Berkeley Unclaimed Property

Berkeley residents can search for unclaimed money through the California State Controller and Alameda County. The state holds property from businesses that lost touch with account owners after three years. Alameda County runs its own program for uncashed county warrants and estates. Both searches are free and filing a claim costs nothing. You do not have to hire anyone to help you find or claim your money. The state keeps your property safe with no deadline to come forward. Searching takes just a few minutes and you can file most claims online or by mail from Berkeley.

Berkeley Quick Facts

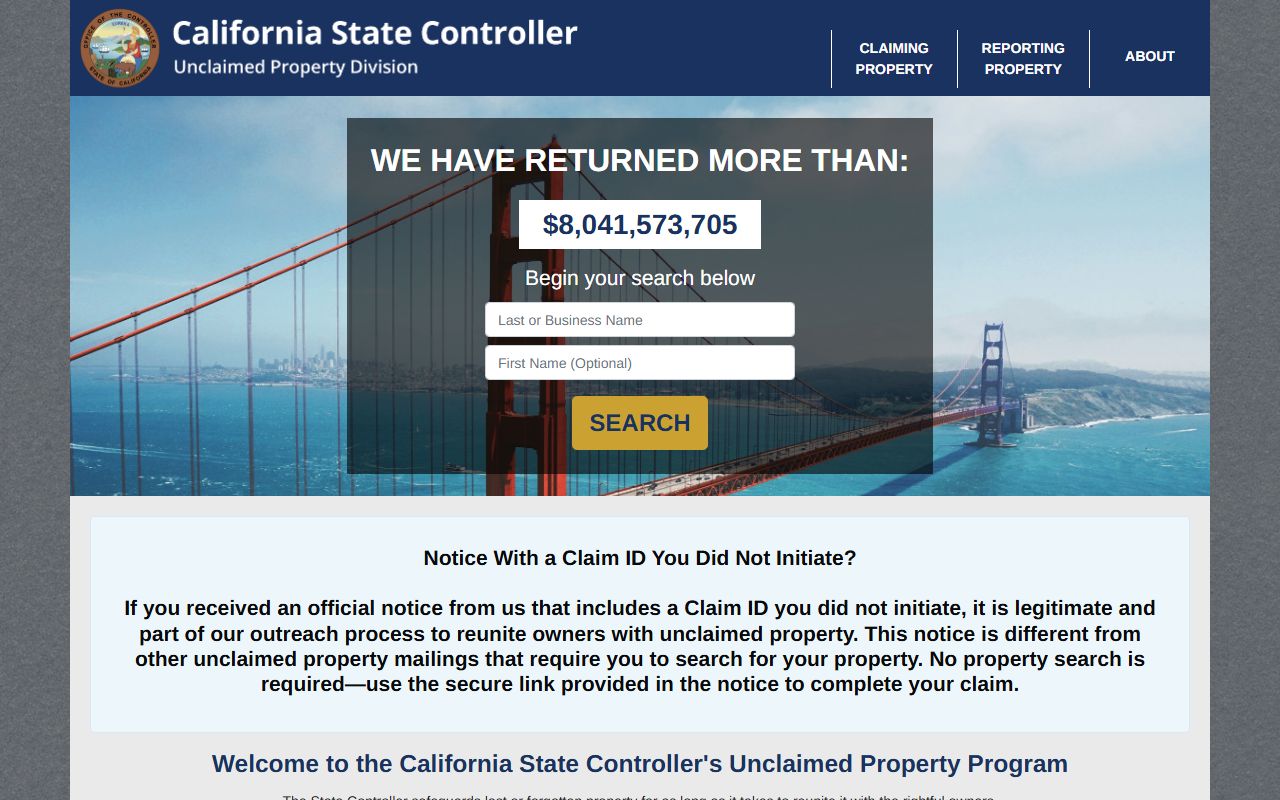

Search State Database

Most unclaimed property in Berkeley goes through the California State Controller. Businesses turn over funds after three years of no contact with the owner. This includes banks, employers, insurance companies, and utilities. Search the database at ucpi.sco.ca.gov by entering your name or business name. The search is free and you do not need to register for an account.

Results show property type and an approximate value. Click on a result to see more details and start a claim. If the claim is simple and the amount is small, you may be able to file online. Larger or more complex claims require mailing in a form with supporting documents. The state provides all the forms and instructions you need at no charge.

