Placer County Unclaimed Funds

Placer County unclaimed money sits with the county treasurer waiting for owners to file claims. The Placer County Treasurer holds funds from property tax refunds, uncashed checks, and estates of deceased persons. Most unclaimed property in California eventually transfers to the state controller, but the county maintains an active program for locally held funds. Residents can search county records and file claims at no charge. The county also coordinates with state databases to help residents find all money that may belong to them.

Placer County Quick Facts

Placer County Unclaimed Property Program

Placer County holds unclaimed funds under Government Code sections 50050 to 50057. These state laws govern how local agencies handle unclaimed money. The county must hold funds for at least three years before they can escheat to the general fund. During that time, rightful owners can file claims to recover their property.

The county treasurer maintains records of all unclaimed funds. This includes uncashed checks issued by county departments, property tax refunds that were never claimed, and deposits from contractors or vendors. When a check goes six months without being cashed, it may be transferred to the unclaimed funds account.

Property tax refunds are a common source of unclaimed money. When someone overpays their property tax bill or wins an assessment appeal, the county issues a refund. If that refund check never gets cashed, the money sits in the treasurer's unclaimed fund. This happens when property owners move without updating their address or when a property changes hands and the refund goes to the wrong party.

Estates of deceased persons also generate unclaimed funds. When someone dies without known heirs, their property may be turned over to the county. The treasurer holds these funds until rightful heirs come forward with proof of their claim. Estate funds can sit for many years before anyone discovers they exist.

Search for Placer County Funds

Contact the Placer County Treasurer to search for unclaimed money. Call 530-889-4136 and provide your name or the name of a deceased relative. The treasurer's staff can check records to see if any funds are being held.

You can also visit the treasurer's office in person at the Placer County Government Center in Auburn. Bring identification and any documentation that supports your claim. For deceased estates, you may need a death certificate, proof of heirship, or probate documents.

The county website provides information about unclaimed funds and the claim process. While not all counties offer online searching, Placer County staff can help by phone or in person. They will tell you what documents are required for your specific claim type.

Note: Processing times vary based on claim complexity, but most simple claims are resolved within 60 days of receiving complete documentation.

