Search Richmond Unclaimed Funds

Richmond residents can search for unclaimed money through several databases at no cost. The State Controller's Office holds the largest collection of unclaimed property in California, with billions waiting for owners. This includes old bank accounts, uncashed checks, insurance refunds, and utility deposits. Contra Costa County maintains its own unclaimed deposit trust fund. The City of Richmond also publishes lists of unclaimed property it holds. All these sources are free to search. You do not need to pay anyone to file a claim. Most searches take just a few minutes online and you can claim your property directly without a service fee.

Richmond Quick Facts

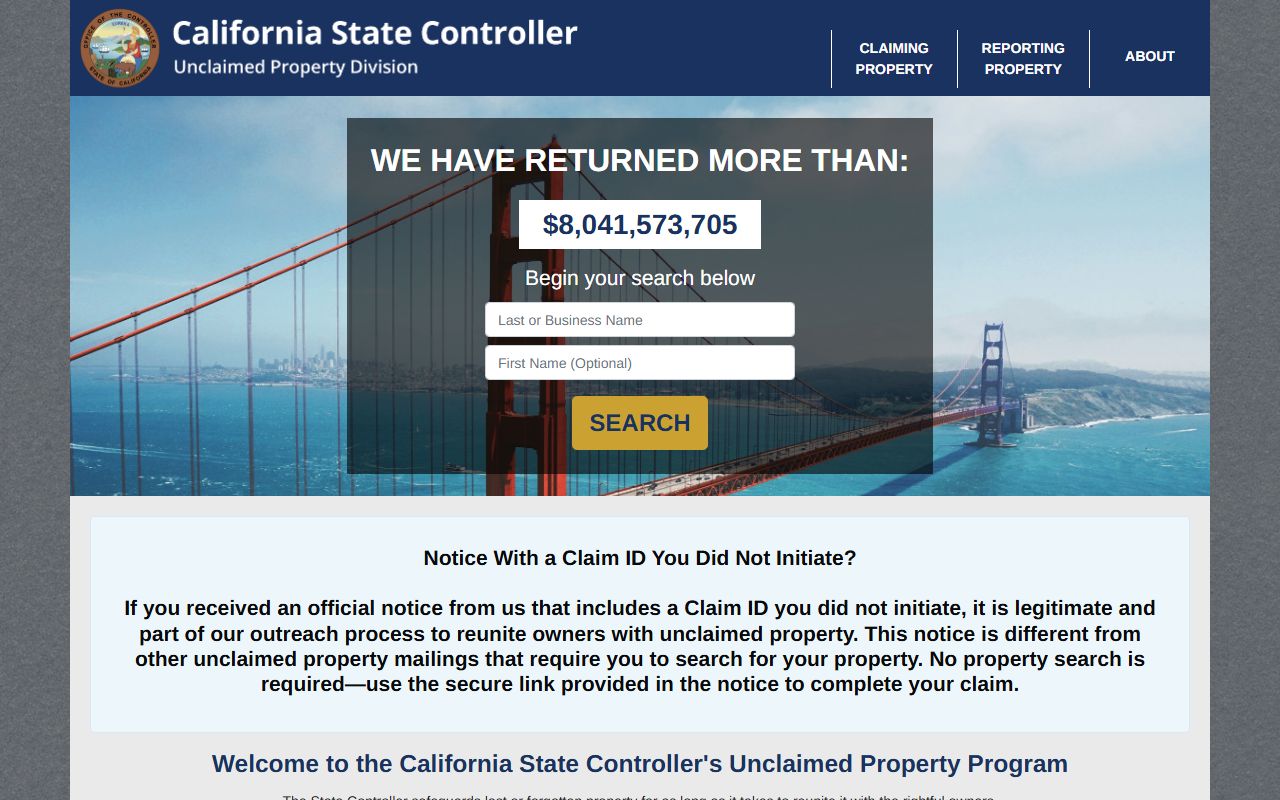

California State Controller Database

Start your search at the State Controller's unclaimed property database. Go to ucpi.sco.ca.gov and enter your name or business name. The system searches all property that banks, employers, insurance companies, and other businesses turned over to California. Results show the property type, who reported it, and when it was sent to the state.