Property types you may find in a Berkeley search:

- Bank accounts dormant for three years or more

- Uncashed paychecks and vendor payments

- Stock certificates, bonds, and dividend payments

- Insurance refunds or policy benefits

- Contents from abandoned safe deposit boxes

- Utility deposits and overpayments

- Trust funds and escrow accounts

California law does not include real estate in unclaimed property programs. The state will hold your property indefinitely. There is no deadline to file a claim. You can come forward 10 years or 20 years later and still get your money back. If you lived in Berkeley when a business lost contact with you, your property will be listed under this city name in the database.

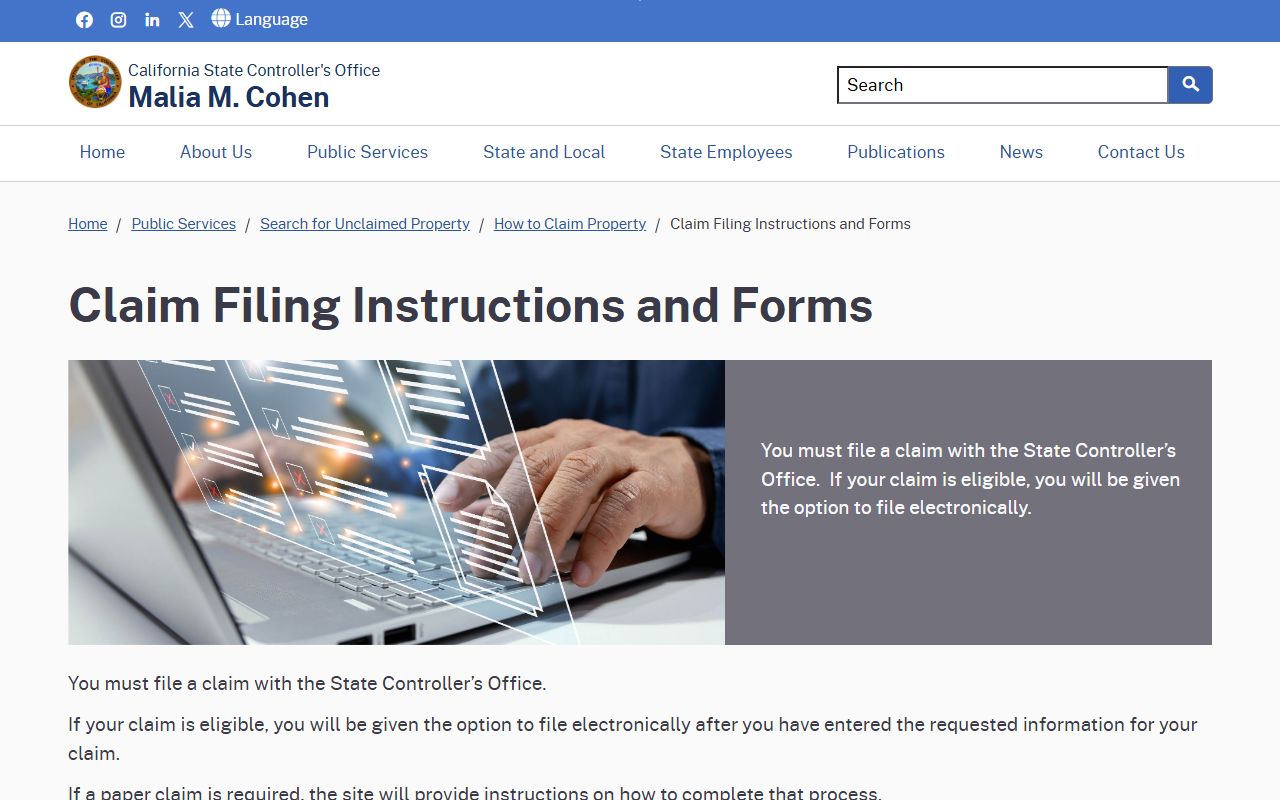

How to File a Claim

Start at sco.ca.gov to search for property. When you find something that belongs to you, select it from the list. The website will generate a Claim Affirmation Form with your details already entered. Review the form and add any missing information. Sign the form and gather the required documents.

For claims under $1,000, you do not need a notary. Just sign the form and send it with a copy of your photo ID and proof of your Social Security number. For claims of $1,000 or more, your signature must be notarized. All claims for securities or safe deposit boxes also need notarization no matter the amount. Mail everything to Chief, Unclaimed Property Division, P.O. Box 942850, Sacramento, CA 94250-5873.

Documents you may need to send from Berkeley:

- Driver's license or state ID card

- Social Security card or tax document with SSN

- Proof of the address where you lived when property was reported

- Death certificate if claiming for a deceased person

- Probate documents if you are an executor or heir

- Marriage or divorce certificate if your name changed

Simple claims take 30 to 60 days. Claims with heirs, multiple owners, or business entities can take up to 180 days. Security claims usually process within 120 days. Once approved, the state mails a check to your current address. Call 1-800-992-4647 if you have questions about your claim or need help with the paperwork from Berkeley.

