Find Tehama County Unclaimed Money

Tehama County unclaimed money primarily flows to the California State Controller. While the county does not maintain an extensive local unclaimed property program, residents and former residents may have money waiting at the state level. Banks, employers, insurance companies, and other businesses operating in Tehama County report unclaimed property to the state after the required dormancy period. This includes forgotten bank accounts, uncashed paychecks, insurance payouts, and more. You can search the state database to find property that may belong to you. The search is free and the claim process costs nothing. No deadline exists for filing a claim once property reaches the state controller.

Tehama County Quick Facts

California State Controller Database

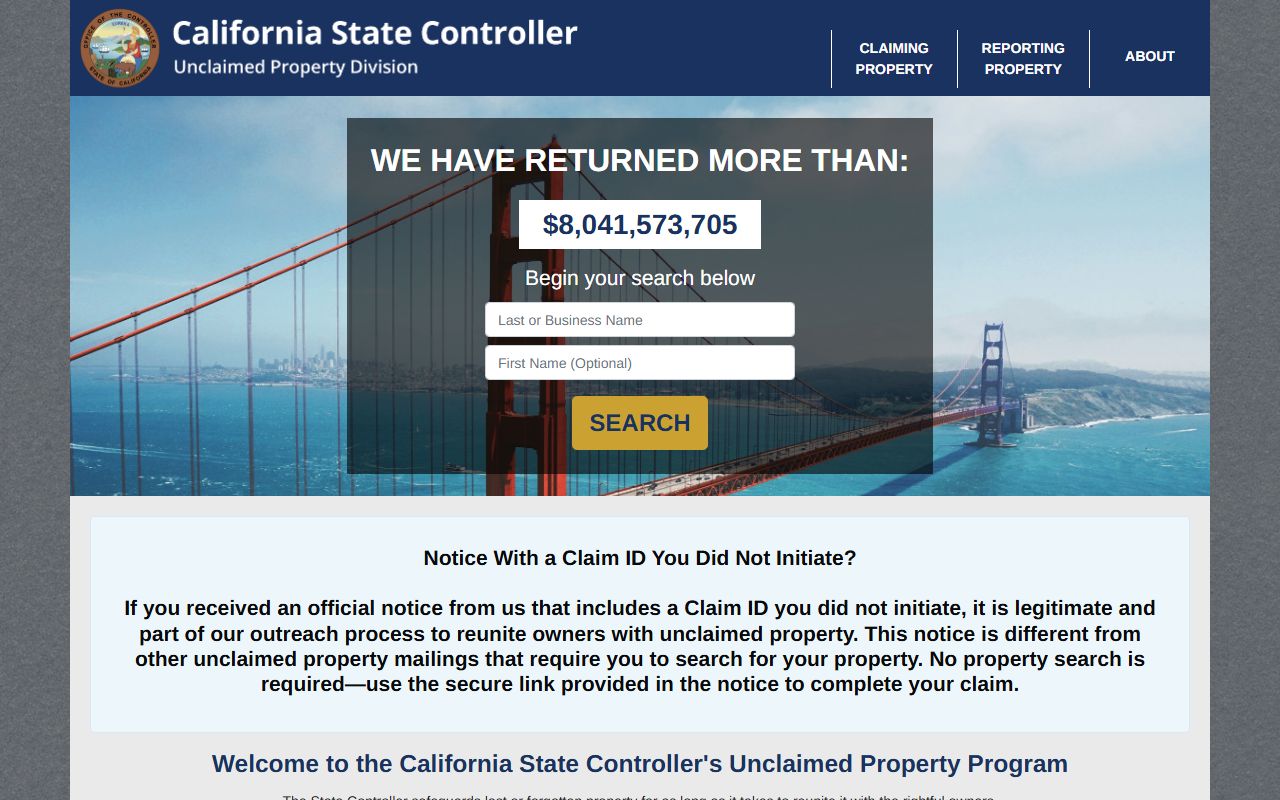

The California State Controller holds over $11 billion in unclaimed property. Tehama County residents account for a portion of these funds. When a bank, employer, or other business cannot locate an account owner after the dormancy period, they must report the property to the state. The state then holds it indefinitely until the rightful owner files a claim.

