Fairfield Unclaimed Property Search

Unclaimed money in Fairfield sits with the state, county, and city. The California State Controller holds billions in property from banks, employers, and insurers across the state. Solano County maintains programs for tax sale proceeds and estates without heirs. The City of Fairfield also tracks uncashed checks from local operations. You can search all these sources at no cost with no deadline to file a claim. Start your search today to see if Fairfield or Solano County has money with your name on it. These funds come from old bank accounts, forgotten paychecks, utility refunds, and insurance payouts that belong to you.

Fairfield Quick Facts

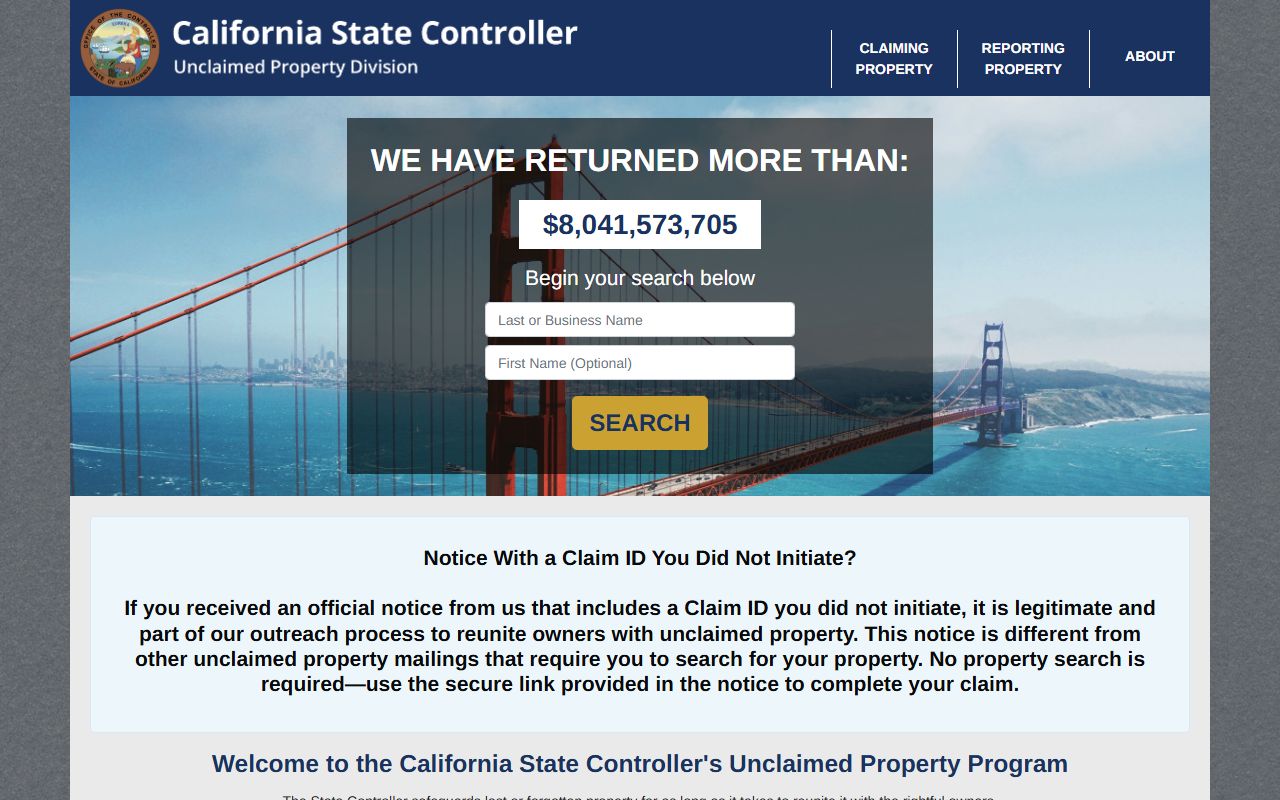

California State Controller Search

The state holds the largest pool of unclaimed money in California. Banks, employers, insurance companies, and other holders send dormant property to the State Controller after three years of no contact. This includes old bank accounts, uncashed paychecks, insurance payouts, stock dividends, and safe deposit box contents. Most Fairfield residents find something when they search the state database.

