Find Sacramento County Unclaimed Money

Sacramento County unclaimed money may be held by the county finance department or the California State Controller. The Sacramento County Department of Finance maintains records of unclaimed funds belonging to individuals, businesses, and other entities. This includes property tax refunds, uncashed checks from county departments, and estates of deceased persons. As the state capital region with over 1.5 million residents, Sacramento County processes significant amounts of unclaimed property each year. Residents should search both county and state databases to find all money that may belong to them.

Sacramento County Quick Facts

Sacramento County Finance Department

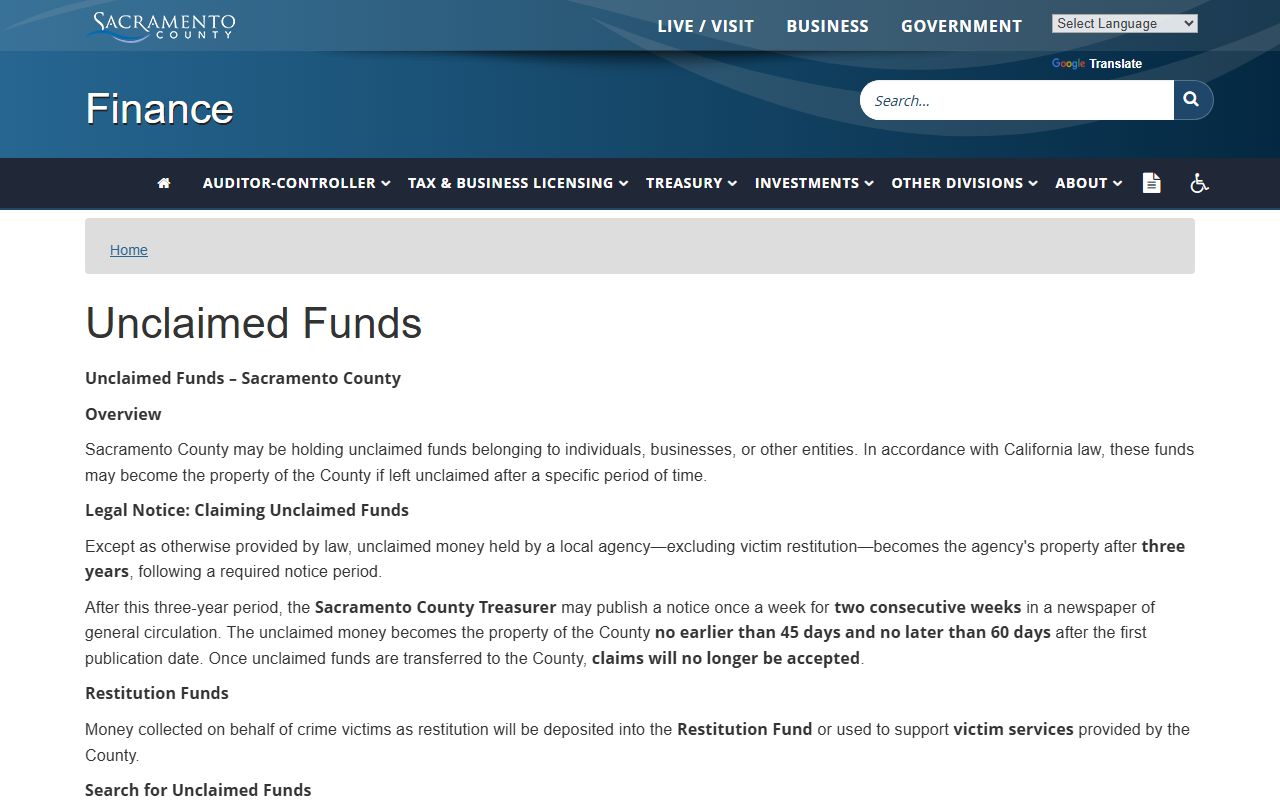

Sacramento County may be holding unclaimed funds from various sources. The county finance department tracks money that belongs to people who moved away, changed names, or never received payment notices. These funds accumulate from county operations and sit waiting for rightful owners to claim them.

Property tax refunds make up a significant portion of county-held funds. Refunds occur when property assessments are reduced after appeals, when taxes are overpaid, or when duplicate payments happen. The county auditor-controller issues refund checks, but sometimes they go uncashed. This happens when owners sell property and the refund goes to an old address, or when estate properties generate refunds that heirs never knew about.

Uncashed checks from county departments also enter the unclaimed funds system. Any check issued by Sacramento County that remains uncashed for six months may be transferred to the unclaimed property account. This includes vendor payments, employee reimbursements, refunds from county services, and deposits being returned.