There is no fee to search this database. There is no deadline to file a claim once your property reaches the state. If you lived in Richmond when a business lost contact with you, your unclaimed funds might be listed under this city name. The state holds your money until you come forward to claim it.

Common types of unclaimed property include bank accounts, stocks, bonds, mutual funds, uncashed paychecks, insurance policy proceeds, utility deposits, and safe deposit box contents. Property becomes unclaimed when a business cannot contact the owner for a certain period. Most property escheats after three years of no activity. Wages and salaries escheat after just one year. Money orders take seven years. Travelers checks need fifteen years before they go to the state.

Richmond residents should search not just their current name but also former names if they changed their name through marriage, divorce, or court order. Search for deceased relatives too. Heirs can claim property that belonged to someone who passed away. Business owners should search their company name and any DBA names they used in Richmond.

City of Richmond Unclaimed Property

The City of Richmond maintains its own unclaimed property program separate from the state. The city publishes notices of unclaimed funds it holds. Visit richmondca.gov to see if the city is holding money that belongs to you. This includes uncashed city checks, deposits, overpayments, and other funds that went unclaimed.

City unclaimed funds come from several sources. Uncashed vendor checks, refunds, and permits are common. Security deposits that were never picked up end up on the list. Overpayments to the city that were refunded but never cashed also appear. Government Code Section 50050 requires the city to hold these funds in trust and make an effort to find the owners.

After three years, the city can escheat unclaimed funds to its general fund if the owner does not come forward. The city must publish a notice before this happens. Check the city's website regularly if you did business with Richmond or paid fees to the city in past years. You might have a refund or deposit waiting for you.

Note: Contact the City of Richmond Finance Department directly if you find your name on a city unclaimed property list.

