail all paper claim forms and supporting documents to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. This is the official mailing address for all state controller claims. The controller sends an acknowledgment when they receive your claim. A decision letter follows when they approve or deny the claim.

Online questions can be submitted through the contact form on the state controller's website. Most questions receive responses within a few business days. Email works for general inquiries but should not be used to send claim forms or sensitive personal information.

Avoiding Unclaimed Property Scams

Scammers target people with unclaimed property. You may receive a letter, email, or phone call saying you have money waiting. The message asks for personal information or payment upfront. This is a scam. The real state controller never charges fees to file claims and never asks for sensitive information through unsolicited contacts.

Asset locators are legal but often unnecessary. These companies search databases and contact people who have unclaimed property. They offer to file claims for a fee. California law caps their fee at 10 percent of the property value. You can cancel the contract within 24 hours at no charge.

You do not need an asset locator for most situations. The state database is easy to search. The claim process is simple. Save the 10 percent fee and do it yourself. Only consider hiring help if you face a very complex estate situation or lack the time to handle it yourself.

Warning signs of scams include:

- Requests for money before you receive your property

- Pressure to act immediately or lose your property

- Emails or calls asking for Social Security numbers

- Claims about large inheritances from unknown people

- Links to websites that are not sco.ca.gov

- Poor grammar or spelling in official-looking letters

Always verify suspicious communications. Call the state controller directly using the phone number from the official website. Do not use contact information provided in the suspicious message. Type website addresses yourself instead of clicking links in emails. Never give out personal information to someone who contacts you first.

Report scam attempts to the state controller's office. They track fraud schemes and warn other California residents. Your report may help prevent others from becoming victims.

Additional Unclaimed Property Resources

Beyond the state controller, other agencies hold specialized types of unclaimed property. CalPERS holds unclaimed retirement benefits for former public employees. If you worked for a California government agency or school district and left before retirement, search the CalPERS unclaimed property database. You may have retirement contributions waiting to be refunded.

CalSTRS holds unclaimed property for teachers and educators. If you worked in California public schools, search for unclaimed funds at the CalSTRS unclaimed property page. Even a short period of teaching can result in contributions that should be refunded if you left the profession.

The California Department of Insurance helps locate lost life insurance policies. If you think a deceased family member may have had a life insurance policy but you cannot find records, use the NAIC Life Insurance Policy Locator. This nationwide service searches participating insurance companies for policies.

The California Franchise Tax Board holds unclaimed tax refunds. If you are owed a state tax refund but the check expired or was never cashed, contact the Franchise Tax Board for information about claiming old refunds. Processing times vary based on how old the refund is.

Search all of these sources in addition to the main state controller database. Many Tuolumne County residents have property in multiple places. A thorough search across all databases ensures you find everything owed to you.