Search the state database at the controller's property search portal. Type your name exactly as it appears on old accounts. Try variations like nicknames and maiden names. The search shows all property reported in your name. You can see the property type, reporting business, and approximate value.

If you find property that belongs to you, click on it to start the claim process. Many claims can be filed online. The system generates a claim form with your property information. You fill in your current address and contact details. For simple cash claims under $1,000, this may be all you need. The state will verify your identity and mail you a check.

Larger claims require more proof. Claims over $1,000 must be notarized. You need to show photo ID and sign the claim form in front of a notary. Securities claims always require notarization regardless of value. Safe deposit box claims have special requirements because the contents may include jewelry, coins, or other valuables.

When Property Becomes Unclaimed

Different types of property have different dormancy periods under California law. A bank account becomes unclaimed after three years of no owner activity. No activity means no deposits, withdrawals, logins, or contact with the bank. The bank must try to reach you before reporting the account. If their letters come back undelivered, they turn the funds over to the state.

Paychecks and wages have a shorter dormancy period. An employer must report an uncashed paycheck after just one year. This is common in Tehama County where seasonal workers may move frequently. A final paycheck gets mailed to an old address. The employee never gets it. After a year, the employer sends the money to the state.

Insurance proceeds vary by type. Life insurance benefits must be reported after the insurer knows the policyholder died. Health insurance refunds follow the same three-year rule as bank accounts. Property and casualty insurance claim checks become unclaimed after three years if not cashed.

Other dormancy periods set by Code of Civil Procedure section 1513 include:

- Money orders: seven years from issuance

- Traveler's checks: fifteen years from issuance

- Utility deposits: one year after account closure

- Court deposits: three years after final judgment

- Mineral proceeds: three years from date payable

Once property reaches the state, the dormancy period no longer matters. You can claim property reported decades ago. The state does not charge storage fees or reduce the value over time. Your 1985 bank account is worth the same today as when it was reported.

Filing Your Claim

Start at the California State Controller's unclaimed property website. This is the official site. Avoid third-party sites that charge fees or claim to speed up the process. The state handles all claims for free.

Search thoroughly. Use your current name and all previous names. Include your spouse's name and any business names. Search addresses where you lived in Tehama County. Many people find property they did not know existed.

When you find your property, the site tells you how to claim it. Online claims are fastest. You create an account, verify your email, and submit the claim form electronically. Upload proof of identity if required. The state reviews online claims first.

Paper claims take longer but work the same way. Print the claim form generated by the search. Fill it out completely. Sign where indicated. Get it notarized if the amount is over $1,000. Mail everything to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873.

Common documents needed for claims:

- Government-issued photo ID

- Social Security number or tax ID

- Proof of address such as utility bill

- Death certificate for deceased owners

- Affidavit or probate documents for estate claims

- Business formation documents for business claims

The state removes your property from the public database while processing your claim. This prevents others from filing fraudulent claims. You receive a letter when the state makes a decision. Approved claims result in a check mailed to your address. Denied claims include an explanation of why the claim failed and what additional information might help.

Note: Processing time ranges from 30 days for simple claims to 180 days or more for complex situations.

What Becomes Unclaimed in Tehama County

Bank accounts lead the list of unclaimed property. Checking accounts with small balances often get forgotten. Savings accounts opened years ago sit dormant. Certificates of deposit mature and the owner never collects the proceeds. Tehama County banks report these accounts to the state after three years of no contact.

Agricultural operations in Tehama County generate unclaimed wages. Seasonal farmworkers receive paychecks but may have moved before the check arrives. The employer cannot locate them. After one year, the uncashed wages go to the state. Ranch hands, harvest workers, and agricultural laborers should search for unclaimed wages regularly.

Utility deposits are common. You close an account with the power company or water district. They owe you a deposit refund. The check goes to your old address. You moved and did not leave a forwarding address. One year later, the utility turns the deposit over to the state.