How to File Claims in Richmond

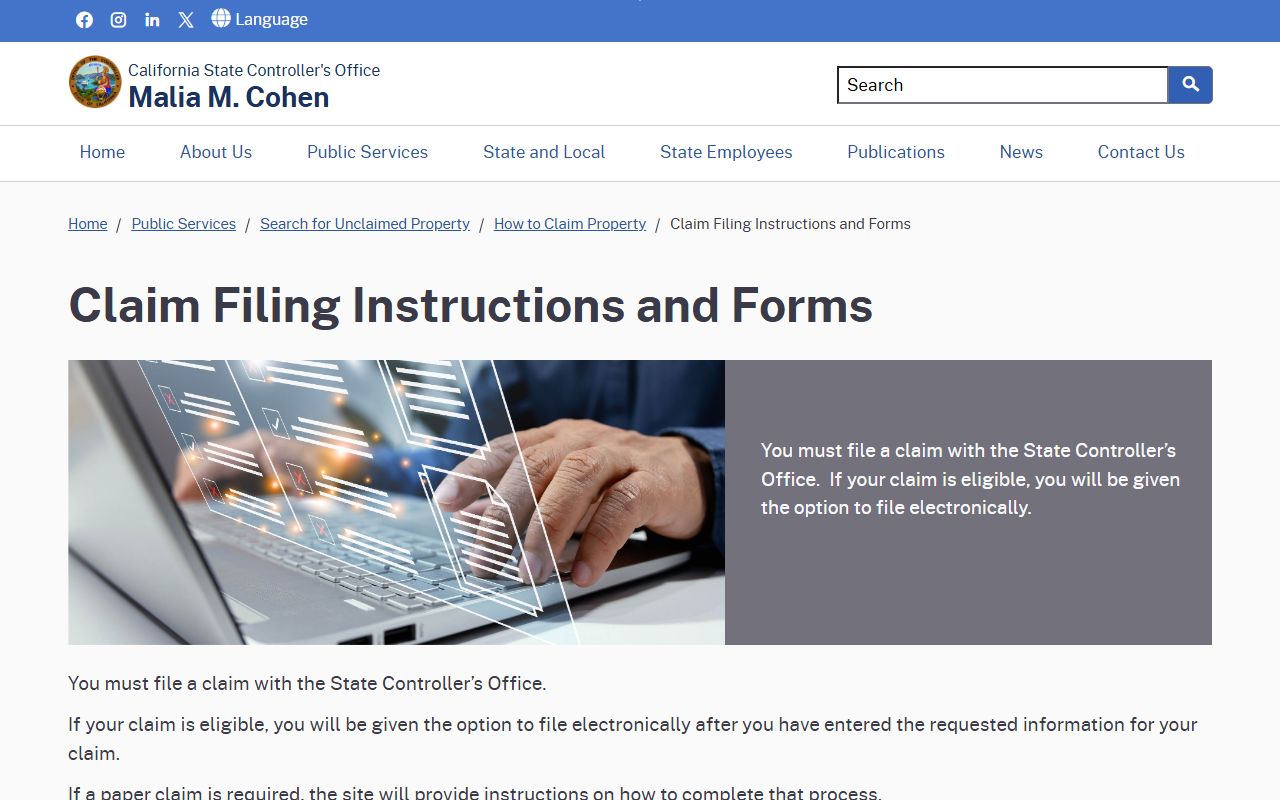

When you find property in the state database, the next step is to file a claim with the State Controller's Office. Visit sco.ca.gov and search for your property. Select it from the results. The website will tell you if you can file online or if you need to mail paperwork.

Many simple claims qualify for electronic filing through the state portal. For claims that need mailed documents, download the Claim Affirmation Form from your search results. Fill it out completely and sign it. Include proof of your identity such as a driver's license or state ID. If the claim is $1,000 or more, you must get your signature notarized. All claims for securities and safe deposit boxes need notarization regardless of value.

Documents commonly needed for Richmond claims include:

- Government-issued photo ID

- Social Security card or SSN verification

- Proof of address when property became unclaimed

- Death certificate for deceased owner claims

- Probate documents or letters testamentary for estates

- Marriage certificate or divorce decree if your name changed

- Business registration documents for business claims

Mail completed claim forms to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873. The state processes simple cash claims in 30 to 60 days. Complex claims with heirs or multiple owners can take up to 180 days. Security claims usually process within 120 days. You can visit the public counter at 10600 White Rock Road, Suite 141, Rancho Cordova if you need help filing your claim. Call 1-800-992-4647 with questions about the process or required documents.

Contra Costa County Resources

Richmond is in Contra Costa County. The county treasurer maintains an Unclaimed Deposit Trust Fund with money that did not go to the state. Visit contracosta.ca.gov to search the county's unclaimed property list. The Treasurer-Tax Collector Dan M. Mierzwa oversees this program. Call 925-957-5280 with questions.

The county's unclaimed funds come from several sources in Richmond and other parts of Contra Costa County. Property tax refunds from overpayments or reduced assessments are common. Estates of deceased persons without heirs end up in county hands. Tax sale surplus funds go into the county's holding account when a property sells for more than the amount owed. Former owners or people with a legal interest can claim these excess proceeds.

County unclaimed property works differently than state unclaimed property. The county follows Government Code Section 50050 through 50057. These laws require the county to publish notice and hold funds for at least three years. If no one claims the money, it escheats to the county general fund. Always check both the county and state databases when searching for unclaimed money in Richmond.