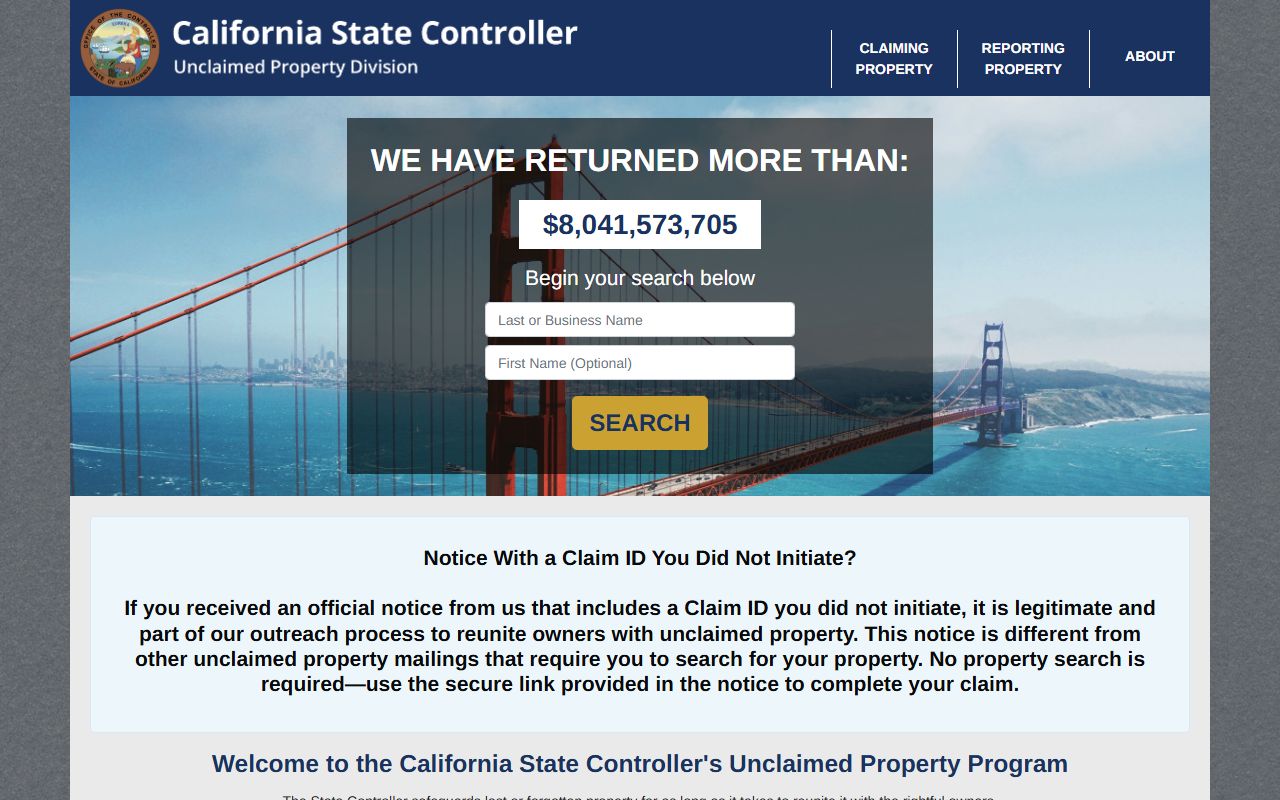

California State Controller Database

Most unclaimed money in Placer County is held by the state, not the county. The California State Controller maintains the largest unclaimed property database. This includes bank accounts, paychecks, insurance policies, stock dividends, and safe deposit box contents.

Banks and businesses must report unclaimed property to the state after three years of no owner contact. Once reported, the state holds these funds forever with no deadline to claim. You can search by name at the state controller website. The search is free and takes just a few seconds.

Filing a claim with the state controller is also free. For most property types, you can file electronically through the claim portal. The system walks you through each step and tells you what documents to upload. Simple claims may be approved in 30 to 60 days. More complex claims involving estates or businesses can take up to 180 days.

Placer County residents who lived elsewhere in California may have unclaimed property from other locations. The state database includes property from all 58 counties. A single search covers the entire state, making it easy to find money no matter where you used to live or work.

Other Sources of Unclaimed Money

Public employees in Placer County may have unclaimed retirement benefits. CalPERS holds unclaimed pension refunds and retirement benefits for county workers, city employees, and other public servants. Search their database or call 888-225-7377.

Teachers and education workers should check CalSTRS for unclaimed property. This pension system serves public school employees throughout California. Call 800-228-5453 or search online.

The California Franchise Tax Board holds unclaimed tax refunds. If you filed a state income tax return but never received your refund, the check may have gone uncashed. Refund checks are valid for six months. After that, you must request a replacement from the tax board.

Unemployment and disability benefits can also go unclaimed. The California Employment Development Department has a claim form for uncashed checks. There is no filing fee as of July 2016. Call 800-300-5616 for unemployment or 800-480-3287 for disability insurance.

Unclaimed Property Laws in California

Code of Civil Procedure Section 1500 establishes California's unclaimed property law. This statute defines what counts as abandoned property and sets dormancy periods for different types of assets.

Bank accounts become unclaimed after three years of no activity. Paychecks and wages are considered abandoned after one year. Money orders need seven years. Traveler's checks take fifteen years. These dormancy periods start from the date of last owner contact or account activity.

Section 1530 requires businesses to file annual reports with the state controller listing all unclaimed property. The report is due by November 1 each year for most businesses. Life insurance companies have different deadlines.

Once property is turned over to the state, there is no time limit to claim it. California does not escheat unclaimed property to the state general fund. The money stays in the unclaimed property fund indefinitely. This differs from some states that impose claim deadlines.

The state controller must decide on claims within 180 days according to Section 1540. However, complex claims may take longer if additional documentation is needed. The state does not pay interest on unclaimed property claims.

How to File a Claim

For county-held funds, contact the Placer County Treasurer at 530-889-4136. Ask about the claim process and required documents. Each type of unclaimed money has different requirements.

Simple claims like uncashed checks just need proof of identity. Bring a driver's license or state ID that matches the name on the check. If you have changed your name through marriage or court order, bring documentation of the name change.

Property tax refunds require proof you owned the property or paid the taxes. Old property tax bills, escrow statements, or mortgage records can establish your claim. If you sold the property, you may need the settlement statement showing tax prorations.

Estate claims are more complex. You must prove the deceased person owned the property and you have a legal right to inherit it. This typically requires a death certificate, birth certificates showing relationship, and possibly probate court documents. California allows small estates to be claimed with an affidavit under Probate Code Section 13100 if the total estate is under a certain value.

For state controller claims, visit the claim filing page to start the process. Search for your property first, then click the claim button. The system generates a claim affirmation form with instructions. Follow the steps carefully and provide all requested documents.

Note: Never pay anyone to file a claim for county or state unclaimed property unless you hire them yourself after finding the property.

Cities in Placer County

Placer County includes Roseville, the largest city with over 147,000 residents. Roseville maintains its own unclaimed property program for city-issued checks and refunds. Contact the city finance department separately from the county treasurer.

Auburn is the county seat with about 14,000 residents. Lincoln has around 50,000 people. Rocklin has roughly 73,000 residents. These cities may hold small amounts of unclaimed funds from utility refunds or business licenses, but most local government unclaimed property goes through the county treasurer.

If you lived in a Placer County city, check both city and county databases. Also search the state controller for private business property like bank accounts or paychecks from local employers.