Insurance proceeds often go unclaimed in rural counties like Tehama. A life insurance policy pays out but the beneficiary does not know it exists. Auto insurance issues a refund after a policy cancels. Health insurance overpays a claim. All of these become unclaimed property if not collected within the dormancy period.

Additional types include:

- Stock dividends from inherited shares

- Rebate checks from manufacturers

- Escrow refunds from cancelled real estate deals

- Royalties from mineral rights or timber sales

- Contents of abandoned safe deposit boxes

- Refunds from closed businesses

Small amounts add up. A $50 utility deposit here, a $100 paycheck there. Many Tehama County residents have multiple small properties that total hundreds or thousands of dollars. It pays to search regularly.

Unclaimed Property Law in California

California's Unclaimed Property Law appears in the Code of Civil Procedure. Section 1500 gives the law its short title. Sections 1501 through 1577 spell out the requirements.

Section 1501 defines important terms. A holder is any person or business holding property that belongs to another. An owner is the person entitled to the property. An apparent owner is the person named in the holder's records. These definitions matter when determining who can claim property.

Section 1530 requires annual reporting. Every business holding unclaimed property must file a report with the state controller by a certain date. Life insurance companies report by December 1 to December 15. All other holders report between June 1 and June 15. The report lists every piece of unclaimed property and identifies the apparent owner. The holder must turn over the property with the report.

The controller reviews the reports and adds the property to the public database. Anyone can search the database. Section 1540 governs claims. You file a claim for property in your name. The controller has 180 days to decide the claim. The controller can ask for more proof of ownership. If approved, you get a check. No interest is paid on the property.

Section 1576 sets penalties for violations. A business that willfully fails to report unclaimed property commits a misdemeanor. Late delivery of property triggers a 12 percent annual interest penalty. These rules push businesses to comply.

Local governments follow Government Code sections 50050 to 50057. Counties, cities, and districts must hold unclaimed money for three years. After public notice, the money can escheat to the local agency. But the owner can still file a claim even after escheatment. These laws apply to Tehama County when it holds unclaimed funds from county operations.

Tehama County and State Contacts

For questions about Tehama County government operations, contact the county treasurer at (530) 527-4535. The county seat is located in Red Bluff. The treasurer can answer questions about county finances and any local unclaimed funds.

For all unclaimed property searches and claims, contact the California State Controller's Unclaimed Property Division. The toll-free number is (800) 992-4647. This line operates nationwide. If you call from outside the United States, dial (916) 323-2827. The call center can help you search for property and answer questions about the claim process.

Visit the public counter at 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670. The staff can help you search the database and file a claim in person. Bring photo ID and any documents related to the property. The office hours are limited so call ahead.

Mail all paper claim forms to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. Include all required documents with your claim. The controller will send you a letter acknowledging receipt. A second letter will notify you when the claim is approved or denied.

You can also email questions through the online form at the state controller's website. Response time varies but most questions get answered within a few business days.

Protect Yourself from Scams

Scammers target people with unclaimed property. You may receive a letter or email claiming you have money waiting. The message asks for personal information or an upfront fee. This is a scam. The state controller never asks for fees or sensitive information through unsolicited messages.

Asset locators and heir finders are legal but often unnecessary. These companies search for unclaimed property and contact the owners. They offer to file your claim for a fee, typically 10 percent of the property value. California law caps the fee at 10 percent. You can fire the company within 24 hours and pay nothing.

You do not need an asset locator. The state database is free and easy to search. The claim process is simple for most people. Save the 10 percent fee and do it yourself. Only consider hiring help if the claim involves a complex estate or business issues.

Warning signs of scams include:

- Requests for money upfront

- Pressure to act immediately

- Emails or texts asking for Social Security numbers

- Promises of large inheritances from unknown relatives

- Links to websites that are not sco.ca.gov

Always go directly to the official state controller website. Type the URL yourself instead of clicking links in emails. Verify any claim letter by calling the state controller directly. Never give out personal information to someone who contacts you first.

If you receive a suspicious message about unclaimed property, report it to the state controller's office. They track scam attempts and warn other residents.