Start at www.sco.ca.gov/search_upd.html for the main search portal. You can also use ucpi.sco.ca.gov/en/Property/SearchIndex for a direct search by name. Type your full name and city, then hit search. The system shows all matches with property type and approximate value for Fairfield residents.

If you find property, click on it to view details and start a claim. The state offers online filing for many claims. You need proof of identity like a driver's license or passport. Claims over $1,000 require a notarized signature to prevent fraud. The state reviews each claim and sends a check if everything checks out. Simple claims take 30 to 60 days. Complex claims with heirs or multiple owners can take up to 180 days for Fairfield residents.

Call the state at 1-800-992-4647 if you need help. Staff can answer questions about the search process, filing requirements, or documents you need. The state does not charge fees to search or claim your property. You get the full value reported by the holder in Fairfield.

Solano County Unclaimed Money Programs

Fairfield is in Solano County, which maintains comprehensive unclaimed property programs. The county holds funds from tax sales, estates, vendor payments, and county operations. Solano County follows California Government Code 50050 for handling unclaimed money. This law requires counties to hold funds for three years before transferring them to the general fund or to the state.

Visit www.solanocounty.com/depts/ttcc/treasurer/unclaimed_money.asp to learn about county unclaimed money programs. The county website explains the types of property they hold and how to file a claim. Call 707-784-6295 to ask if Solano County has funds under your name from Fairfield.

Solano County unclaimed money comes from several sources for Fairfield residents:

- Property tax refunds from overpayments or reduced assessments

- Uncashed county warrants from vendors or payroll

- Estates from deceased persons with no known heirs

- Trust funds held by the county treasurer

- Excess proceeds from tax sales

To claim county funds, contact the Solano County Treasurer with your name and details about the property. They will tell you what forms to fill out and what documents you need. County claims are free to file. If the county sent the money to the state, they will direct you to the State Controller in Fairfield.

Note: Solano County publishes annual notices of unclaimed funds in local newspapers before transferring money to the general fund.

Fairfield City Unclaimed Funds

Cities keep lists of uncashed checks from their own operations. These funds come from vendor payments, utility refunds, business license deposits, and other city transactions. Fairfield may hold unclaimed money from local services. The city finance department tracks these amounts and reports them annually.

Contact Fairfield City Hall to ask if they have uncashed checks under your name. City staff can search their records and walk you through the claim steps. You may need to provide ID and fill out a simple claim form for Fairfield.

Fairfield City Hall is at 1000 Webster Street, Fairfield, CA 94533. Call the finance or accounts payable department to ask about unclaimed checks. Some cities post annual lists on their websites or in local papers. Check the city website for notices about unclaimed funds held by the City of Fairfield.

After a set time, cities send unclaimed checks to the state. If Fairfield sent your funds to Sacramento, the city will tell you to file with the State Controller instead. Always start by asking the city where the money is now before you file a claim in Fairfield.