Estates of deceased persons generate unclaimed funds when someone dies without known heirs. The county public administrator handles these cases. Property from the estate may be sold with proceeds held in trust. The county publishes legal notices trying to locate heirs. If no one claims the funds during the notice period, they remain available for future claims.

How to Search County Records

Contact the Sacramento County Department of Finance to inquire about unclaimed funds. Email DOF-SystemControl@saccounty.gov with your name and any previous addresses in Sacramento County. Staff can search records to see if any funds are being held.

Provide as much information as possible when contacting the county. Include your full legal name, maiden name if applicable, previous married names, and addresses where you lived in Sacramento County. If you are searching for a deceased relative, provide their name, approximate date of death, and last known address.

The county will respond with information about any matching records. If funds are found, they will explain the claim process and what documents are needed. Requirements vary based on the type of property and your relationship to it.

Note: Sacramento County does not charge fees to file claims for county-held unclaimed funds.

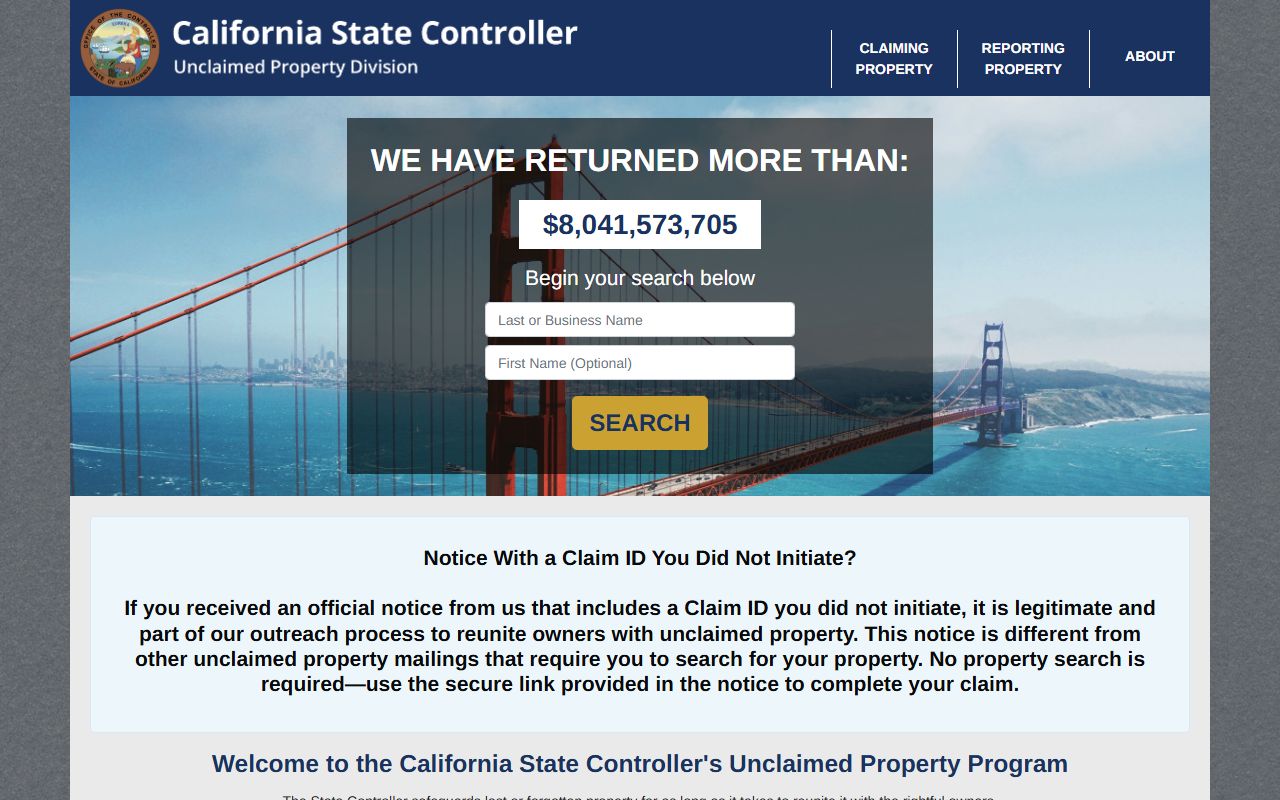

California State Controller Database

Most unclaimed money in Sacramento County is held by the state, not the county. The California State Controller maintains the largest unclaimed property database with over $11 billion waiting for owners.

This includes bank accounts, paychecks, insurance policies, stock dividends, utility deposits, and safe deposit box contents. Banks and businesses report property to the state after three years of no owner contact. The state holds these funds indefinitely with no deadline to claim.

