Sutter County Unclaimed Money

Sutter County unclaimed money includes property tax refunds and other funds held by the county treasurer. The Sutter County Treasurer-Tax Collector maintains records of unclaimed property tax refunds that have not been claimed by rightful owners. These refunds come from reduced assessments, overpayments, and duplicate payments. Beyond county-held funds, most unclaimed property from Sutter County residents ends up with the California State Controller. You can search both the county system and the state database to locate money that may belong to you. The process is free and does not require hiring an outside company.

Sutter County Quick Facts

Sutter County Property Tax Refunds

The Sutter County Treasurer-Tax Collector holds unclaimed property tax refunds. These refunds occur when property owners overpay their taxes or when assessments are reduced after payment. The county maintains these funds in a trust account until the rightful owner claims them.

Unclaimed refunds can sit with the county for years. Many property owners move and never update their address with the county. The refund check gets mailed to the old address and never reaches them. Some people sell their property and forget they may be owed a refund from a prior year. Others simply overlook the refund notice in the mail. Sutter County publishes information about unclaimed refunds to help reunite owners with their money.

You can contact the Sutter County Treasurer-Tax Collector by mail at P.O. Box 546, Yuba City, CA 95992. The office handles questions about property tax refunds and provides claim forms. There is no fee to file a claim for county-held refunds. The county will verify your ownership and issue a new check if you are entitled to the funds.

Under Government Code sections 50050 to 50057, local agencies in California must hold unclaimed money for three years. After that time, the funds may escheat to the county general fund if no claim is filed. Sutter County follows this state law when handling unclaimed property.

California State Controller Unclaimed Property

Most unclaimed money from Sutter County residents is held by the California State Controller. Banks, employers, insurance companies, and other businesses turn over unclaimed property to the state. This includes dormant bank accounts, uncashed paychecks, insurance payouts, and stock dividends. The state holds billions in unclaimed property and reunites it with owners at no cost.

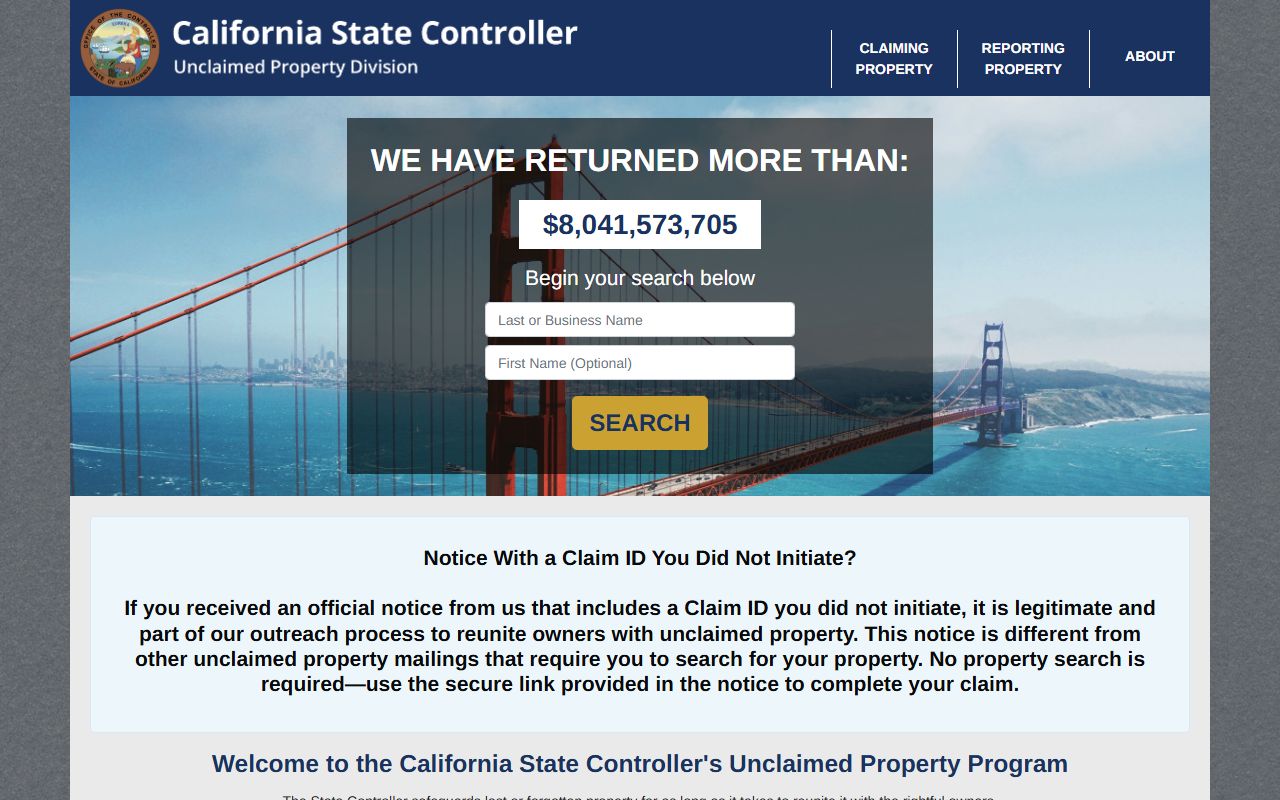

You can search the state database at the state controller's property search portal. Enter your name to see if the state is holding property for you. The search is free and shows property type and approximate value. If you find your property, you can file a claim online in many cases.