State Agency Unclaimed Funds

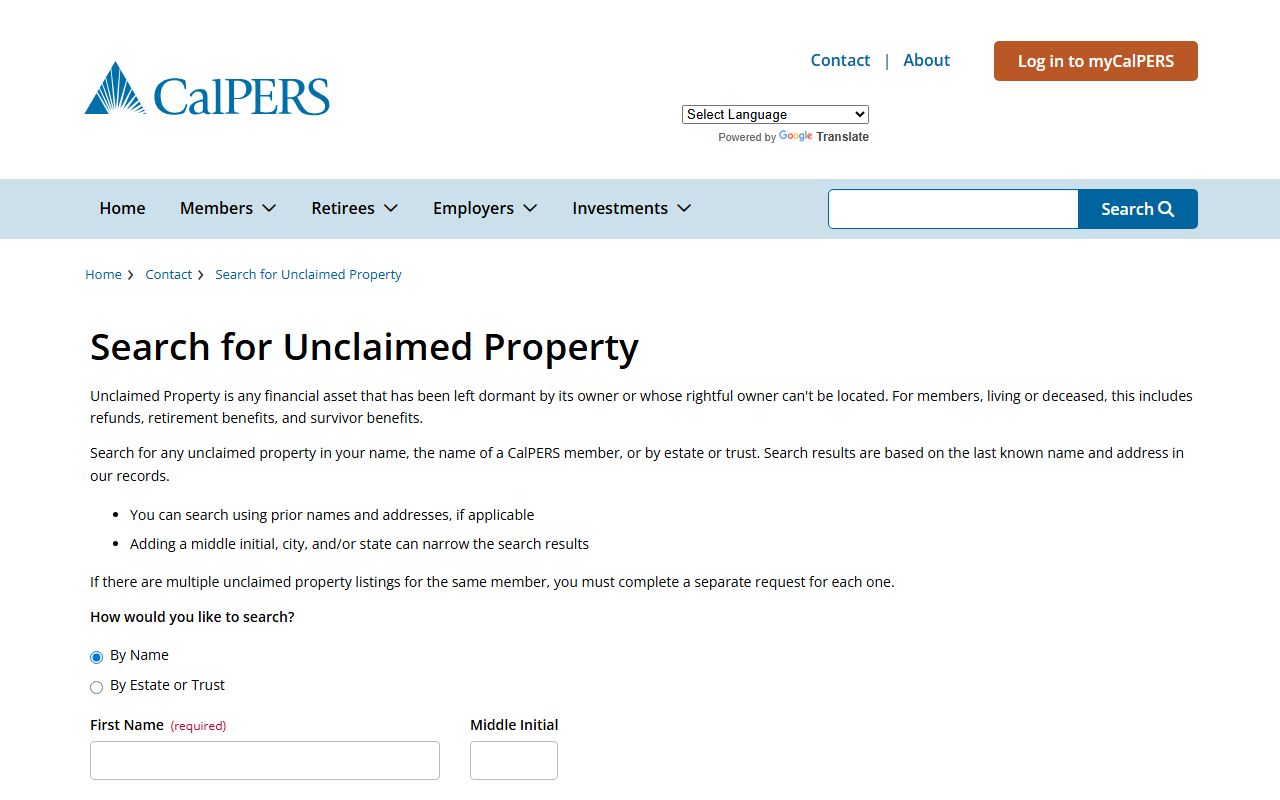

If you worked for a government agency in Fairfield or elsewhere in California, you may have unclaimed retirement benefits. CalPERS manages pensions for state and local employees. They hold unclaimed refunds when they cannot find former members. Search their database at www3.calpers.ca.gov/a/contact-us/unclaimed-property-search to see if you have funds waiting.

Call CalPERS at 888-225-7377 if you need help. They operate Monday through Friday from 8 a.m. to 5 p.m. If you worked in a school district in Fairfield, check CalSTRS at 800-228-5453. Teachers have a separate retirement system with its own unclaimed property program.

The California Franchise Tax Board holds old tax refunds. If you moved and never got a refund check, call 800-852-5711 to request a new one. Refunds older than three years need a special claim form. The Employment Development Department has uncashed unemployment and disability checks. File form DE 903SD to claim these funds if you collected benefits while living in Fairfield.

The Division of Labor Standards Enforcement manages the Unpaid Wage Fund. This program holds wages from employers who went out of business or lost lawsuits. Call 1-833-526-4636 to ask if they have wages from an old job in Fairfield. This fund helps workers get money when a company fails to pay after a court judgment.

Lost Insurance and Investment Accounts

Life insurance companies must search for beneficiaries when a policyholder dies. If they cannot find the family, the payout goes to the state. The NAIC Life Insurance Policy Locator helps you find lost policies for relatives who lived in Fairfield. Go to eapps.naic.org/life-policy-locator and submit a request. The system contacts insurers on your behalf.

The California Department of Insurance runs a consumer hotline at 1-800-927-4357. Call if you have questions about insurance policies, annuities, or claims from Fairfield. They can help track down companies and explain your rights under state law.

Old stock accounts and dividends also become unclaimed property. Brokerages and transfer agents send these funds to the state after three years of no contact. Search the State Controller database for securities and investment accounts under your name. If you find a match, you may need to provide extra proof like old statements or tax forms from Fairfield.