The state database is searchable by name at no cost. Just enter your name to see all matching properties. Many Sacramento County residents have multiple items listed from different sources over the years. You might find old bank accounts, uncashed paychecks from previous employers, or insurance proceeds.

Filing a claim with the state is free and can be done online for most property types. The system generates a claim form based on your specific property. Upload copies of your ID and supporting documents. Simple claims are processed within 30 to 60 days. Complex claims involving estates or businesses can take up to 180 days.

City of Sacramento Unclaimed Property

The City of Sacramento runs its own unclaimed property program separate from the county. This includes uncashed checks from city departments, utility refunds, business license deposits, and other city-issued payments.

If you lived in the city limits of Sacramento, search the city database in addition to county and state systems. The city handles funds from city operations. The county handles property tax refunds and county department checks. The state handles private business property like bank accounts.

Sacramento is the state capital and county seat with about 525,000 residents. The city maintains detailed records of unclaimed funds and publishes information on its website about the claim process.

Other Sacramento County Cities

Sacramento County includes several other large cities. Elk Grove has over 176,000 residents and runs its own unclaimed property program. The city publishes unclaimed funds lists and accepts claims through its finance department.

Roseville has about 147,000 people and maintains an unclaimed funds database. Contact the Roseville finance department for city-issued checks and refunds. The city is actually split between Sacramento County and Placer County, so some Roseville residents fall under Placer County jurisdiction.

Other Sacramento County cities include Citrus Heights, Folsom, Rancho Cordova, and Galt. These cities may hold small amounts of unclaimed funds from utility refunds or business licenses. Contact their finance departments to ask about local unclaimed property programs.

Pension and Retirement Benefits

Sacramento County is home to thousands of state and local government employees. Many of these workers have retirement accounts through CalPERS. If you left public employment without claiming retirement contributions, CalPERS may hold that money.

CalPERS serves county workers, city employees, state agencies, and many special districts. Search their unclaimed property database or call 888-225-7377. The search is free and claims can be filed online.

Teachers and school employees should check CalSTRS for unclaimed pension benefits. CalSTRS serves public school employees throughout California. Call 800-228-5453 or search online.

Since Sacramento is the state capital, many residents work for state agencies. State employee pensions go through CalPERS. Former state workers who left before vesting may have refundable contributions waiting in their accounts.

Unclaimed Tax Refunds

The California Franchise Tax Board holds unclaimed state income tax refunds. Refund checks are valid for six months from the issue date. If you never cashed your refund, you can request a replacement.

For refunds one to three years old, send a letter to the tax board with your name, tax year, and subject line noting old refund check. Include your current address and phone number. Processing takes about eight weeks.

Refunds over three years old require form 3900A for individuals or 3900B for businesses. These older refunds can take up to eighteen months to process. The tax board must verify the original return and confirm the refund was never cashed before issuing a replacement warrant.

Call the tax board at 800-852-5711 with questions about unclaimed refunds. Have your social security number and the tax year ready when you call.

California Unclaimed Property Law

Code of Civil Procedure Section 1500 creates California's unclaimed property law. This statute defines abandoned property and sets dormancy periods for different asset types.

Bank accounts are deemed abandoned after three years of no activity. Paychecks need one year. Money orders take seven years. Traveler's checks require fifteen years before businesses must report them to the state.

Government Code sections 50050 to 50057 govern county and city unclaimed funds. These laws require local agencies to hold money for three years before it can escheat to the general fund. Sacramento County follows this framework for its unclaimed property program.

Section 1530 requires businesses to file annual reports with the state controller. The report must list all unclaimed property with owner names and addresses. Most businesses file by November first each year.

Section 1540 gives the state controller 180 days to decide on claims. Complex claims may take longer if additional documents are needed. The state does not pay interest on unclaimed property.

Search Tips and Warnings

Search multiple databases. County, city, and state systems are separate. Each holds different types of property. Search all three to find everything that may belong to you.

Try different name variations. Use maiden names, previous married names, nicknames, and middle names. Property databases use the name on file when the account was opened, which may differ from your current legal name.

Look for deceased relatives. Many heirs don't know family members left unclaimed property. Search for parents, grandparents, and other relatives. You may be entitled to estate funds that were never claimed.

Be wary of heir finders. These people search databases and contact you about money in your name. They charge fees up to ten percent. You can claim the same property yourself at no cost.

Never pay upfront fees. The state controller, county finance department, and city finance offices never charge filing fees. Anyone asking for money upfront is likely running a scam.

Note: Sacramento County residents should search county, city, and state databases to locate all unclaimed money.