Search Plumas County Unclaimed Property

Plumas County unclaimed money goes primarily to the California State Controller rather than staying with local government. As a rural mountain county with about 19,000 residents, Plumas County directs most unclaimed property inquiries to the state database. The state controller maintains the main search system for bank accounts, paychecks, insurance policies, and other financial assets. County residents can search state records at no cost and file claims online. The county treasurer can be reached at 530-283-6260 for questions about any locally held funds such as tax refunds or estates.

Plumas County Quick Facts

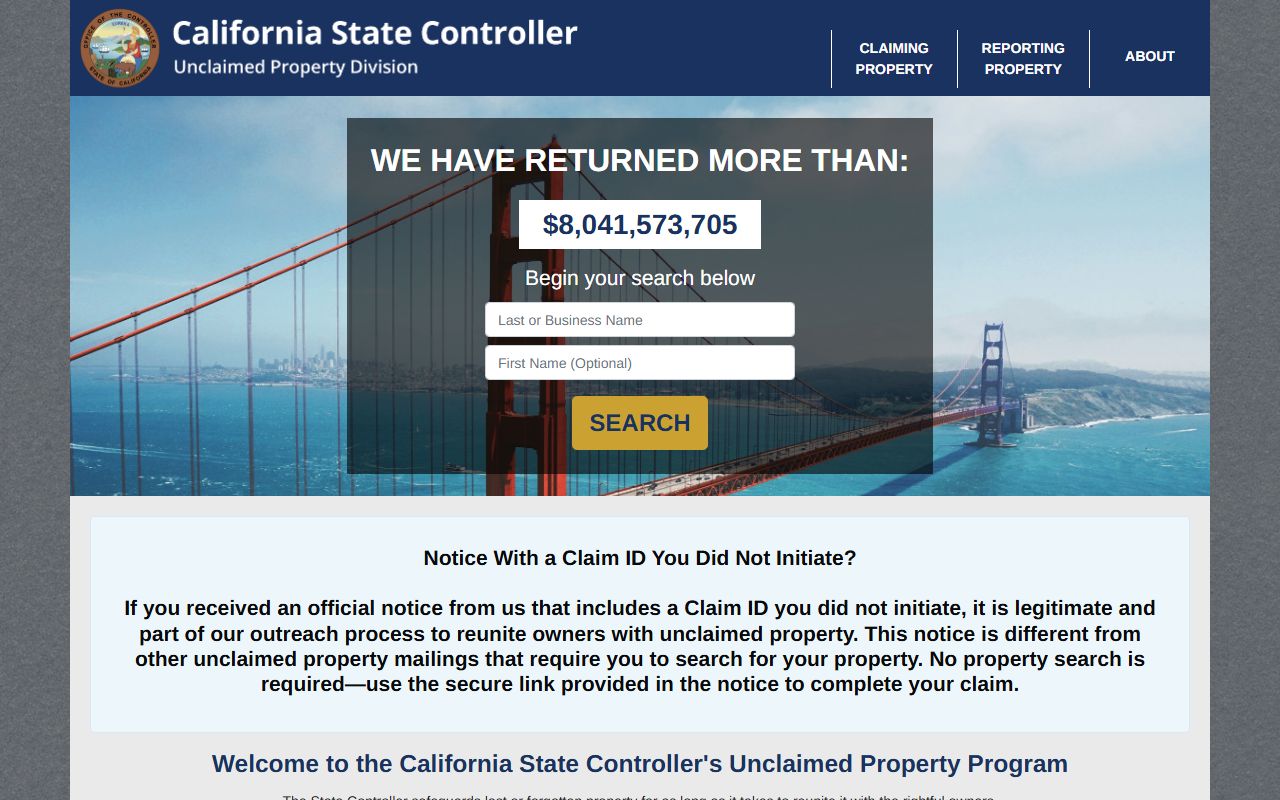

California State Controller Unclaimed Property

The California State Controller holds over $11 billion in unclaimed property from all 58 counties. Plumas County residents can search this database for lost money. The state system includes bank accounts, paychecks, stock dividends, insurance payouts, safe deposit box contents, and utility deposits.

Banks and businesses turn property over to the state after three years of no owner contact. This happens when you move without updating your address, forget about an old bank account, or never cash a paycheck. The business tries to reach you but eventually reports the property to the state controller.

The state database is searchable by name. Just type your name or a relative's name into the search box. The system shows all matching properties with the holder name and approximate value. Many people have multiple properties listed from different sources over the years.

There is no deadline to claim property from the state. California law requires the controller to hold unclaimed money forever. You can file a claim this year or twenty years from now. The money stays available until the rightful owner comes forward.