Filing Claims in Fairfield

Each agency has its own claim process. The steps depend on the type of property and who holds it. Most claims are simple if you are the owner. Heirs need extra documents to prove their relationship to a deceased owner in Fairfield.

For state claims, search the State Controller database first. If you find property, click to start the claim online. The site asks for your driver's license and social security number. Claims over $1,000 need a notary. The state reviews your claim and sends a check to the address on file. This takes 30 to 60 days for simple claims and up to 180 days for complex ones in Fairfield.

For county claims, contact the Solano County Treasurer. Ask what forms you need and where to send them. Most counties want a copy of your ID and a signed statement that you are the rightful owner. If the county sent the money to the state, they will tell you to file with the State Controller instead. Always check where the funds are before you submit paperwork in Fairfield.

For city claims, call Fairfield City Hall. Ask the finance or accounts payable department if they have unclaimed funds under your name. They may have a simple claim form or just ask for ID. Small amounts get approved fast. Larger amounts may need extra review. Follow the steps the city gives you and be patient with the process in Fairfield.

California Unclaimed Property Laws

California law protects your right to claim unclaimed money with no time limit. The Unclaimed Property Law is in the Code of Civil Procedure starting at Section 1500. This law tells businesses and agencies when they must turn over dormant property to the state. It also explains how the state holds and returns that property to owners in Fairfield.

Under CCP Section 1513, most property is dormant after three years of no contact. Wages go dormant after one year. Money orders take seven years. Once property is dormant, holders must report it to the State Controller and send the funds to Sacramento. This gives Fairfield residents one central place to search for all unclaimed property.

The state must hold your property forever under CCP Section 1540. There is no deadline to file a claim. Even if 30 years pass, you can still get your money. The state does not pay interest, but you get the full value reported by the holder. You pay no fees to search or claim unclaimed money in Fairfield.

Local agencies follow Government Code 50050 to 50057 for city and county unclaimed funds. These sections let local agencies hold money for three years, then transfer it to their general fund or to the state. You can still file a claim after the transfer. The agency must reimburse you if they can verify your ownership in Fairfield.

Protect Yourself from Scams

Scammers send fake letters saying you have large amounts of unclaimed money. They ask for fees up front or personal details like your social security number. Real agencies never charge fees to return your own property. Be careful if someone contacts you out of the blue about unclaimed funds in Fairfield.

Asset locators can help you find property if you have a common name or moved around a lot. California law limits their fees to 10 percent of the property value. They must have a written contract before they start work. Never sign a deal that gives them more than 10 percent or asks for money up front in Fairfield.

If you get a call or email, verify it yourself. Go to the State Controller website and search your name. If you find a match, file the claim directly. If you see nothing, the contact may be a scam. Never give out your social security number or bank details over the phone unless you called a known agency first in Fairfield.

The state does not charge fees. The county does not charge fees. The city does not charge fees. If someone asks you to pay to get your money back, it is a scam. Report suspicious contacts to the California Attorney General. Protect your information and claim your money safely in Fairfield.

Search Tips for Fairfield Residents

Start with the state database and work down to county and city. Search all names you have used over the years. If you changed your name, search both old and new names. Many people find money under maiden names or nicknames in Fairfield.

Search for deceased relatives. If your parents or grandparents lived in California, they may have left unclaimed property. You need to prove your relationship, but the state and county will help you through the process. Estates without heirs often end up in county programs before going to the state in Fairfield.

Check back every few years. New property gets added to the lists all the time. An old employer may send a check years after you left the job. A bank may close an account with a small balance. A utility may owe you a deposit. These small amounts add up if you keep searching in Fairfield.

If you owned a business in Fairfield, search under the business name too. Vendors may have sent checks that never got cashed. The state may have business tax refunds tied to your company. Search any DBA names you used while operating in Fairfield.

Solano County Resources

Fairfield is in Solano County. The county treasurer handles unclaimed funds from tax sales, estates, and county operations. For a full list of Solano County programs and contact details, visit the county page on this site. You can search for both city and county unclaimed money at the same time.