Note: Once you file a claim, the property is removed from the public search while your claim is being processed.

Alameda County Escheatment

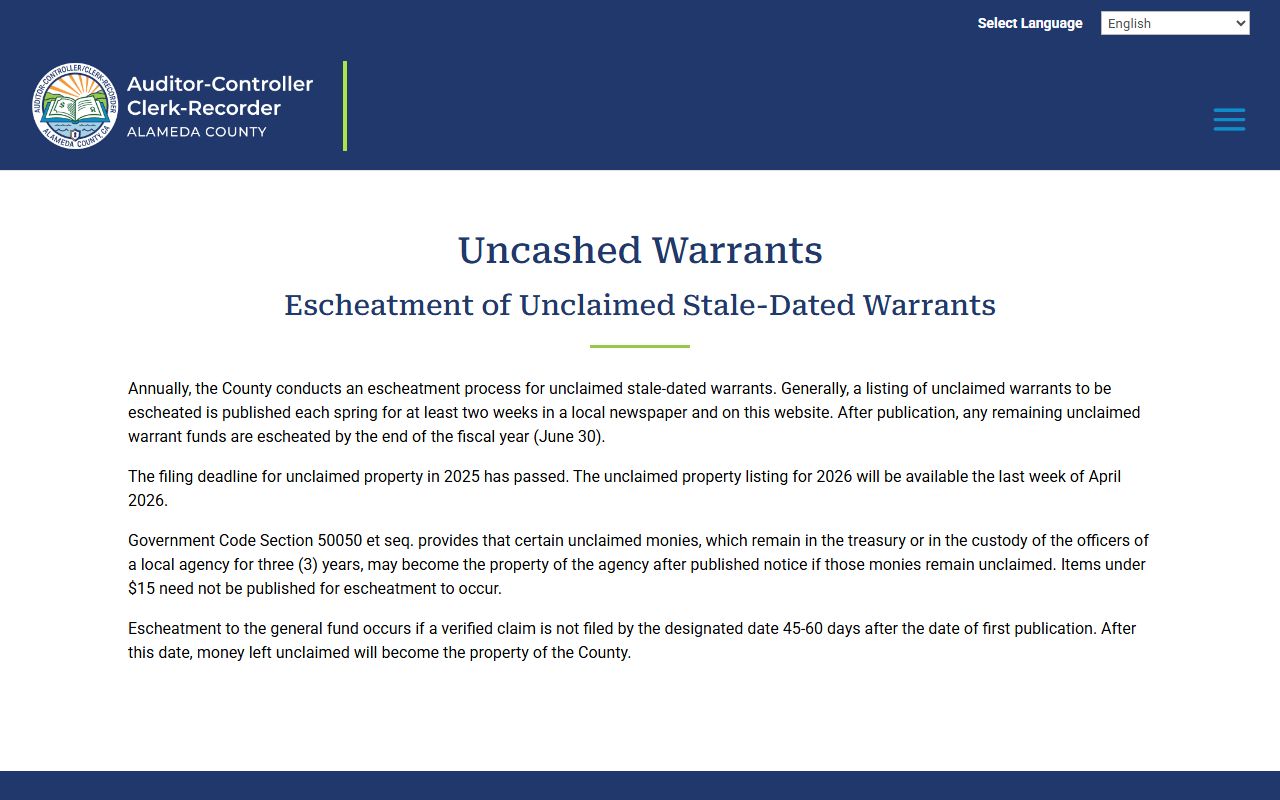

Berkeley is in Alameda County. The county auditor runs an escheatment program for uncashed warrants and unclaimed funds. Each year, the county publishes a list of unclaimed money that has been in the treasury for three years. If no one claims it after the published notice, the money escheats to the county general fund. You can claim before that happens by contacting the county treasurer.

Alameda County uncashed warrants and escheatment information is at auditor.alamedacountyca.gov. The county follows Government Code Section 50050, which sets the rules for local agency unclaimed money. Items under $15 do not need to be published but can still be claimed. Larger amounts get published in a legal notice before they escheat.

If you see your name on an Alameda County escheatment list, call the Treasurer-Tax Collector at 510-272-6800. Their office is at 1221 Oak Street, Room 131, Oakland, CA 94612. You may need to visit in person or mail documents to prove your claim. County claims are separate from state claims, so you need to follow the county's process for Berkeley county funds.