Filing a Claim for State Property

Start your claim at the state controller claim page. First search for your property, then click the claim button next to each item you want to recover. The system generates a claim affirmation form customized to your specific property.

Most claims can be filed electronically. Upload copies of your ID and any supporting documents the system requests. For bank accounts, you may need an old statement or canceled check. For paychecks, a W-2 form or pay stub helps. Insurance claims often require policy documents or proof of relationship to the insured.

If your claim amount exceeds one thousand dollars, you must get your signature notarized. Claims under that amount do not need notarization. All claims for securities like stocks or bonds require notarization regardless of value. Safe deposit box claims also need a notary signature.

Simple claims are processed within 30 to 60 days. Complex claims involving estates, businesses, or multiple owners can take up to 180 days. The controller sends payment by check to the address you provide on the claim form.

Note: The state controller never charges fees to file claims or recover your property.

Plumas County Local Funds

While most unclaimed money goes to the state, Plumas County may hold small amounts of local funds. These could include property tax refunds, uncashed checks from county departments, or estates of deceased persons without known heirs.

Contact the Plumas County Treasurer-Tax Collector at 530-283-6260 to ask about locally held unclaimed property. The office is located in Quincy, the county seat. Staff can check records for your name and explain the claim process if any funds are found.

Under Government Code sections 50050 to 50057, counties must hold unclaimed money for three years before it can escheat to the general fund. During that time, owners can file claims. After three years, the county may transfer funds to the state or keep them locally depending on county policy.

Plumas County is one of California's smallest counties by population. It covers a large geographic area in the northern Sierra Nevada but has relatively few businesses and residents. This means less unclaimed property activity compared to urban counties. Most funds end up with the state controller rather than accumulating at the county level.

California Unclaimed Property Law

Code of Civil Procedure Section 1500 creates the legal framework for unclaimed property in California. This statute defines terms like holder, owner, and abandoned property. It also sets dormancy periods for different asset types.

Bank deposits are deemed abandoned after three years of no activity. Wages and paychecks need just one year. Money orders take seven years. Traveler's checks require fifteen years before they must be reported to the state.

Section 1530 requires businesses to file annual reports listing all unclaimed property. The report must include owner names, last known addresses, and property descriptions. Most businesses file by November first each year. Life insurance companies have different deadlines tied to the policy type.

Once reported, the business must turn the property over to the state controller. Section 1540 says the controller must decide on claims within 180 days. The state does not pay interest on claims, so you only get back the original property value.

Other Sources of Unclaimed Money

Public employees in Plumas County may have unclaimed pension benefits. CalPERS serves county workers, city employees, and many public agencies. If you left public employment without claiming your retirement contributions, CalPERS may be holding that money. Search their database or call 888-225-7377.

Teachers should check CalSTRS for unclaimed property from school employment. CalSTRS handles retirement benefits for public education workers throughout California. Call 800-228-5453 with questions.

The California Franchise Tax Board holds unclaimed tax refunds. If you filed a state income tax return but never received your refund check, it may have gone stale. Refund checks are valid for six months from the issue date. After that, you need to request a replacement warrant.

For refunds one to three years old, send a letter to the tax board with your name, tax year, and subject line noting old refund check. Processing takes about eight weeks. Refunds over three years old require form 3900A or 3900B and can take up to eighteen months to process.

Unemployment and disability insurance benefits can also go unclaimed. The California Employment Development Department has form DE 903SD for claiming uncashed checks. There is no filing fee. Call 800-300-5616 for unemployment questions or 800-480-3287 for disability insurance.

Tips for Finding Unclaimed Money

Search for maiden names, nicknames, and previous married names. The unclaimed property database uses the name on record when the account was opened or the check was issued. If you changed your name, that property may be listed under your old name.

Search for deceased relatives. Many people have no idea their parents or grandparents left unclaimed property. The state holds billions of dollars from estates where heirs never filed claims. You may be entitled to property from a relative who died years ago.

Check old addresses. The database sometimes lists partial addresses or cities where you used to live. If you see a match with an old address, it likely belongs to you even if the name spelling is slightly different.

Be wary of heir finders and asset locators. These are people who search unclaimed property databases and contact you about money in your name. They are legitimate but charge fees of up to ten percent. You can claim the same property yourself at no cost by searching the state database directly.

Never pay upfront fees to claim property. The state controller and county treasurer never charge filing fees. If someone asks for money upfront to help you claim property, it is likely a scam. Legitimate heir finders only get paid after you receive your money, and their fees are capped at ten percent by California law.

Note: Plumas County residents should search both county and state databases to find all unclaimed money that may belong to them.