Public Retirement Account Searches

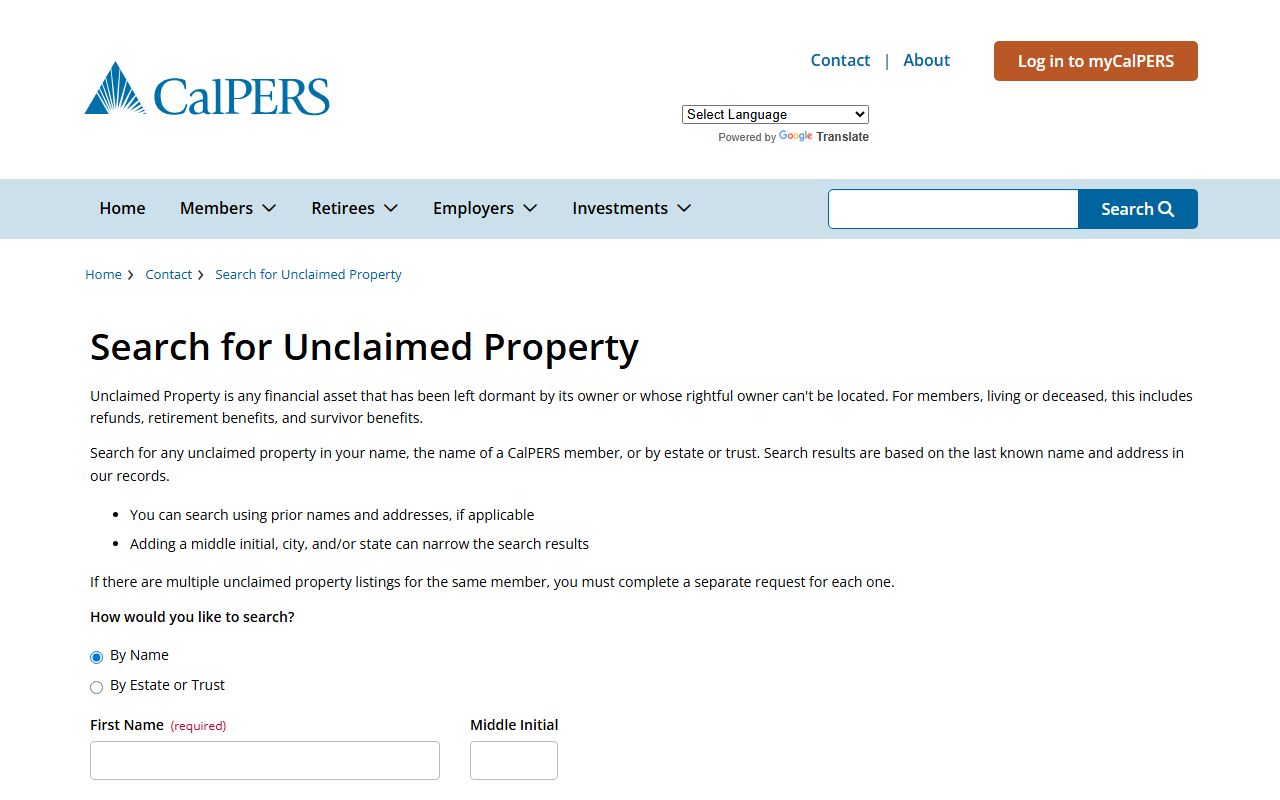

Richmond residents who worked for state agencies, school districts, or local governments should check CalPERS and CalSTRS for unclaimed retirement benefits. These systems are separate from the main unclaimed property database. CalPERS covers most public employees. CalSTRS covers teachers and education staff.

Search CalPERS unclaimed property at calpers.ca.gov. If you find a match, call 888-225-7377 to request a claim form. Hours are Monday through Friday, 8:00 a.m. to 5:00 p.m. Pacific time. You can also write to CalPERS Member Account Management Division, P.O. Box 942704, Sacramento, CA 94229-2704.

CalSTRS has unclaimed property from teachers who left the profession without claiming their contributions. Visit calstrs.com for information. Call 800-228-5453 or 916-414-1099 to ask if you have funds waiting. If you taught in Richmond schools or anywhere in California and left before retirement, you might have unclaimed CalSTRS money.