CalPERS and CalSTRS

Public employees and teachers who worked in Berkeley may have unclaimed retirement accounts. CalPERS serves state and local government workers. CalSTRS serves school district employees and teachers. Both agencies run unclaimed property programs separate from the State Controller. If you worked for a public agency or school in Berkeley and left before retirement, check these systems.

CalPERS has a search tool at calpers.ca.gov. Type your name to see if there is an account. If you find a match, call 888-225-7377 during weekday business hours. CalPERS will send you a claim form and explain what documents you need. You can also write to CalPERS Member Account Management Division, P.O. Box 942704, Sacramento, CA 94229-2704.

CalSTRS handles teacher retirement accounts at calstrs.com. Call 800-228-5453 or 916-414-1099 to ask about unclaimed property. If you taught in Berkeley schools or worked for a school district and left before you were vested, you may have contributions sitting unclaimed. Check both CalSTRS and the main state database to cover all sources.

Life Insurance Benefits

Unclaimed life insurance happens when beneficiaries do not know a policy exists. California law now requires insurers to search the Death Master File and try to locate beneficiaries. Older policies may not have gone through this process. If a relative died and you think they may have had life insurance, use the national policy locator.

The National Association of Insurance Commissioners runs the Life Insurance Policy Locator at eapps.naic.org. This free service contacts participating insurers to see if they have a policy for the deceased person. You need the person's full name, date of birth, date of death, and Social Security number. Insurers may take a few weeks to respond.

California Department of Insurance has more information at insurance.ca.gov. Call their consumer hotline at 1-800-927-4357 if you have trouble or if an insurer will not cooperate. Some life insurance proceeds end up in the State Controller's database if the insurer cannot find the beneficiary, so check both the NAIC locator and the state search for Berkeley residents.

Unclaimed Tax Refunds

California tax refund checks expire after six months. If you moved from Berkeley and never received your refund, or if you have an old check you forgot to cash, you can request a replacement. The California Franchise Tax Board handles all state tax refund replacements. The process depends on how old the refund is.

For refunds one to three years old, send a letter to the Franchise Tax Board. Include your name, the tax year, and write "Old refund check" in the subject line. Processing takes about eight weeks. For refunds over three years old, you must complete a Replacement Warrant Claim form. These older claims can take up to 18 months. Call 800-852-5711 to ask what you need to do for your specific refund.

More details are at ftb.ca.gov. Do not wait too long because older refunds require more paperwork and longer processing times. If you are owed a refund and it never arrived at your Berkeley address, contact the Franchise Tax Board as soon as possible.

Unemployment and Disability Benefits

The Employment Development Department handles unclaimed unemployment insurance and disability insurance benefits. If you had a payment you never cashed, or if money went to a debit card you lost or never activated, you can file a claim with EDD. There is no filing fee. Use form DE 903SD, which is at edd.ca.gov.

Call 1-800-300-5616 for unemployment insurance questions. Call 1-800-480-3287 for disability insurance. The phone staff can tell you if you have unclaimed benefits and explain how to claim them. These benefits do not show up in the State Controller's database, so you must contact EDD directly if you think you have unclaimed UI or DI payments from Berkeley.

Unclaimed wages are another source. The Division of Labor Standards Enforcement runs the Unpaid Wage Fund for workers owed money by employers that went out of business. If you worked for a Berkeley business that closed while owing you wages, call 1-833-526-4636. More information is at dir.ca.gov. This is less common than other types of unclaimed property but worth checking if you have unpaid wages.

Note: EDD stopped charging the $25 filing fee for uncashed checks in 2016.

Avoiding Unclaimed Money Scams

Scammers know people are looking for unclaimed money. You may get letters or phone calls from companies offering to help you claim property for a fee. Some are legitimate asset locators, but others are scams. The State Controller warns Berkeley residents to watch for red flags before you sign a contract or pay any fees.

California law allows registered investigators to charge up to 10 percent of the property value if you hire them. They cannot ask for an upfront fee. If someone contacts you and demands payment before they help you, that is a scam. If they ask for your Social Security number or bank information before you verify who they are, do not give it. The real State Controller's Office will never call or email asking for payment or personal details.

You can always claim your property for free. Search the database yourself at claimit.ca.gov. File your claim online or download the forms and mail them in. The state provides all the instructions you need. There is no reason to pay someone unless your claim is very complex and you want professional help. If you do hire someone in Berkeley, make sure they are registered with the state and read the contract before you sign.

Alameda County Unclaimed Money

Berkeley is in Alameda County. The county auditor and treasurer maintain programs for uncashed warrants and escheatment separate from the state system. For more on county unclaimed money and how to file claims with Alameda County offices, visit the county page.