Different types of property have different dormancy periods. Bank accounts become unclaimed after three years with no owner contact. Wages must be reported after one year. These rules are set in Code of Civil Procedure section 1513. Once property is with the state, there is no deadline to claim it. You can file a claim decades later if you can prove ownership.

The state controller processes claims free of charge. Claims under $1,000 typically require basic identification. Claims over $1,000 must be notarized. If you are claiming on behalf of a deceased person, you need a death certificate and proof of heirship. Simple cash claims take 30 to 60 days to process. Complex claims can take up to 180 days or more.

Filing a Claim for Unclaimed Money

Start by searching both the Sutter County system and the state controller database. The county holds property tax refunds. The state holds everything else.

For county refunds, contact the Sutter County Treasurer-Tax Collector. Ask if they have any unclaimed refunds in your name. They will send you a claim form. Fill it out and return it with proof of identity. The county will verify your claim and mail you a check.

For state-held property, visit the California State Controller's unclaimed property website. Search your name and any previous names you have used. Include maiden names and nicknames. The database searches all property reported to the state. When you find your property, click on it to start a claim.

The website will tell you if you can file online or need to submit a paper claim. Online claims are faster. Paper claims must be mailed to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. You can also drop off claims at the public counter at 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670.

Documents you may need include:

- Claim Affirmation Form generated from the search results

- Photo ID such as driver's license or passport

- Social Security number or tax ID

- Proof of address like a utility bill or bank statement

- Death certificate if claiming for a deceased person

- Probate documents or affidavit for estate claims

The state controller removes property from the public database while processing a claim. This prevents duplicate claims. You will receive a letter when your claim is approved. The state mails a check for approved claims. There is no interest paid on unclaimed property held by the state.

Note: Never pay someone to find or claim your unclaimed property when you can do it yourself for free.

Common Types of Unclaimed Property

Unclaimed property comes from many sources. Bank accounts are the most common. When you stop using a checking or savings account and the bank cannot reach you, the account becomes dormant. After three years of no activity, the bank must turn the funds over to the state. Sutter County has hundreds of forgotten bank accounts with the state controller.

Paychecks get lost all the time. An employer issues a final paycheck but the employee has moved. The check cannot be delivered. After one year, the employer must report the uncashed check to the state. This is very common in agricultural areas like Sutter County where seasonal workers move frequently.

Insurance proceeds often go unclaimed. Life insurance pays out when someone dies but the beneficiary may not know about the policy. Health insurance companies issue refunds that never get cashed. Auto insurance claim checks get lost in the mail. All of these become unclaimed property after the legal dormancy period.

Other types include:

- Utility deposits from closed accounts

- Security deposits from rentals

- Stock dividends and mutual fund distributions

- Rebates and refunds from retailers

- Contents of safe deposit boxes

- Mineral rights and royalty payments

Sutter County property tax refunds are a specific type. They result from overpayments or reduced assessments. If you paid your property tax and the assessor later lowered your value, you get a refund. If you paid twice by mistake, you get the duplicate payment back. These refunds stay with the county until you claim them.

California Unclaimed Property Law

California's unclaimed property law is found in the Code of Civil Procedure starting at section 1500. The law is called the Unclaimed Property Law. It defines what property must be reported and when.

Section 1501 defines key terms. An owner is the person entitled to the property. A holder is a business or entity that holds property belonging to another. An apparent owner is the person whose name appears on the holder's records.

Section 1530 requires holders to file annual reports with the state controller. The reports list all unclaimed property and identify the owners. Holders must turn over the property with the report. The state then holds the property and tries to find the owners.

Section 1540 covers the claim process. The controller must decide claims within 180 days. No interest is paid on claimed property. The controller can require proof of ownership before approving a claim.

Section 1576 sets penalties for violations. Willful failure to report unclaimed property is a misdemeanor. Late delivery of property results in a 12 percent interest penalty. These penalties encourage businesses to comply with reporting requirements.

Local agencies like Sutter County follow Government Code sections 50050 to 50057. These sections govern unclaimed money held by cities, counties, and districts. The rules are similar to the state law but apply to public entities instead of businesses.

Sutter County Contact Information

For questions about property tax refunds or other county-held unclaimed money, contact the Sutter County Treasurer-Tax Collector. Mail claims and inquiries to P.O. Box 546, Yuba City, CA 95992. You can also visit the county website for more information.

For all other unclaimed property, contact the California State Controller's Unclaimed Property Division. Call the nationwide toll-free number at (800) 992-4647. From outside the United States, call (916) 323-2827. You can also submit questions through the online contact form at the state controller's website.

The state controller's physical address for in-person visits is 10600 White Rock Road, Suite 141, Rancho Cordova, CA 95670. This office has a public counter where you can drop off claim forms and get help with searches. Hours are limited so call ahead before visiting.

Mail claim forms and supporting documents to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. Use this address for all paper claims. The controller will acknowledge receipt and notify you of the claim decision.