Unclaimed retirement accounts happen when public employees change careers and forget to withdraw their contributions. Survivor benefits also go unclaimed if family members do not know about them. Both CalPERS and CalSTRS make efforts to find members and beneficiaries, but sometimes people move from Richmond without leaving a forwarding address. Check these databases if you or a family member ever worked in public service.

Life Insurance Policy Searches

Life insurance benefits are a major source of unclaimed money in Richmond and across California. The National Association of Insurance Commissioners runs a free policy locator service at eapps.naic.org. Enter information about a deceased family member to see if any insurance company has a policy on file.

California law requires insurance companies to check the Social Security Death Master File and look for deceased policyholders. Insurance Code Section 10509.940 through 946 sets out these rules. If an insurer finds a death match and cannot locate the beneficiary, they must turn the benefits over to the State Controller. You can also call the California Department of Insurance Consumer Hotline at 1-800-927-4357 for help finding a lost policy.

Many Richmond families discover life insurance years after someone died. The deceased might have had a small policy through work that family forgot about. Policies purchased decades ago sometimes get lost in moves or estate settlement. Insurers are supposed to pay when they learn of a death, but sometimes paperwork is missing or addresses are wrong. Always search the state unclaimed property database and the NAIC locator if a relative passed away and you think they might have had coverage.

Unclaimed Tax Refund Checks

The Franchise Tax Board holds unclaimed state income tax refunds. Refund checks expire after six months. If you did not cash your refund check in time, you need to request a replacement. For refunds one to three years old, send a letter to the Franchise Tax Board with your name, tax year, and "Old refund check" in the subject line. Processing takes about eight weeks.

Refunds over three years old need a Replacement Warrant Claim form. Use Form 3900A for individuals or Form 3900B for businesses. This process can take up to 18 months. Call 800-852-5711 if you need help with an unclaimed refund from Richmond. Eventually, very old refunds get transferred to the State Controller's Unclaimed Property Division and show up in the main database.

Uncashed tax refunds happen for many reasons in Richmond. People move and forget to update their address with the tax board. The check goes to an old address and gets returned. Some taxpayers do not know they are owed a refund and never look for the check. Others cash their main refund but miss a small supplemental payment that comes later. Check with both the Franchise Tax Board and the State Controller if you think you have an old tax refund waiting.

Unpaid Wage and Benefit Claims

The Division of Labor Standards Enforcement maintains the Unpaid Wage Fund for wages the Labor Commissioner recovered but could not deliver to workers. If an employer in Richmond owed you money and the state collected it on your behalf, but you never picked it up, it might be in this fund. Call 833-526-4636 to ask about unclaimed wages. You can also search the main state unclaimed property database because old wage claims get transferred to the State Controller.

Uncashed unemployment and disability checks also become unclaimed property. The Employment Development Department holds these checks for a period, then sends them to the state. Call 1-800-300-5616 for unemployment insurance questions or 1-800-480-3287 for disability insurance. There is no fee to claim unpaid wages or benefits from Richmond. Many workers have final paychecks, back pay awards, or benefit checks they never received. All of these eventually end up in the unclaimed property system if the worker cannot be found.

Legal Foundation for Unclaimed Property

California unclaimed property law begins at Code of Civil Procedure Section 1500. This section gives the law its short title. CCP Section 1501 defines important terms like owner, holder, and apparent owner.

CCP Section 1513 sets dormancy periods. Bank accounts escheat after three years. Wages and salaries escheat after one year. Money orders take seven years. Travelers checks take fifteen years. CCP Section 1530 requires businesses to file annual reports with the State Controller listing unclaimed property they hold.

CCP Section 1540 covers claim procedures. The Controller must decide claims within 180 days. No interest is paid on claims. CCP Section 1576 sets penalties for violations. Willful violations are a misdemeanor. Late delivery triggers 12 percent interest on the property value.

Government Code Section 50050 through 50057 governs local agency unclaimed money. This is why Richmond and Contra Costa County have their own programs. Local governments must publish notice and give owners a chance to claim funds before escheating them to the local treasury.